Question: You want to estimate the weighted average cost of capital for a privately held footwear company, Mercury Athletic Footwear (MA). To do so, you

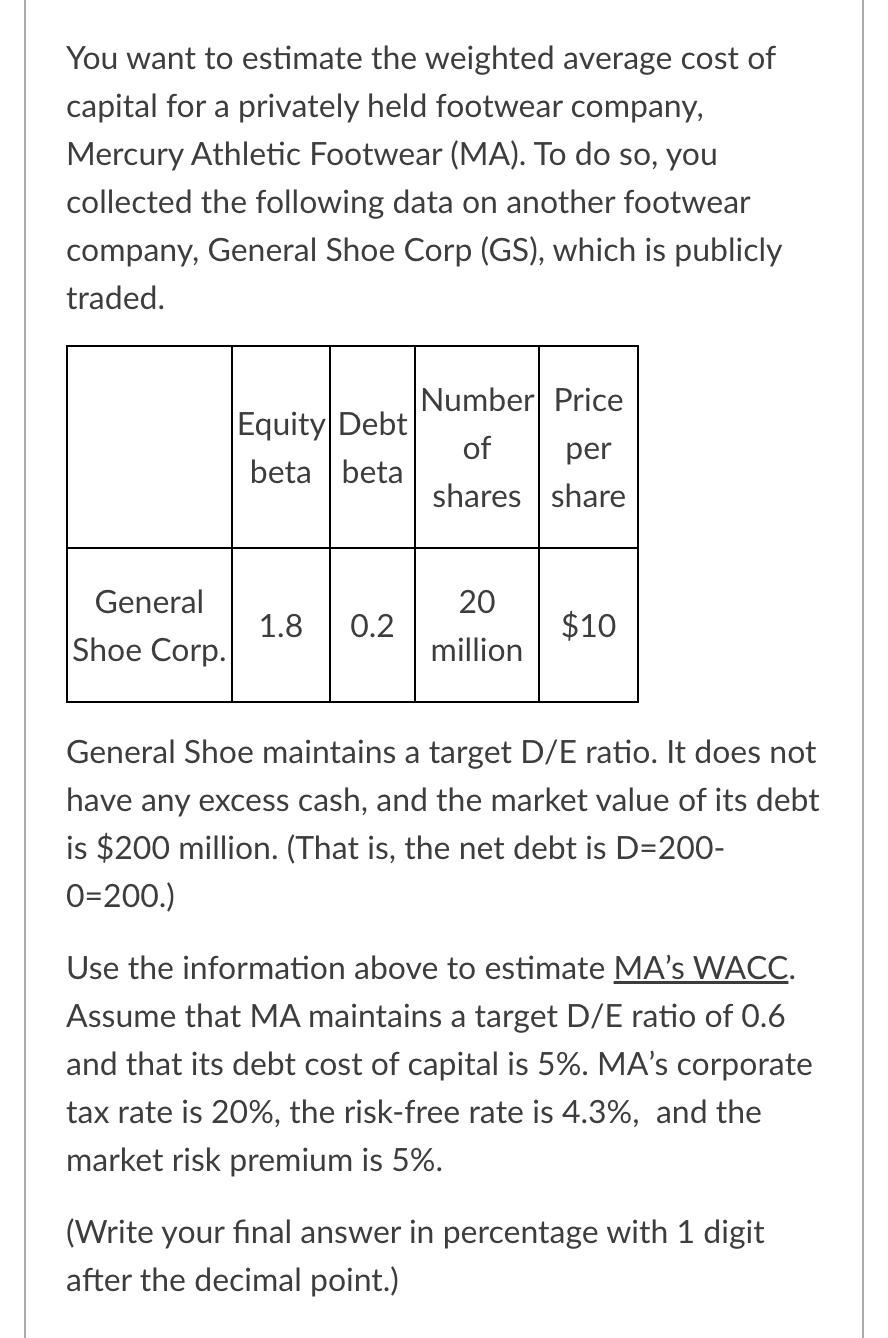

You want to estimate the weighted average cost of capital for a privately held footwear company, Mercury Athletic Footwear (MA). To do so, you collected the following data on another footwear company, General Shoe Corp (GS), which is publicly traded. General Shoe Corp. Equity Debt beta beta 1.8 0.2 Number Price of shares 20 million per share $10 General Shoe maintains a target D/E ratio. It does not have any excess cash, and the market value of its debt is $200 million. (That is, the net debt is D=200- 0=200.) Use the information above to estimate MA's WACC. Assume that MA maintains a target D/E ratio of 0.6 and that its debt cost of capital is 5%. MA's corporate tax rate is 20%, the risk-free rate is 4.3%, and the market risk premium is 5%. (Write your final answer in percentage with 1 digit after the decimal point.)

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

General shoe corp GS Equity Beta Be 18 Debt Beta Pd 02 Value of Equity ... View full answer

Get step-by-step solutions from verified subject matter experts