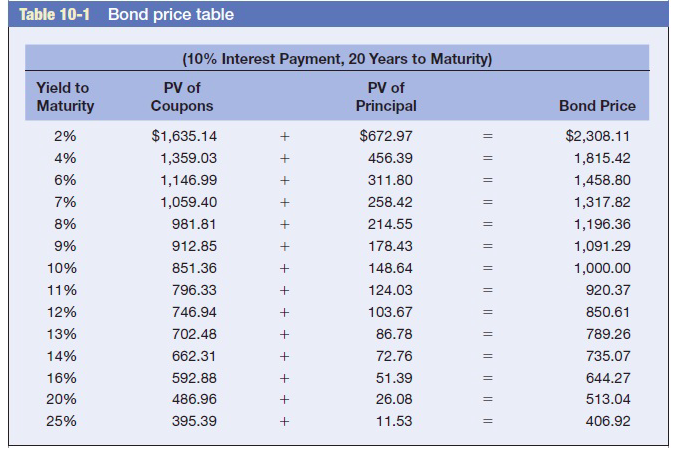

Question: Refer to Table 10-1, which is based on bonds paying 10 percent interest for 20 years. Assume interest rates in the market (yield to maturity)

Refer to Table 10-1, which is based on bonds paying 10 percent interest for 20 years. Assume interest rates in the market (yield to maturity) decline from 12 percent to 8 percent. a. What is the bond price at 12 percent?

b. What is the bond price at 8 percent?

c. What would be your percentage return on investment if you bought when rates were 12 percent and sold when rates were 8 percent? (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places

.)

Table 10-1 Bond price table (10% Interest Payment, 20 Years to Maturity) PV of Yield to PV of Maturity Coupons Principal Bond Price $1,635.14 $672.97 $2,308.11 2% 4% 1,359.03 456.39 1,815.42 + 6% 1,146.99 311.80 1,458.80 7% 258.42 1,317.82 1,059.40 + 8% 1,196.36 981.81 214.55 9% 912.85 178.43 1,091.29 10% 851.36 148.64 1,000.00 + 11% 796.33 920.37 124.03 + 12% 746.94 103.67 850.61 789.26 13% 702.48 + 86.78 14% 735.07 662.31 72.76 16% 592.88 51.39 644.27 20% 26.08 486.96 513.04 25% 395.39 406.92 11.53 IIII + + +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts