Question: Refer to the expected value document when doing problems 13 - 18. Try to set up your tables to calculate the expected values, either

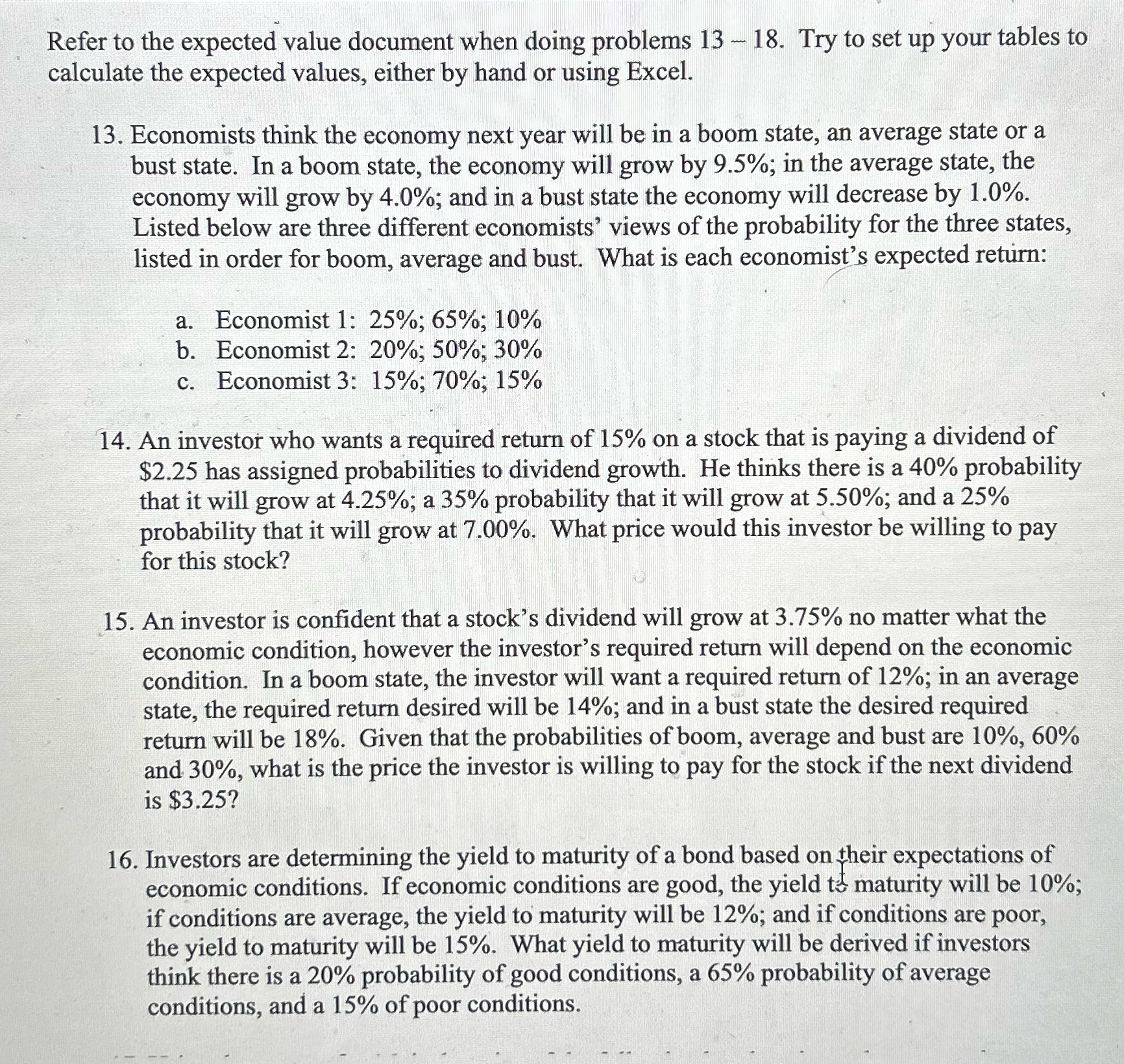

Refer to the expected value document when doing problems 13 - 18. Try to set up your tables to calculate the expected values, either by hand or using Excel. 13. Economists think the economy next year will be in a boom state, an average state or a bust state. In a boom state, the economy will grow by 9.5%; in the average state, the economy will grow by 4.0%; and in a bust state the economy will decrease by 1.0%. Listed below are three different economists' views of the probability for the three states, listed in order for boom, average and bust. What is each economist's expected return: a. Economist 1: 25%; 65%; 10% Economist 2: 20%; 50%; 30% b. c. Economist 3: 15%; 70%; 15% 14. An investor who wants a required return of 15% on a stock that is paying a dividend of $2.25 has assigned probabilities to dividend growth. He thinks there is a 40% probability that it will grow at 4.25%; a 35% probability that it will grow at 5.50%; and a 25% probability that it will grow at 7.00%. What price would this investor be willing to pay for this stock? 15. An investor is confident that a stock's dividend will grow at 3.75% no matter what the economic condition, however the investor's required return will depend on the economic condition. In a boom state, the investor will want a required return of 12%; in an average state, the required return desired will be 14%; and in a bust state the desired required return will be 18%. Given that the probabilities of boom, average and bust are 10%, 60% and 30%, what is the price the investor is willing to pay for the stock if the next dividend is $3.25? 16. Investors are determining the yield to maturity of a bond based on their expectations of economic conditions. If economic conditions are good, the yield te maturity will be 10%; if conditions are average, the yield to maturity will be 12%; and if conditions are poor, the yield to maturity will be 15%. What yield to maturity will be derived if investors think there is a 20% probability of good conditions, a 65% probability of average conditions, and a 15% of poor conditions.

Step by Step Solution

There are 3 Steps involved in it

Expected Value Calculations for Problems 1316 13 Economist Expected Returns Economist Boom Probability Average Probability Bust Probability Growth Rat... View full answer

Get step-by-step solutions from verified subject matter experts