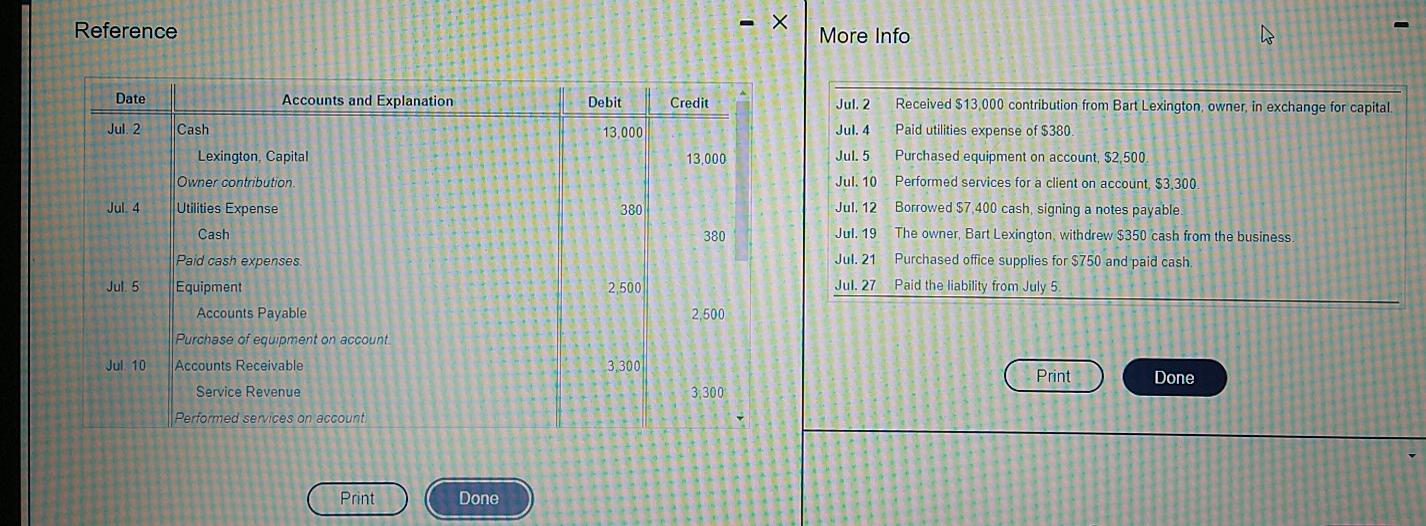

Question: Reference - X 1 More Info Date Accounts and Explanation Debit Credit Jul. 2 Cash 13,000 13,000 Lexington, Capital Owner contribution Utilities Expense Jul. 2

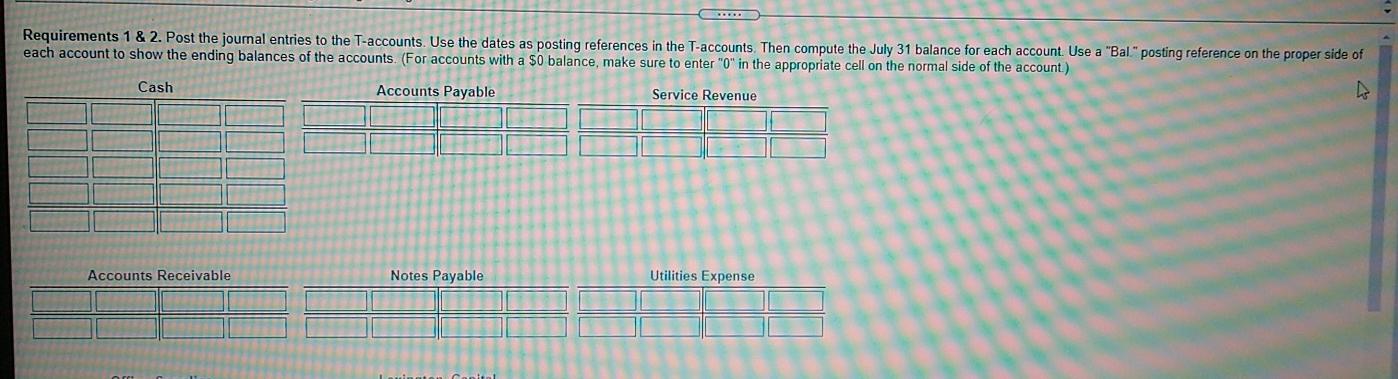

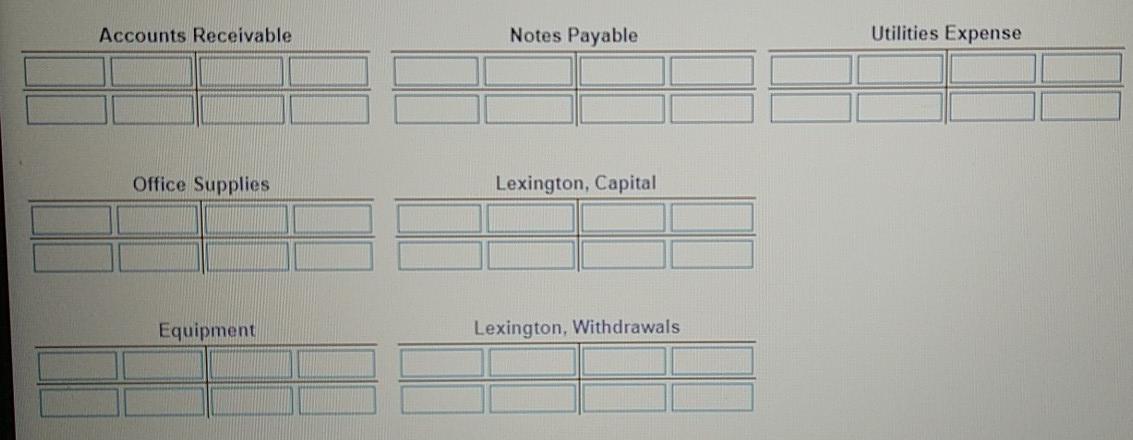

Reference - X 1 More Info Date Accounts and Explanation Debit Credit Jul. 2 Cash 13,000 13,000 Lexington, Capital Owner contribution Utilities Expense Jul. 2 Received $13,000 contribution from Bart Lexington, owner, in exchange for capital Jul. 4 Paid utilities expense of $380. Jul. 5 Purchased equipment on account, $2,500 Jul. 10 Performed services for a client on account, $3,300 Jul. 12 Borrowed $7400 cash, signing a notes payable Jul. 19 The owner, Bart Lexington, withdrew $350 cash from the business. Jul. 21 Purchased office supplies for $750 and paid cash Jul. 27 Paid the liability from July 5. Jul 4 380 Cash 380 Paid cash expenses Jul 5 2.500 2,500 Equipment Accounts Payable Purchase of equipment on account Accounts Receivable Jul 10 3,300 Print Done Service Revenue 3,300 Performed services on account Print Done Requirements 1 & 2. Post the journal entries to the T-accounts. Use the dates as posting references in the T-accounts. Then compute the July 31 balance for each account. Use a "Bal" posting reference on the proper side of each account to show the ending balances of the accounts. (For accounts with a $0 balance, make sure to enter "0" in the appropriate cell the normal side of the account) Cash Accounts Payable Service Revenue Accounts Receivable Notes Payable Utilities Expense Accounts Receivable Notes Payable Utilities Expense Office Supplies Lexington, Capital Equipment Lexington, Withdrawals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts