Question: Refer to the question posted previously. Don't ask for additional information. Answer correctly or get ready for a series of downvotes. Answer with proper explanation.

Refer to the question posted previously. Don't ask for additional information. Answer correctly or get ready for a series of downvotes. Answer with proper explanation. Q11

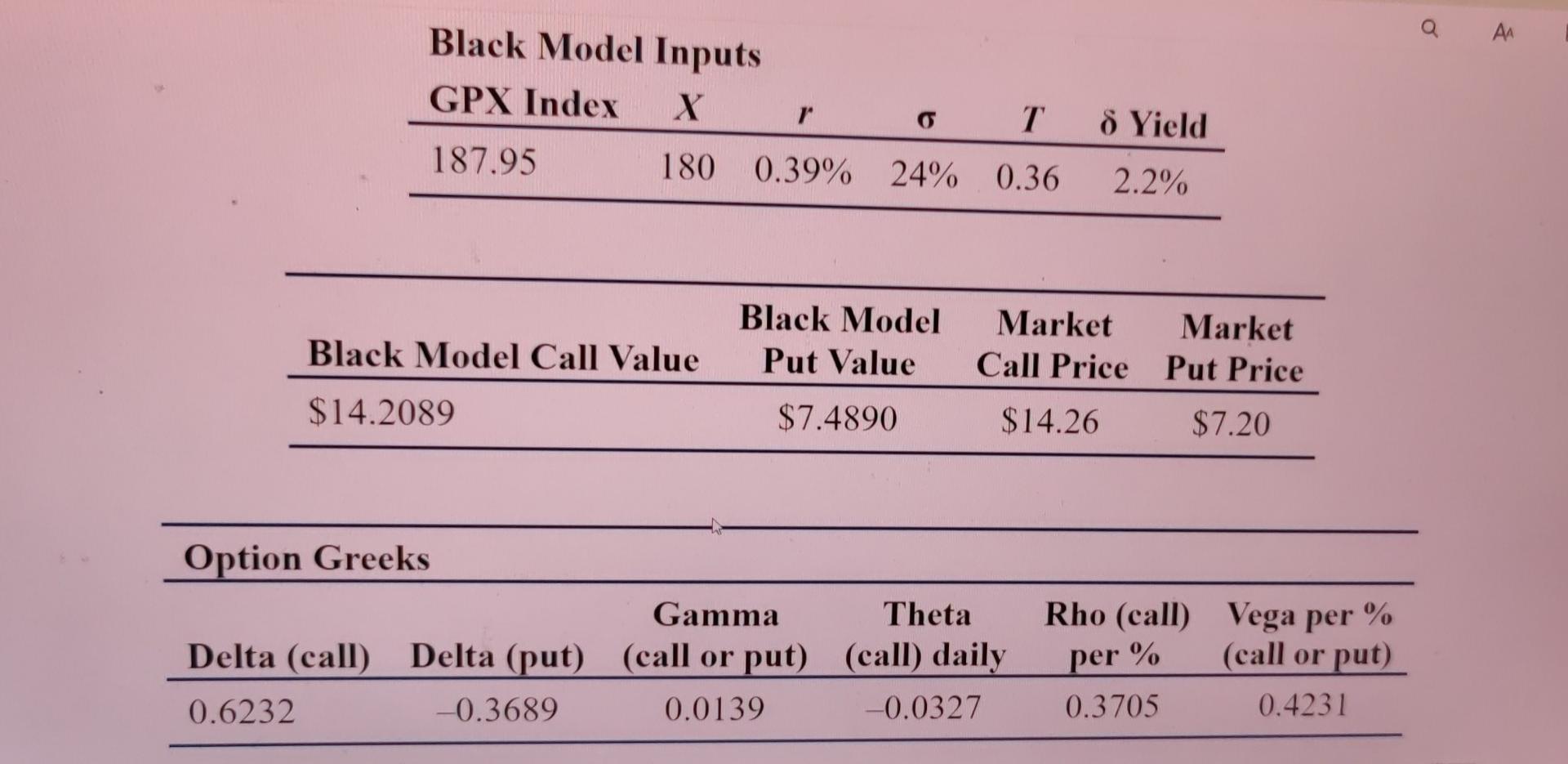

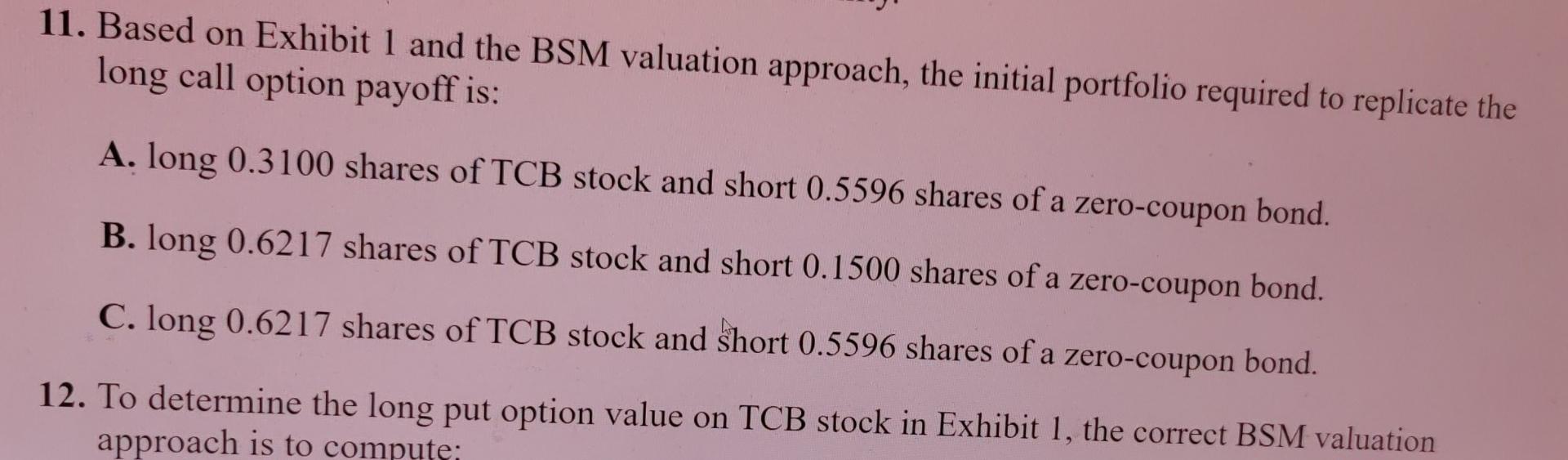

Black Model Inputs GPX Index X r T 8 Yield 187.95 180 0.39% 24% 0.36 2.2% Black Model Call Value Black Model Put Value Market Market Call Price Put Price $14.2089 $7.4890 $14.26 $7.20 Option Greeks Gamma Theta Delta (call) Delta (put) (call or put) (call) daily 0.6232 0.3689 0.0139 -0.0327 Rho (call) Vega per % (call or put) 0.3705 0.4231 per % 11. Based on Exhibit 1 and the BSM valuation approach, the initial portfolio required to replicate the long call option payoff is: A. long 0.3100 shares of TCB stock and short 0.5596 shares of a zero-coupon bond. B. long 0.6217 shares of TCB stock and short 0.1500 shares of a zero-coupon bond. C. long 0.6217 shares of TCB stock and short 0.5596 shares of a zero-coupon bond. 12. To determine the long put option value on TCB stock in Exhibit 1, the correct BSM valuation approach is to computer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts