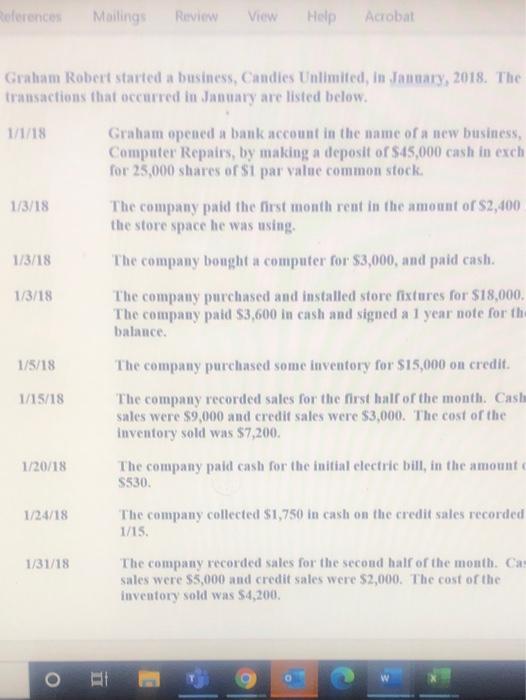

Question: References Mailings Review View Help Acrobat Graham Robert started a business, Candies Unlimited, in January, 2018. The transactions that occurred in January are listed below.

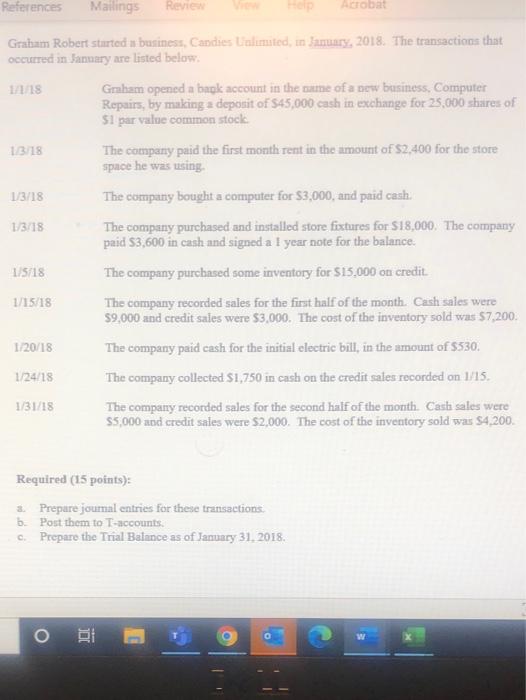

References Mailings Review View Help Acrobat Graham Robert started a business, Candies Unlimited, in January, 2018. The transactions that occurred in January are listed below. 1/1/18 Graham opened a bank account in the name of a new business, Computer Repairs, by making a deposit of $45,000 cash in exch for 25,000 shares of $1 par value common stock 1/3/18 The company paid the first month rent in the amount of $2,400 the store space he was using. 1/3/18 The company bought a computer for $3,000, and paid cash. 13/18 The company purchased and installed store fixtures for $18,000, The company paid $3,600 in cash and signed a 1 year note for the balance. 1/5/18 1/15/18 The company purchased some inventory for $15,000 on credit. The company recorded sales for the first half of the month. Castu sales were $9,000 and credit sales were $3,000. The cost of the inventory sold was $7,200 The company paid cash for the initial electric bill, in the amount S530 1/20/18 1/24/18 The company collected $1,750 in cash on the credit sales recorded 1/15 1/31/18 The company recorded sales for the second half of the month. Ca sales were $5,000 and credit sales were $2,000. The cost of the inventory sold was $4,200. O References Mailings ROVER Help Graham Robert Started business, Candies Unlimited, in January, 2018. The transactions that occurred in January are listed below. 118 Graham opened a bank account in the name of a new business. Computer Repairs, by making a deposit of $45,000 cash in exchange for 25,000 shares of $1 par value common stock 13/18 The company paid the first month rent in the amount of $2,400 for the store space he was using 13/18 The company bought a computer for $3,000, and paid cash 13/18 The company purchased and installed store fixtures for $18,000. The company paid $3,600 in cash and signed a l year note for the balance. 1/5/18 The company purchased some inventory for $15.000 on credit. 1/15/18 The company recorded sales for the first half of the month Cash sales were $9,000 and credit sales were $3,000. The cost of the inventory sold was 57,200. 1/20/18 The company paid cash for the initial electric bill, in the amount of $530. 1/24/18 The company collected $1,750 in cash on the credit sales recorded on 1/15, 1/31/18 The company recorded sales for the second half of the month Cast sales were $5,000 and credit sales were $2,000. The cost of the inventory sold was $4,200 Required (15 points): * Prepare journal entries for these transactions b Post them to T-accounts. c. Prepare the Trial Balance as of January 31, 2018 o JOE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts