Question: References Mailings Review View Help A Table Illustrations Reuse Add- Files ins Online Videos Links Comment Header & Footer Text Symbols Tables Reuse Files

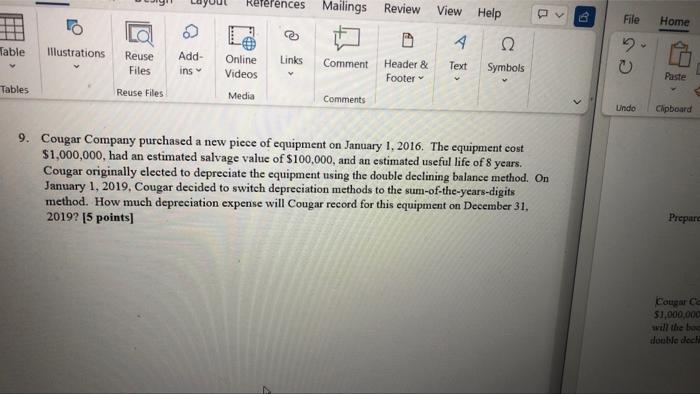

References Mailings Review View Help A Table Illustrations Reuse Add- Files ins Online Videos Links Comment Header & Footer Text Symbols Tables Reuse Files Media Comments EL 9. Cougar Company purchased a new piece of equipment on January 1, 2016. The equipment cost $1,000,000, had an estimated salvage value of $100,000, and an estimated useful life of 8 years. Cougar originally elected to depreciate the equipment using the double declining balance method. On January 1, 2019, Cougar decided to switch depreciation methods to the sum-of-the-years-digits method. How much depreciation expense will Cougar record for this equipment on December 31, 2019? [5 points] File Home Paste Undo Clipboard Prepares Cougar Ca $1,000,000 will the bo double decli

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts