Question: Referring to the Texaco-Pennzoil example in Chapter 4 of Making Hard Decisions with Decision Tool ed., pp. 118-119), Hugh Liedtke, chairman of Pennzoil, is deciding

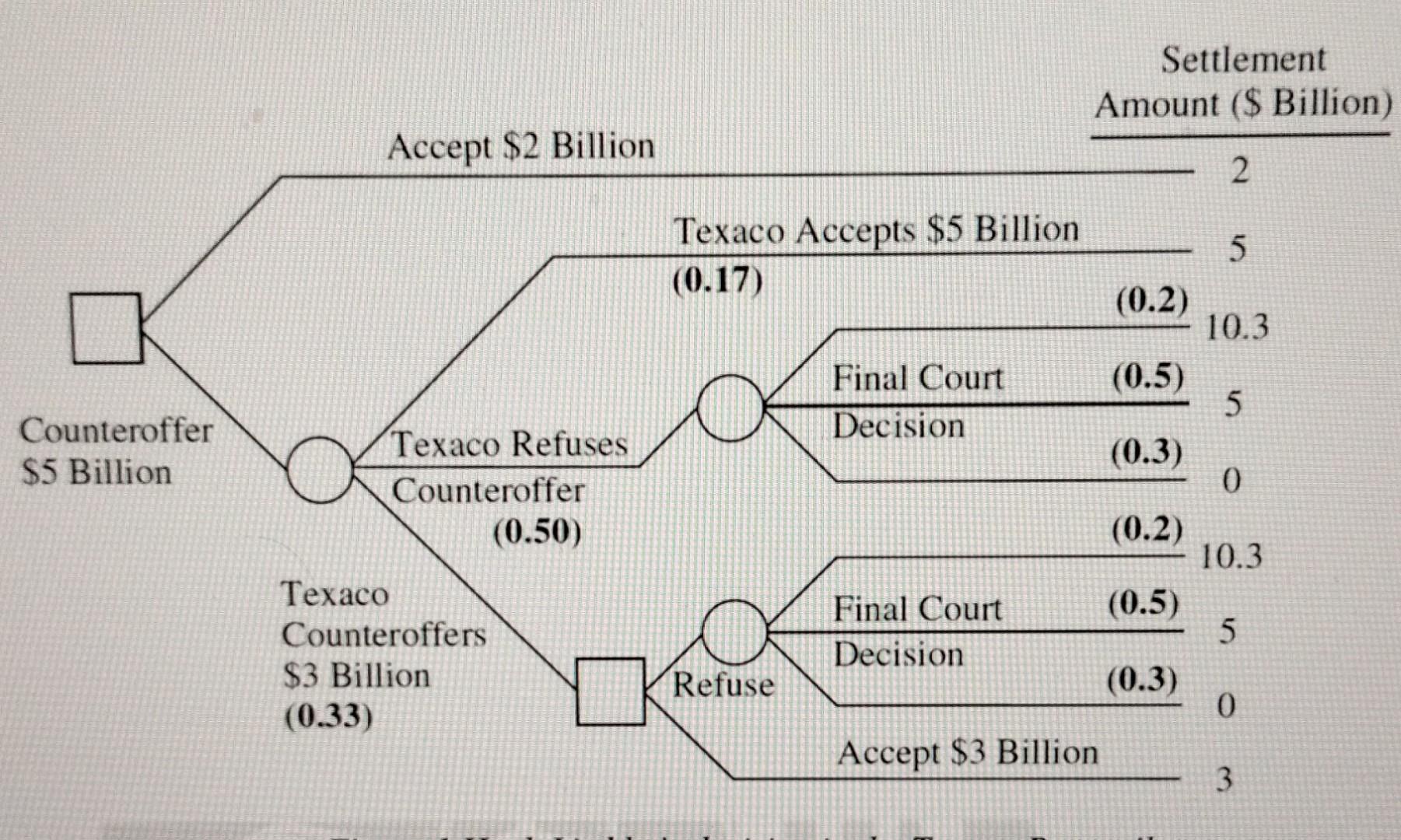

Referring to the Texaco-Pennzoil example in Chapter 4 of Making Hard Decisions with Decision Tool ed., pp. 118-119), Hugh Liedtke, chairman of Pennzoil, is deciding if he should accept $2 billion to ttle a lawsuit case between Texaco and Pennzoil, or counteroffer $5 billion to Texaco. If Liedtke refuses e sure $2 billion, Texaco might agree to pay $5 billion, counter with $3 billion, or simply pursue further peals. Suppose that Liedtke's utility function is given in the following table: Table 1 Utility function for Liedtke Payoff (billions). Utility $10.03 1.00 $5.0 0.75 $3.0 0.6 $2.0 0.45 0.0 0.00 a. Graph this utility function. Based on this graph, how would you classify Liedtke's attitude toward risk? b. Use the utility function with the decision tree shown below to solve Liedtke's problem. With these utilities, what strategy should he pursue? Should he still counteroffer $5 billion? What if Texaco counteroffers $3 billion? c. Based on this utility function, what is the least amount (approximately) that Liedtke should agree to in a settlement? (Hint: Find a sure amount that gives him the same expected utility he gets for going to court.) What does this suggest regarding plausible counteroffers that Liedtke might make?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts