Question: References Mailings Review View Help You are looking to value some common stock using various valuation models and are answering the following questions: 8. T/E

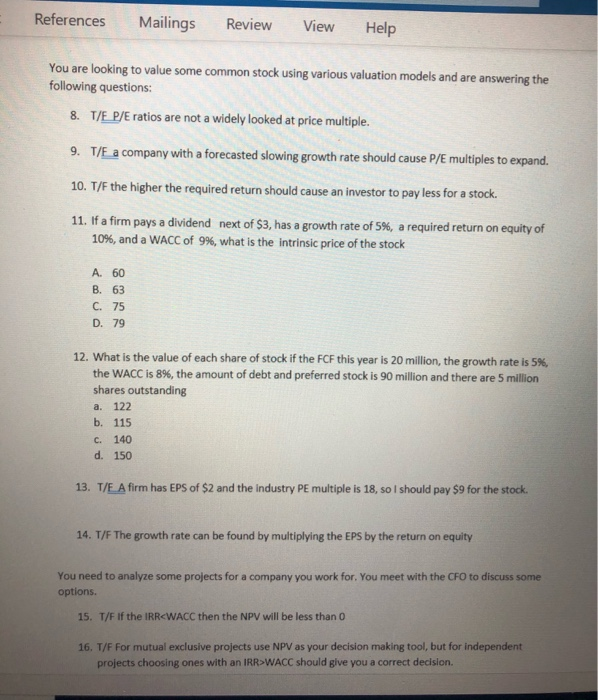

References Mailings Review View Help You are looking to value some common stock using various valuation models and are answering the following questions: 8. T/E P/E ratios are not a widely looked at price multiple. 9. T/F a company with a forecasted slowing growth rate should cause P/E multiples to expand. 10. T/F the higher the required return should cause an investor to pay less for a stock. 11. If a firm pays a dividend next of $3, has a growth rate of 5%, a required return on equity of 10%, and a WACC of 9%, what is the intrinsic price of the stock A. 60 B. 63 C. 75 D. 79 12. What is the value of each share of stock if the FCF this year is 20 million, the growth rate is 5% the WACC is 8%, the amount of debt and preferred stock is 90 million and there are 5 million shares outstanding a. 122 b. 115 c. 140 d. 150 13. T/E A firm has EPS of $2 and the industry PE multiple is 18, so I should pay $9 for the stock. 14. T/F The growth rate can be found by multiplying the EPS by the return on equity You need to analyze some projects for a company you work for. You meet with the CFO to discuss some options. 15. T/F If the IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts