Question: Regarding Mutual Funds (both open end and closed end), Exchange Traded Funds, and Hedge Funds, which of the following statements is least correct? Hedge Funds

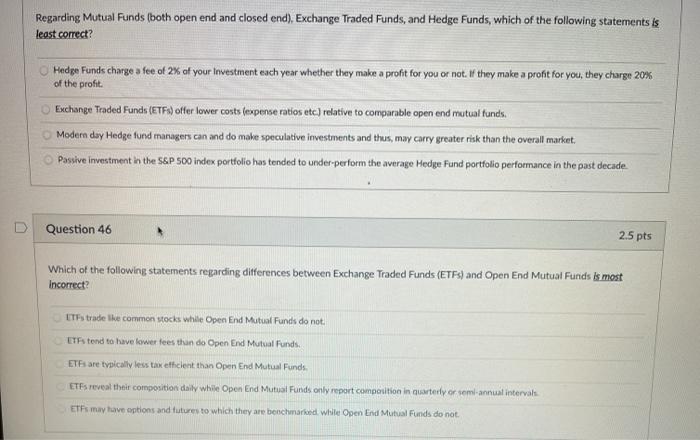

Regarding Mutual Funds (both open end and closed end), Exchange Traded Funds, and Hedge Funds, which of the following statements is least correct? Hedge Funds charge a fee of 2% of your investment each year whether they make a profit for you or not. If they make a profit for you, they charge 20% of the profit Exchange Traded Funds (ETFs) offer lower costs (expense ratios etc.) relative to comparable open end mutual funds. Modern day Hedge fund managers can and do make speculative investments and thus, may carry greater risk than the overall market. Passive investment in the S&P 500 index portfolio has tended to under-perform the average Hedge Fund portfolio performance in the past decade Question 46 2.5 pts Which of the following statements regarding differences between Exchange Traded Funds (ETFs) and Open End Mutual Funds is most Incorrect? LTEs trade the common stocks while Open End Mutual Funds do not ETA tend to have lower fees thundo Open End Mutual Funds ETs are typically less tax efficient than Open End Mutual Funds ETFs reveal their composition daily while Open End Mutual Funds only report composition in quarterly or semi-annual intervals. ETFs may have options and futures to which they are benchmarked white Open End Mutual Funds do not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts