Question: Regarding Michael Smith Hedging Strategy (case study): *Using transaction Exposure Theory to Answer* For the 1 million dividend to be received on September 15 (7

Regarding Michael Smith Hedging Strategy (case study): *Using transaction Exposure Theory to Answer*

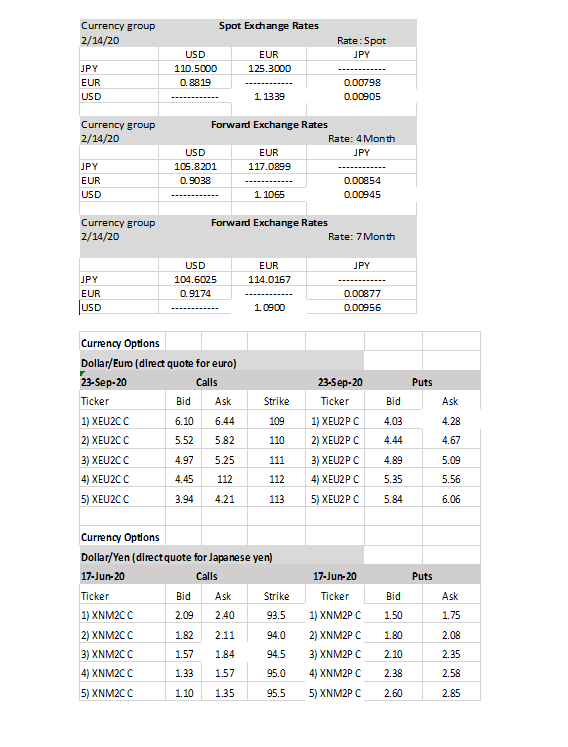

- For the 1 million dividend to be received on September 15 (7 months from now), should Mr. Smith hedge with forward contracts or options contracts? You should calculate the dollars received under each hedging strategy and draw a graph with Excel to show the relation between the dollar amount received and future spot rate 7 months from now. You may make your suggestion based on what your graph shows. Suppose the interest rate is very low and you do not need to compute the effect of time value of money on options premium in your calculation.

- For the 1800 million to be paid on June 10th (4 months from now), should Mr. Smith hedge with forward contracts or options contracts? You should calculate the dollars paid under each hedging strategy and draw a graph with Excel to show the relation between the dollar amount paid and future spot rate 4 months from now. You may make your suggestion based on what your graph shows. Suppose the interest rate is very low and you do not need to compute the effect of time value of money on options premium in your calculation.

Spot Exchange Rates Currency group 2/14/20 Rate: Spot JPY USD 110.5000 0.8819 EUR 125.3000 JPY EUR USD 0.00798 0.00905 1. 1339 Currency group 2/14/20 Forward Exchange Rates Rate: 4 Month USD EUR JPY 105.8201 117.0899 0.9038 0.00854 1. 1065 0.00945 JPY EUR USD Currency group 2/14/20 Forward Exchange Rates Rate: 7 Month JPY USD 104.6025 0.9174 EUR 114.0167 JPY EUR USD 0.00877 0.00956 1.0900 Puts Strike Bid Ask Currency Options Dollar/Euro (direct quote for euro) 23-Sep-20 Calls Ticker Bid Ask 1) XEU2CC 6.10 6.44 2) XEU2CC 5.52 5.82 3) XEU2CC 4.97 4) XEU2CC 4.45 112 5) XEU2CC 3.94 4.21 109 4.03 4.28 110 23-Sep-20 Ticker 1) XEU2PC 2) XEU2PC 3) XEU2PC 4) XEU2PC 5) XEU2PC 4.44 4.67 5.25 5.09 111 112 4.89 5.35 5.56 113 5.84 6.06 Puts Bid Currency Options Dollar/Yen (direct quote for Japanese yen) 17-Jun-20 Calls Ticker Ask Strike 1) XNM2CC 2.09 2.40 93.5 2) XNM2CC 1.82 2.11 94.0 3) XNM2CC 1.57 1.84 94.5 4) XNM2CC 1.33 1.57 95.0 5) XNM2CC 1.10 1.35 95.5 Bid 1.50 Ask 1.75 17-Jun-20 Ticker 1) XNM2PC 2) XNM2PC 3) XNM2PC 4) XNM2PC 5) XNM2PC 1.80 2.08 2.10 2.35 2.58 2.38 2.60 2.85 Spot Exchange Rates Currency group 2/14/20 Rate: Spot JPY USD 110.5000 0.8819 EUR 125.3000 JPY EUR USD 0.00798 0.00905 1. 1339 Currency group 2/14/20 Forward Exchange Rates Rate: 4 Month USD EUR JPY 105.8201 117.0899 0.9038 0.00854 1. 1065 0.00945 JPY EUR USD Currency group 2/14/20 Forward Exchange Rates Rate: 7 Month JPY USD 104.6025 0.9174 EUR 114.0167 JPY EUR USD 0.00877 0.00956 1.0900 Puts Strike Bid Ask Currency Options Dollar/Euro (direct quote for euro) 23-Sep-20 Calls Ticker Bid Ask 1) XEU2CC 6.10 6.44 2) XEU2CC 5.52 5.82 3) XEU2CC 4.97 4) XEU2CC 4.45 112 5) XEU2CC 3.94 4.21 109 4.03 4.28 110 23-Sep-20 Ticker 1) XEU2PC 2) XEU2PC 3) XEU2PC 4) XEU2PC 5) XEU2PC 4.44 4.67 5.25 5.09 111 112 4.89 5.35 5.56 113 5.84 6.06 Puts Bid Currency Options Dollar/Yen (direct quote for Japanese yen) 17-Jun-20 Calls Ticker Ask Strike 1) XNM2CC 2.09 2.40 93.5 2) XNM2CC 1.82 2.11 94.0 3) XNM2CC 1.57 1.84 94.5 4) XNM2CC 1.33 1.57 95.0 5) XNM2CC 1.10 1.35 95.5 Bid 1.50 Ask 1.75 17-Jun-20 Ticker 1) XNM2PC 2) XNM2PC 3) XNM2PC 4) XNM2PC 5) XNM2PC 1.80 2.08 2.10 2.35 2.58 2.38 2.60 2.85

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts