Question: Refer to the information given below: a. The August 31 balance shown on the bank statement is $9,050. b. There is a deposit in transit

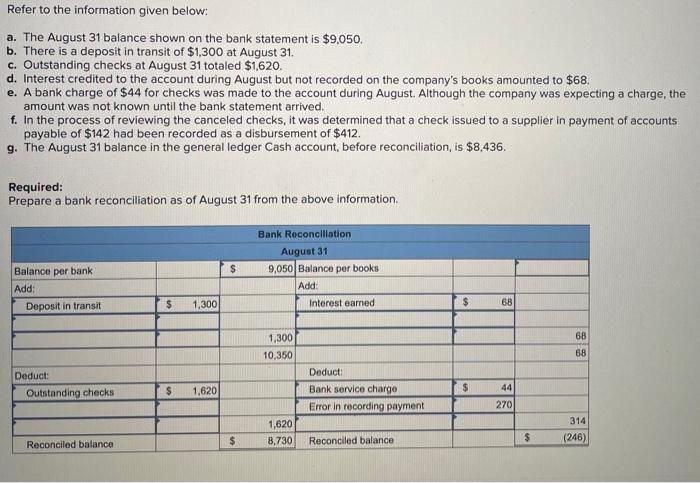

Refer to the information given below: a. The August 31 balance shown on the bank statement is $9,050. b. There is a deposit in transit of $1,300 at August 31. c. Outstanding checks at August 31 totaled $1,620. d. Interest credited to the account during August but not recorded on the company's books amounted to $68. e. A bank charge of $44 for checks was made to the account during August. Although the company was expecting a charge, the amount was not known until the bank statement arrived. f. In the process of reviewing the canceled checks, it was determined that a check issued to a supplier in payment of accounts payable of $142 had been recorded as a disbursement of $412. g. The August 31 balance in the general ledger Cash account, before reconciliation, is $8,436. Required: Prepare a bank reconciliation as of August 31 from the above information. Bank Reconciliation August 31 Balance per bank $ 9,050 Balance per books Add: Add: $ Deposit in transit $ Interest earned 68 1,300 10,350 Deduct: $ 44 Outstanding checks $ Bank service charge Error in recording payment 270 1,620 8,730 Reconciled balance Reconciled balance i Deduct: 1,300 1,620 $ 68 68 314 (246)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts