Question: Refer to page 29. Read the example about how to calculate the present value of an ordinary annuity. Now consider a slightly different question. You

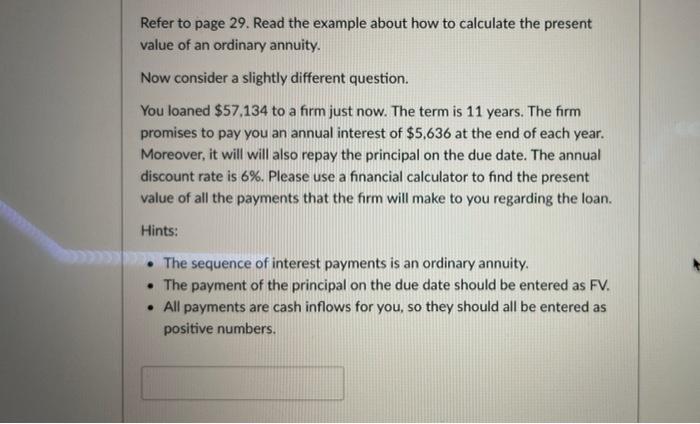

Refer to page 29. Read the example about how to calculate the present value of an ordinary annuity. Now consider a slightly different question. You loaned $57,134 to a firm just now. The term is 11 years. The firm promises to pay you an annual interest of $5,636 at the end of each year. Moreover, it will will also repay the principal on the due date. The annual discount rate is 6%. Please use a financial calculator to find the present value of all the payments that the firm will make to you regarding the loan. Hints: The sequence of interest payments is an ordinary annuity, The payment of the principal on the due date should be entered as FV. All payments are cash inflows for you, so they should all be entered as positive numbers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts