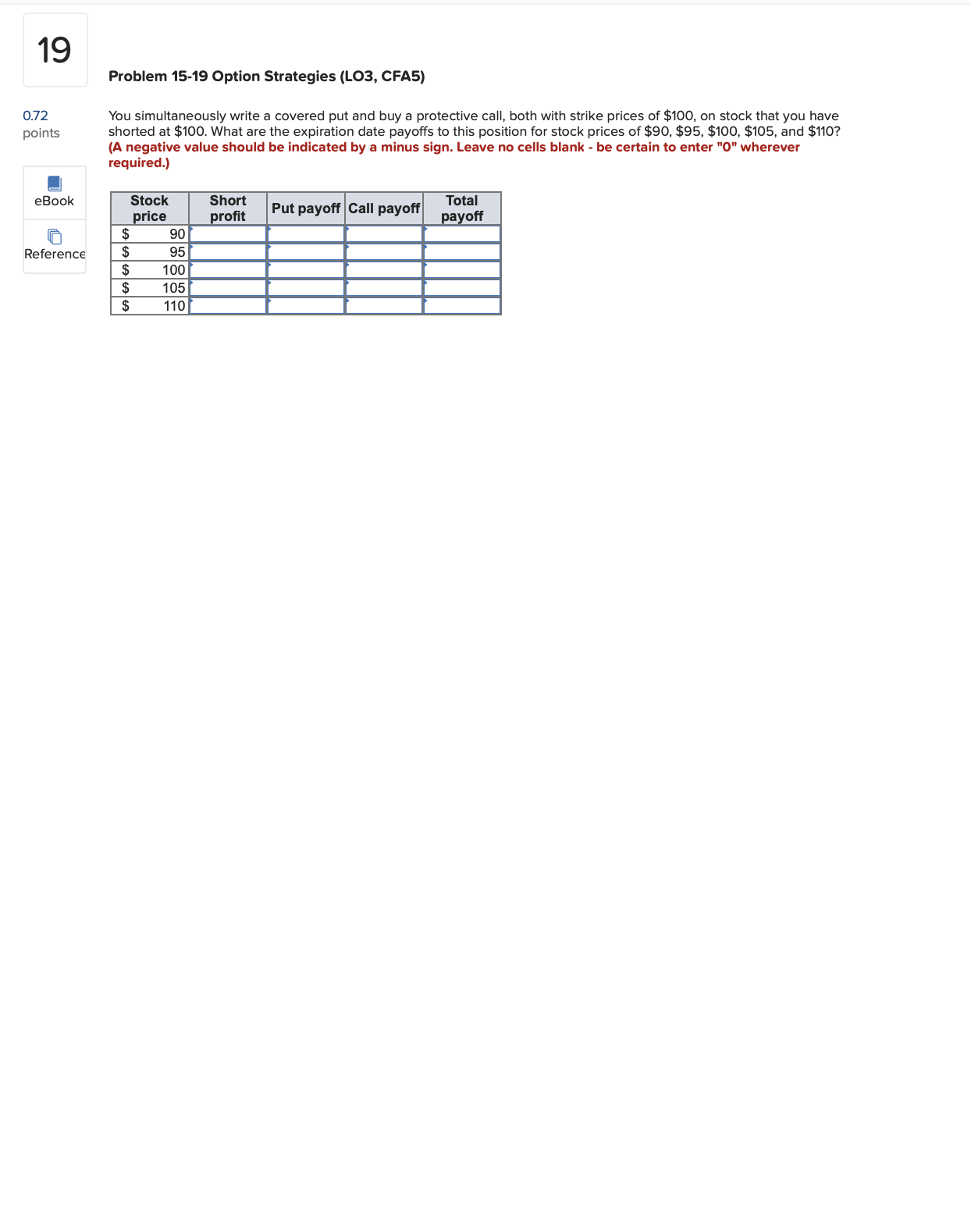

Question: Reference Problem 15-19 Option Strategies (L03, CFAS) You simultaneously write a covered put and buy a protective call. both with strike prices of $100. on

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock