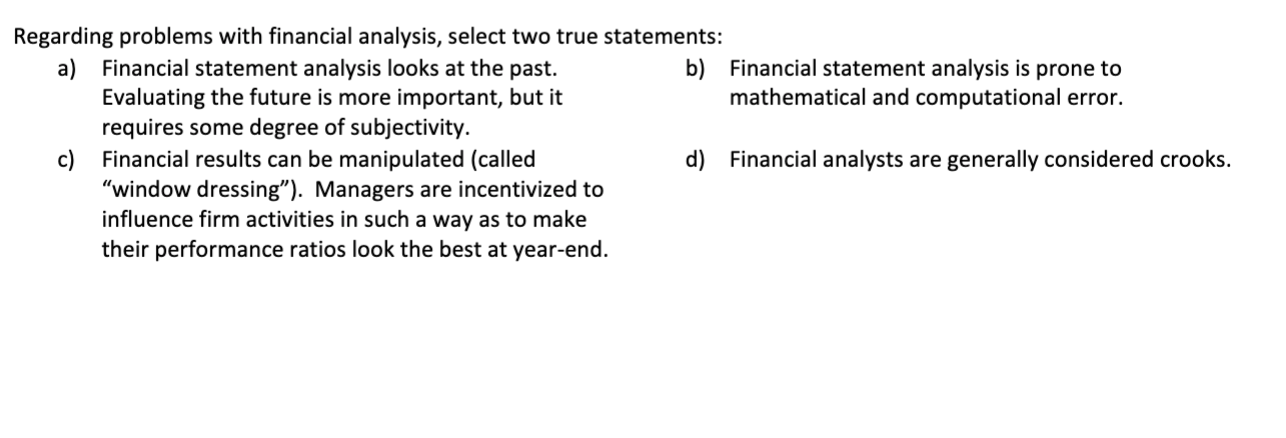

Question: Regarding problems with financial analysis, select two true statements: a) Financial statement analysis looks at the past. b) Financial statement analysis is prone to Evaluating

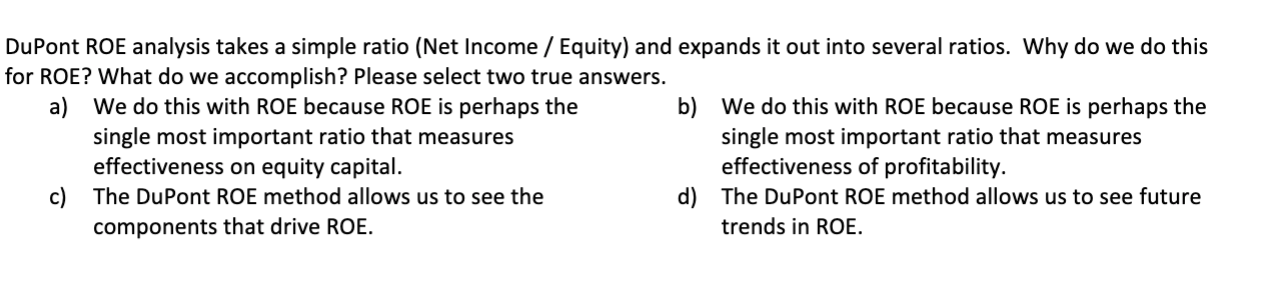

Regarding problems with financial analysis, select two true statements: a) Financial statement analysis looks at the past. b) Financial statement analysis is prone to Evaluating the future is more important, but it mathematical and computational error. requires some degree of subjectivity. Financial results can be manipulated (called d) Financial analysts are generally considered crooks. "window dressing). Managers are incentivized to influence firm activities in such a way as to make their performance ratios look the best at year-end. DuPont ROE analysis takes a simple ratio (Net Income / Equity) and expands it out into several ratios. Why do we do this for ROE? What do we accomplish? Please select two true answers. a) We do this with ROE because ROE is perhaps the b) We do this with ROE because ROE is perhaps the single most important ratio that measures single most important ratio that measures effectiveness on equity capital. effectiveness of profitability. c) The DuPont ROE method allows us to see the d) The DuPont ROE method allows us to see future components that drive ROE. trends in ROE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts