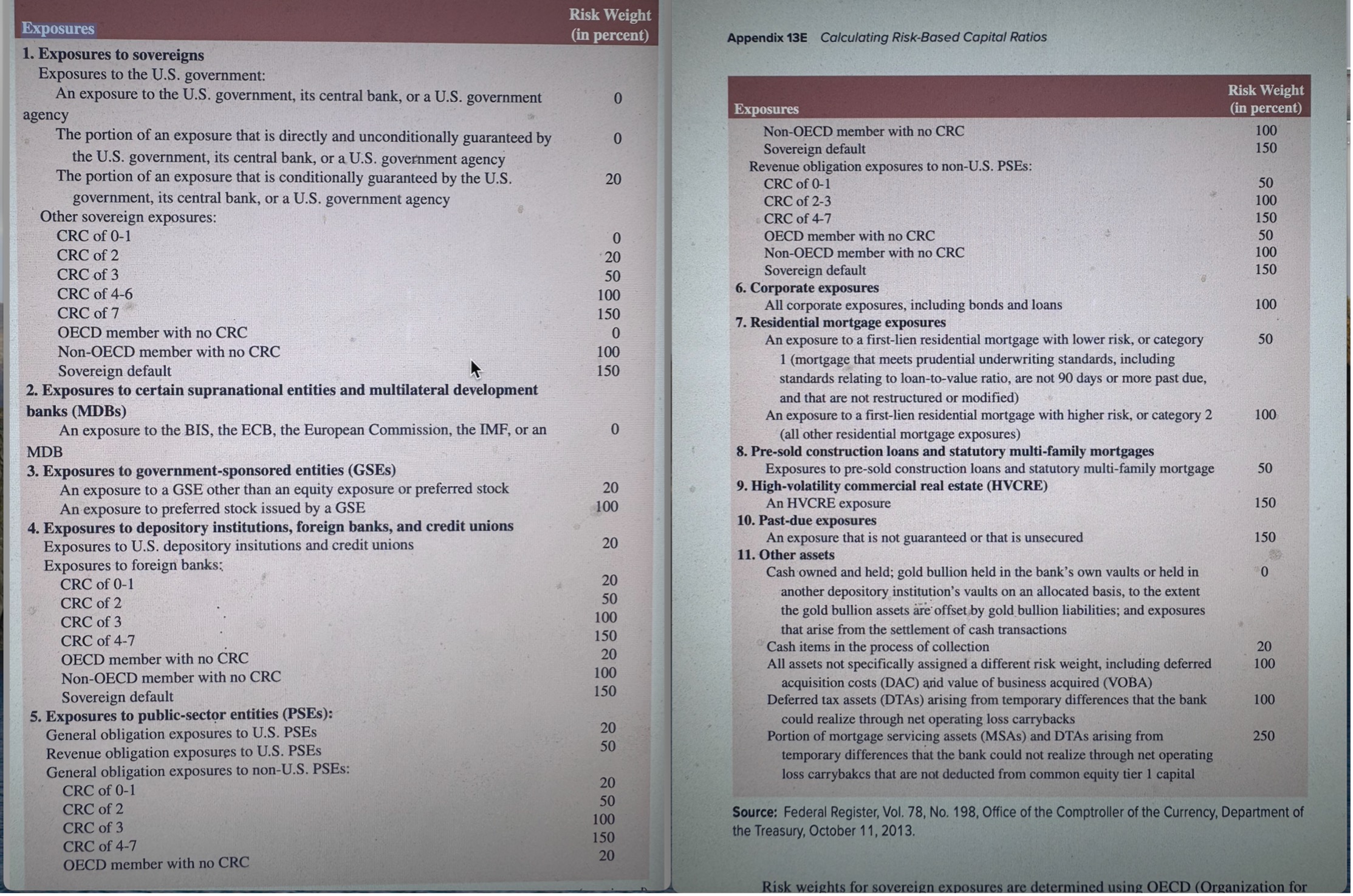

Question: Refer to Table 1 3 2 8 . ( attached ) Onshore Bank has $ 3 6 million in assets, with risk - weighted assets

Refer toTable attached Onshore Bank has $ million in assets, with riskweighted assets of $ million. Core Equity Tier CET capital is $ additional Tier I capital is $ and Tier II capital is $ The current value of the CET ratio is percent, the Tier I ratio is percent, and the total capital ratio is percent. Calculate the new value ofCET Tier I, and total capital ratios for the following transactions. The bank repurchases $ of common stock with cash. The bank issues $ million of CDs and uses the proceeds to issue category mortgage loans with a loantovalue ratio of percent. The bank receives $ in deposits and invests them in Tbills. The bank issues $ in common stock and lends it to help finance a new shopping mall. The developer has an A credit rating. The bank issues $ million in nonqualifying perpetual preferred stock and purchases general obligation municipal bonds. Homeowners pay back $ million of mortgages with loantovalue ratios of percent and the bank uses the proceeds to build new ATMs.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock