Question: Refer to Module 3 for reference Explain the steps AND the rationale for calculating the amount of life insurance needed using the CAPITAL UTILIZATION approach.

Refer to Module 3 for reference

Explain the steps AND the rationale for calculating the amount of life insurance needed using the CAPITAL UTILIZATION approach.

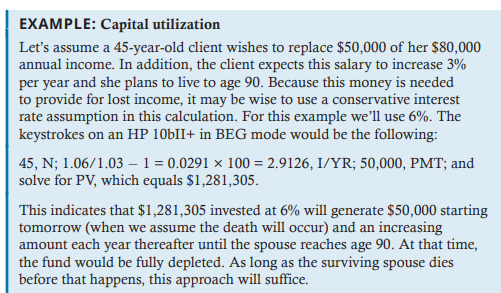

EXAMPLE: Capital utilization Let's assume a 45 -year-old client wishes to replace $50,000 of her $80,000 annual income. In addition, the client expects this salary to increase 3% per year and she plans to live to age 90 . Because this money is needed to provide for lost income, it may be wise to use a conservative interest rate assumption in this calculation. For this example we'll use 6%. The keystrokes on an HP 10bII+ in BEG mode would be the following: 45,N;1.06/1.031=0.0291100=2.9126, I/YR; 50,000, PMT; and solve for PV, which equals $1,281,305. This indicates that $1,281,305 invested at 6% will generate $50,000 starting tomorrow (when we assume the death will occur) and an increasing amount each year thereafter until the spouse reaches age 90 . At that time, the fund would be fully depleted. As long as the surviving spouse dies before that happens, this approach will suffice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts