Question: Refer to the problem above. Suppose 100 extra units had been acquired on December 30, 20X8, for $80 each, a total of $8,000. How would

Refer to the problem above. Suppose 100 extra units had been acquired on December 30, 20X8, for $80 each, a total of $8,000. How would net income and income taxes have been affected under FIFO and under LIFO? Show a tabulated comparison.

Refer to the problem above. Suppose 100 extra units had been acquired on December 30, 20X8, for $80 each, a total of $8,000. How would net income and income taxes have been affected under FIFO and under LIFO? Show a tabulated comparison.

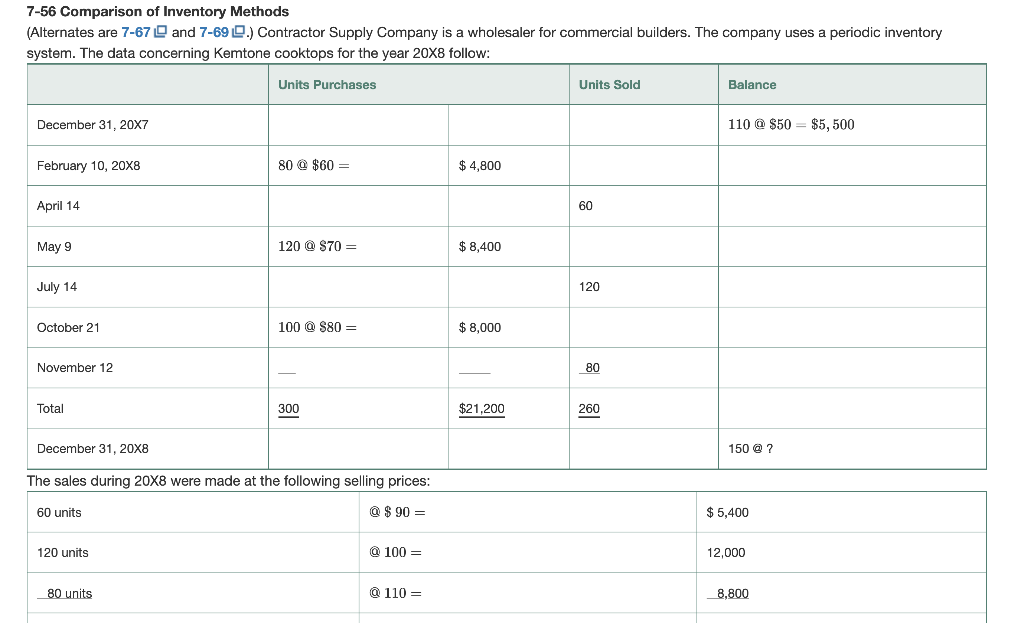

7-56 Comparison of Inventory Methods (Alternates are 7-67 and 7-690.) Contractor Supply Company is a wholesaler for commercial builders. The company uses a periodic inventory system. The data concerning Kemtone cooktops for the year 20X8 follow: Units Purchases Units Sold Balance December 31, 20X7 110 @ $50 = $5,500 February 10, 20X8 80 @ $60 = $ 4,800 April 14 60 May 9 120 @ $70 = $ 8,400 July 14 120 October 21 100 @ 880 = $ 8.000 November 12 80 Total 300 $21,200 260 December 31, 20X8 150 @? The sales during 20X8 were made at the following selling prices: 60 units @ $ 90 = $ 5,400 120 units @ 100 = 12,000 80 units @ 110 = 8,800 260 $26,200 1. Prepare a comparative statement of gross profit for the year ended December 31, 20X8, using FIFO, LIFO, and average cost inventory methods. Remember that when average cost is used with the periodic inventory system we refer to it as the weighted average method. 2. By how much would income taxes differ if Contractor Supply Company had used LIFO instead of FIFO for Kemtone cooktops? Assume a 40% income tax rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts