Question: Reference Reference Reference Reference Future Value of Annuitv of $1 Benton Music is considering investing $700,000 in private lesson studios that will have no residual

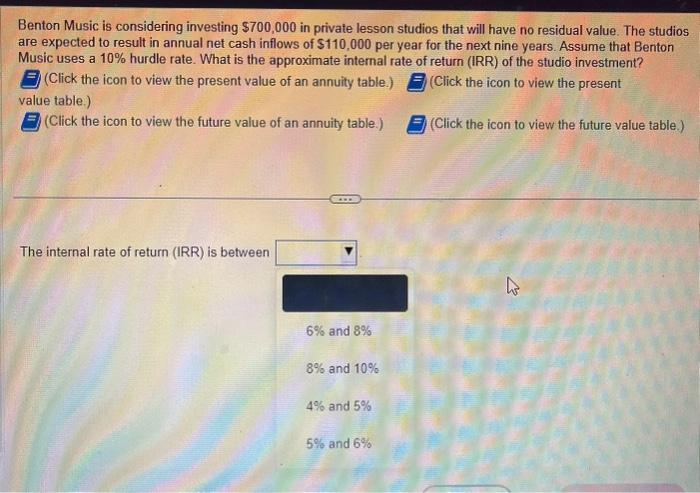

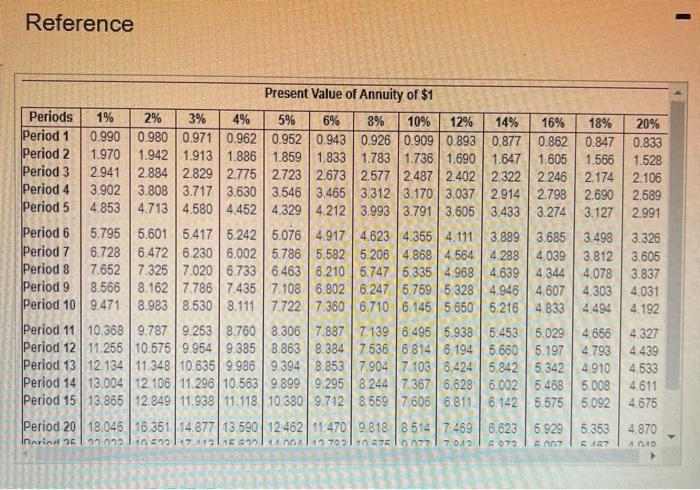

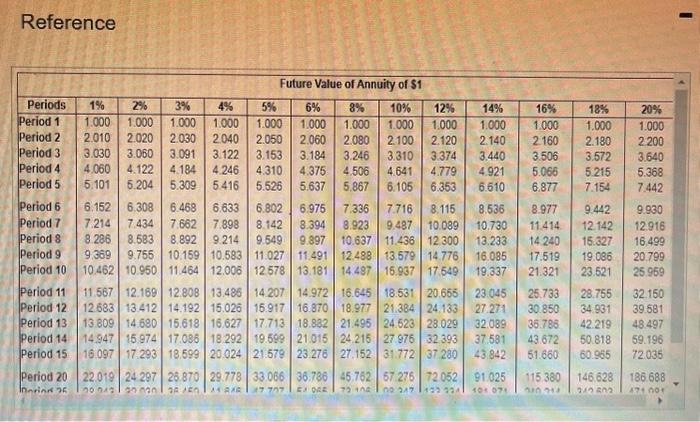

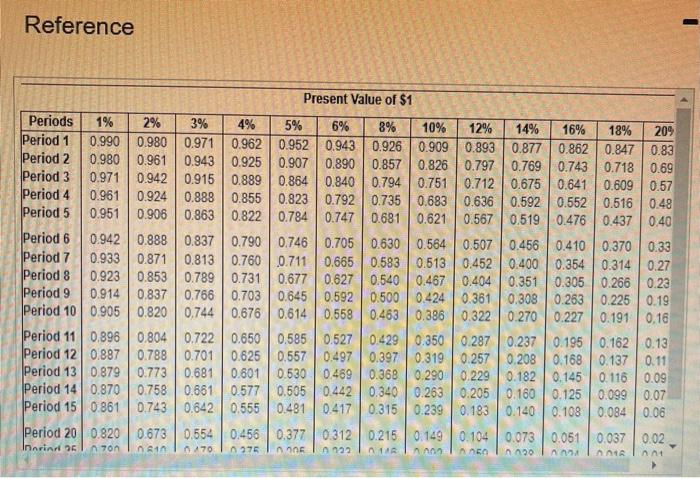

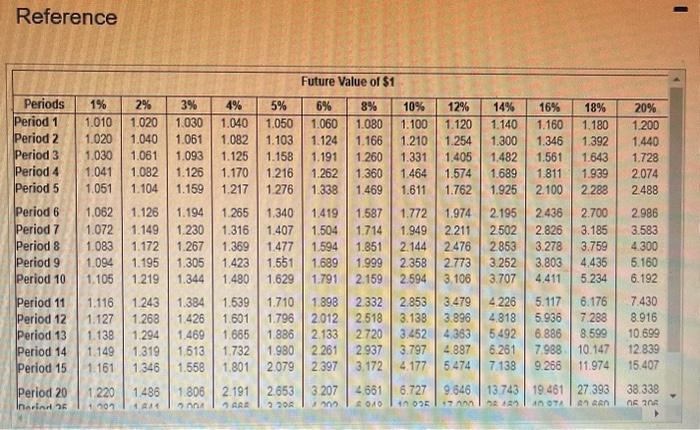

Reference Reference Reference Reference Future Value of Annuitv of \$1 Benton Music is considering investing $700,000 in private lesson studios that will have no residual value. The studios are expected to result in annual net cash inflows of $110,000 per year for the next nine years. Assume that Benton Music uses a 10% hurdle rate. What is the approximate internal rate of return (IRR) of the studio investment? (Click the icon to view the present value of an annuity table.) (Click the icon to view the present value table) (Click the icon to view the future value of an annuity table.) (Click the icon to view the future value table.) The internal rate of return (IRR) is between 6%and8%8%and10%4%and5%5%and6%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts