Question: Refer to the sample Personal Auto Policy shown in Appendix A of your text. For each of the cases described below, evaluate whether the loss

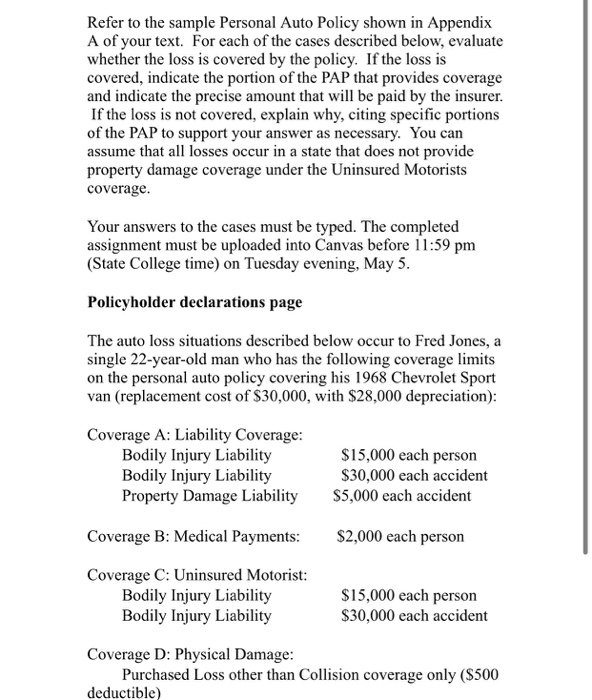

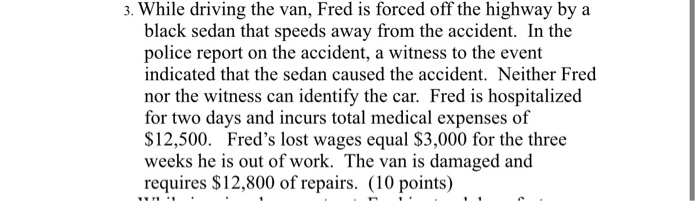

Refer to the sample Personal Auto Policy shown in Appendix A of your text. For each of the cases described below, evaluate whether the loss is covered by the policy. If the loss is covered, indicate the portion of the PAP that provides coverage and indicate the precise amount that will be paid by the insurer. If the loss is not covered, explain why, citing specific portions of the PAP to support your answer as necessary. You can assume that all losses occur in a state that does not provide property damage coverage under the Uninsured Motorists coverage. Your answers to the cases must be typed. The completed assignment must be uploaded into Canvas before 11:59 pm (State College time) on Tuesday evening, May 5. Policyholder declarations page The auto loss situations described below occur to Fred Jones, a single 22-year-old man who has the following coverage limits on the personal auto policy covering his 1968 Chevrolet Sport van (replacement cost of $30,000, with $28,000 depreciation): Coverage A: Liability Coverage: Bodily Injury Liability Bodily Injury Liability Property Damage Liability $15,000 each person $30,000 each accident $5,000 each accident Coverage B: Medical Payments: $2,000 each person Coverage C: Uninsured Motorist: Bodily Injury Liability Bodily Injury Liability $15,000 each person $30,000 each accident Coverage D: Physical Damage: Purchased Loss other than Collision coverage only ($500 deductible) 3. While driving the van, Fred is forced off the highway by a black sedan that speeds away from the accident. In the police report on the accident, a witness to the event indicated that the sedan caused the accident. Neither Fred nor the witness can identify the car. Fred is hospitalized for two days and incurs total medical expenses of $12,500. Fred's lost wages equal $3,000 for the three weeks he is out of work. The van is damaged and requires $12,800 of repairs. (10 points) Refer to the sample Personal Auto Policy shown in Appendix A of your text. For each of the cases described below, evaluate whether the loss is covered by the policy. If the loss is covered, indicate the portion of the PAP that provides coverage and indicate the precise amount that will be paid by the insurer. If the loss is not covered, explain why, citing specific portions of the PAP to support your answer as necessary. You can assume that all losses occur in a state that does not provide property damage coverage under the Uninsured Motorists coverage. Your answers to the cases must be typed. The completed assignment must be uploaded into Canvas before 11:59 pm (State College time) on Tuesday evening, May 5. Policyholder declarations page The auto loss situations described below occur to Fred Jones, a single 22-year-old man who has the following coverage limits on the personal auto policy covering his 1968 Chevrolet Sport van (replacement cost of $30,000, with $28,000 depreciation): Coverage A: Liability Coverage: Bodily Injury Liability Bodily Injury Liability Property Damage Liability $15,000 each person $30,000 each accident $5,000 each accident Coverage B: Medical Payments: $2,000 each person Coverage C: Uninsured Motorist: Bodily Injury Liability Bodily Injury Liability $15,000 each person $30,000 each accident Coverage D: Physical Damage: Purchased Loss other than Collision coverage only ($500 deductible) 3. While driving the van, Fred is forced off the highway by a black sedan that speeds away from the accident. In the police report on the accident, a witness to the event indicated that the sedan caused the accident. Neither Fred nor the witness can identify the car. Fred is hospitalized for two days and incurs total medical expenses of $12,500. Fred's lost wages equal $3,000 for the three weeks he is out of work. The van is damaged and requires $12,800 of repairs. (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts