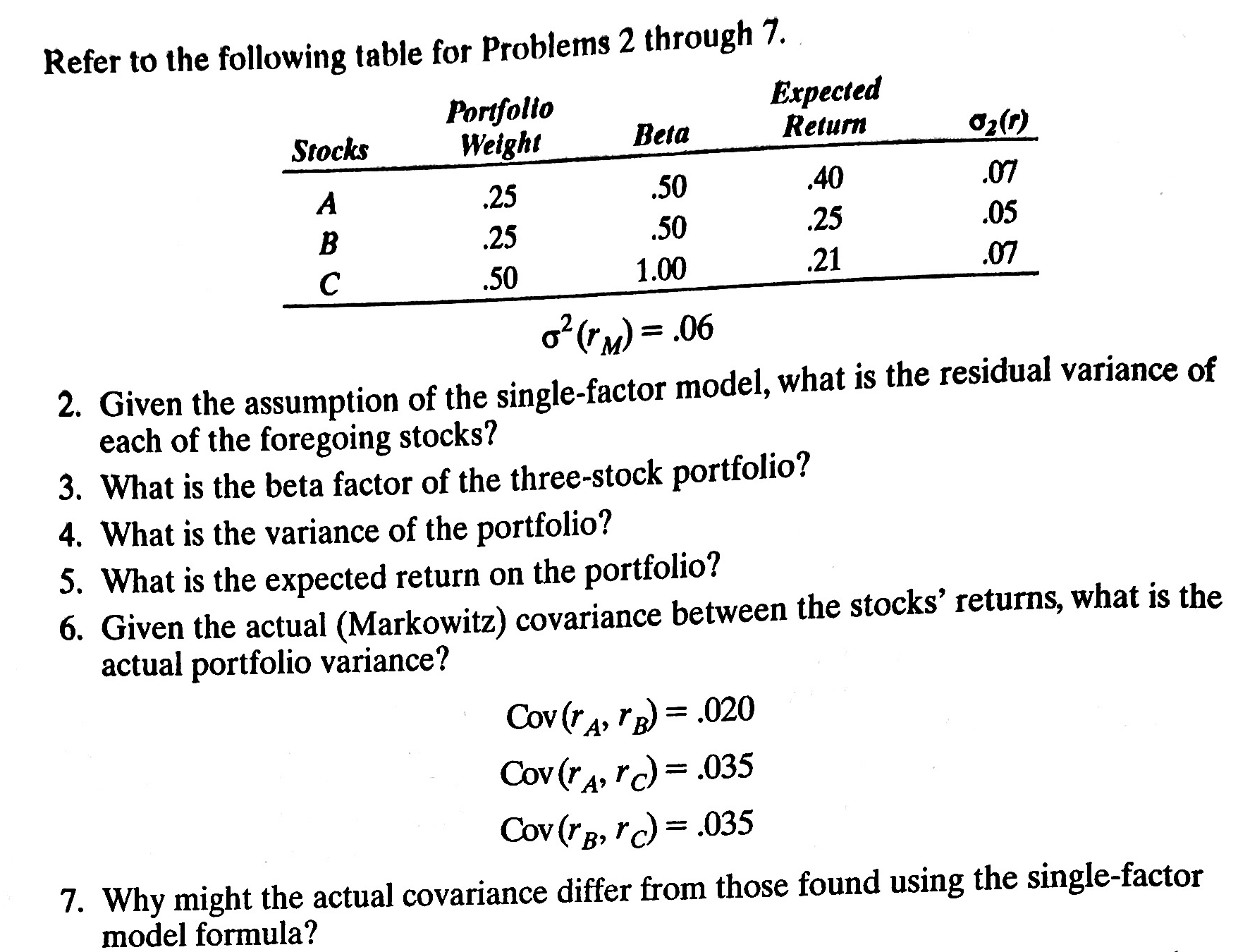

Question: Refer to the followine table for Problems 2 through 7. 2(rM)=.06 2. Given the assumption of the single-factor model, what is the residual variance of

Refer to the followine table for Problems 2 through 7. 2(rM)=.06 2. Given the assumption of the single-factor model, what is the residual variance of each of the foregoing stocks? 3. What is the beta factor of the three-stock portfolio? 4. What is the variance of the portfolio? 5. What is the expected return on the portfolio? 6. Given the actual (Markowitz) covariance between the stocks' returns, what is the actual portfolio variance? Cov(rA,rB)=.020Cov(rA,rC)=.035Cov(rB,rC)=.035 7. Why might the actual covariance differ from those found using the single-factor model formula

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock