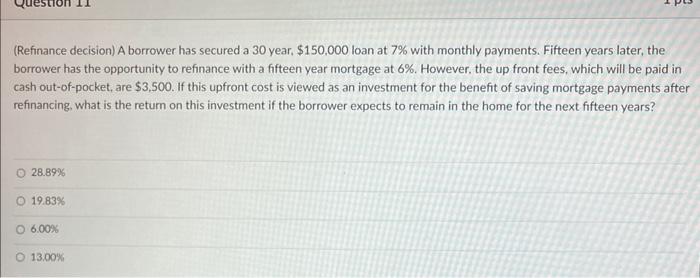

Question: (Refinance decision) A borrower has secured a 30 year, $150,000 loan at 7% with monthly payments. Fifteen years later, the borrower has the opportunity to

(Refinance decision) A borrower has secured a 30 year, $150,000 loan at 7% with monthly payments. Fifteen years later, the borrower has the opportunity to refinance with a fifteen year mortgage at 6%. However, the up front fees, which will be paid in cash out-of-pocket, are $3,500. If this upfront cost is viewed as an investment for the benefit of saving mortgage payments after refinancing, what is the retum on this investment if the borrower expects to remain in the home for the next fifteen years? 28.89% 19.83% 6.00% 13.00%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock