Question: Regarding CFA Level 1 question. Why when they calculate the PV of annuity, they use the formula that I bracketed in green but not the

Regarding CFA Level 1 question.

Why when they calculate the PV of annuity, they use the formula that I bracketed in green but not the formula PV=A[(1-(1+r)^-N)/r] (the denominator r is inside the brackets.

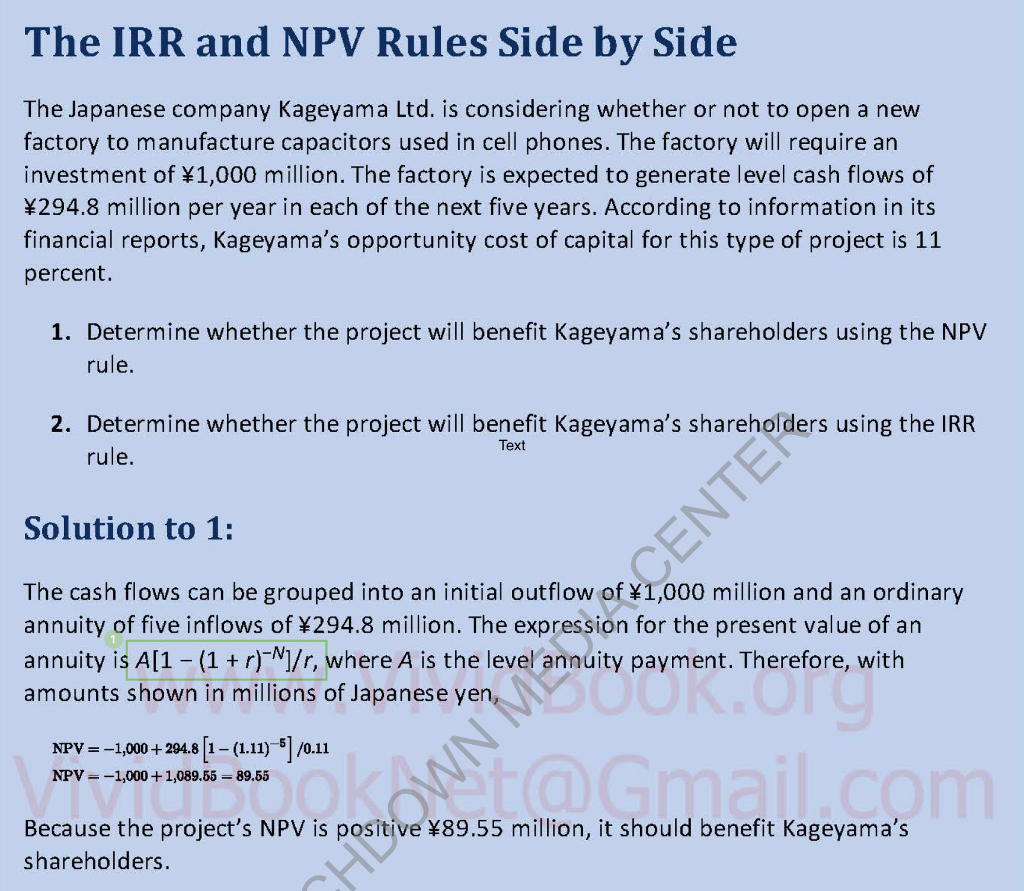

The IRR and NPV Rules Side by Side panese company Kageyama Ltd. is considering whether or not to open a new factory to manufacture capacitors used in cell phones. The factory will require an investment of 1,000 million. The factory is expected to generate level cash flows of 294.8 million per year in each of the next five years. According to information in its financial reports, Kageyama's opportunity cost of capital for this type of project is 11 percent. 1. Determine whether the project will benefit Kageyama's shareholders using the NPV rule. 2. Determine whether the project will benefit Kageyama's shareholders using the IRR rule. Text Solution to 1: The cash flows can be grouped into an initial outflow of 1,000 million and an ordinary annuity of five inflows of 294.8 million. The expression for the present value of an annuity is A[1 - (1 + r)-N]/r, where A is the level annuity payment. Therefore, with amounts shown in millions of Japanese yen, NPV =1,000+ 294.8 [1 (1.11)5] /0.11 NPV=-1,000 + 1,089.55 = 89.55 Because the project's NPV is positive 89.55 million, it should benefit Kageyama's shareholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts