Question: Refer to Question 25 below 26. Problem 12.26. Repeat Problem 12.25 for an American put option on a futures contract. The strike price and the

Refer to Question 25 below 26.

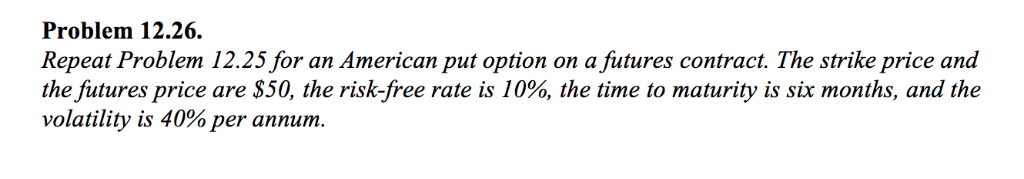

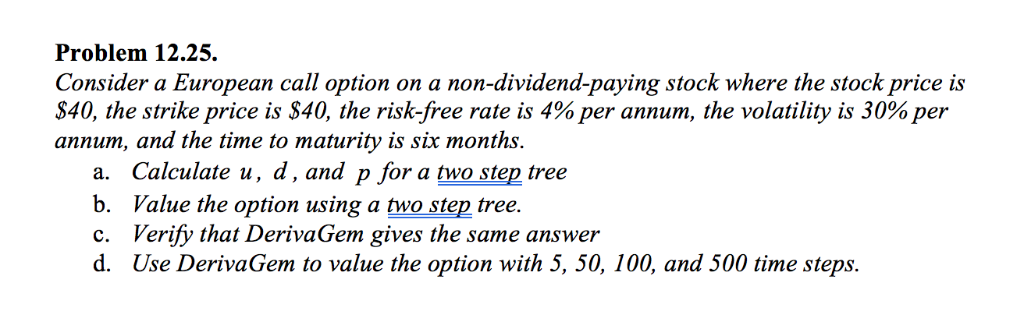

Problem 12.26. Repeat Problem 12.25 for an American put option on a futures contract. The strike price and the futures price are $50, the risk-free rate is 10%, the time to maturity is six months, and the volatility is 40% per annum. Problem 12.25. Consider a European call option on a non-dividend-paying stock where the stock price is $40, the strike price is $40, the risk-free rate is 4% per annum, the volatility is 30% per annum, and the time to maturity is six months a. Calculate u, d, and p for a two step tree b. Value the option using a two step tree. c. Verify that DerivaGem gives the same answer d. Use DerivaGem to value the option with 5, 50, 100, and 500 time steps. Problem 12.26. Repeat Problem 12.25 for an American put option on a futures contract. The strike price and the futures price are $50, the risk-free rate is 10%, the time to maturity is six months, and the volatility is 40% per annum. Problem 12.25. Consider a European call option on a non-dividend-paying stock where the stock price is $40, the strike price is $40, the risk-free rate is 4% per annum, the volatility is 30% per annum, and the time to maturity is six months a. Calculate u, d, and p for a two step tree b. Value the option using a two step tree. c. Verify that DerivaGem gives the same answer d. Use DerivaGem to value the option with 5, 50, 100, and 500 time steps

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts