Question: regarding the initial monthly payment. One popular option ARM allowed borrowers to make a monthly payment equal to only half of the interest due in

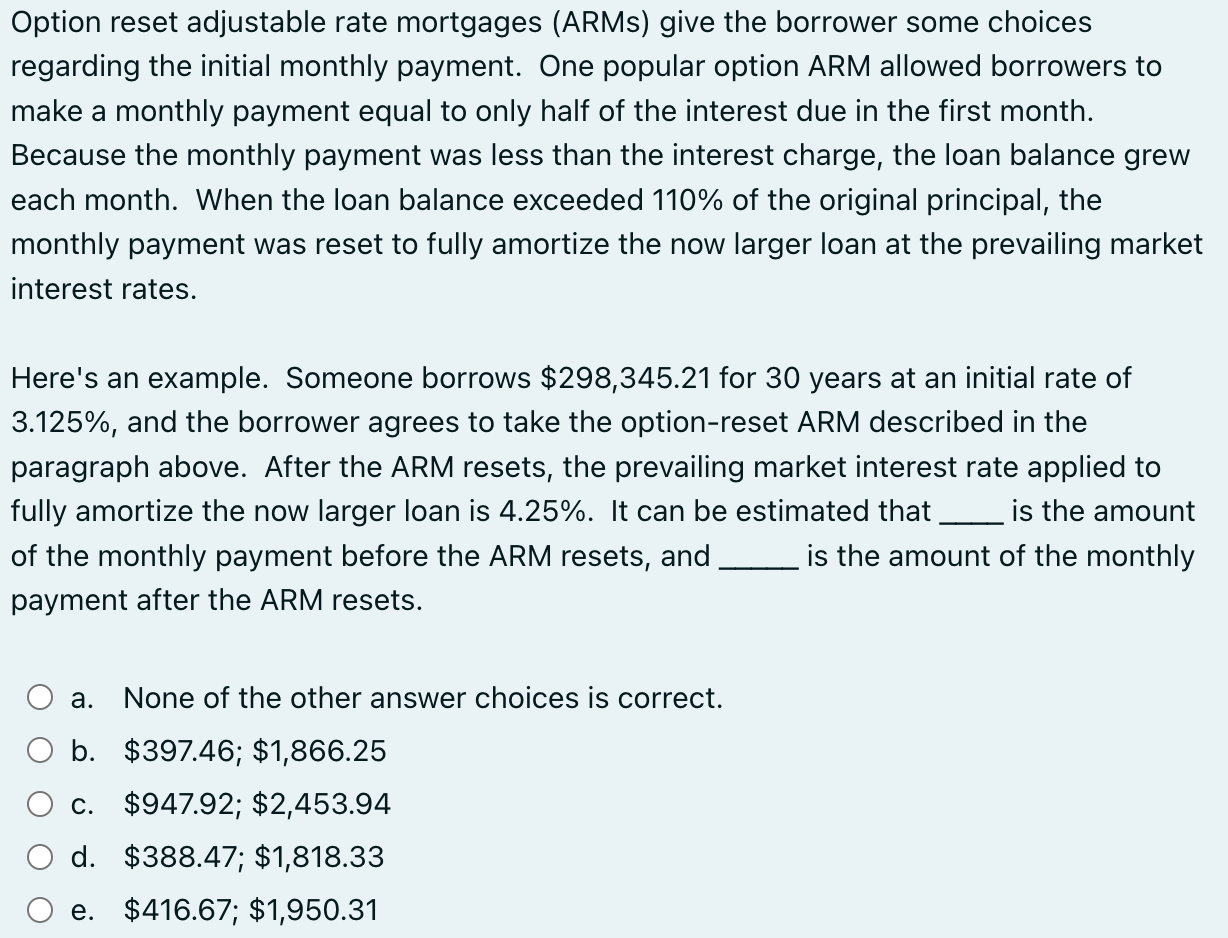

regarding the initial monthly payment. One popular option ARM allowed borrowers to make a monthly payment equal to only half of the interest due in the first month. Because the monthly payment was less than the interest charge, the loan balance grew each month. When the loan balance exceeded 110% of the original principal, the monthly payment was reset to fully amortize the now larger loan at the prevailing market interest rates. Here's an example. Someone borrows $298,345.21 for 30 years at an initial rate of 3.125%, and the borrower agrees to take the option-reset ARM described in the paragraph above. After the ARM resets, the prevailing market interest rate applied to fully amortize the now larger loan is 4.25%. It can be estimated that is the amount of the monthly payment before the ARM resets, and is the amount of the monthly payment after the ARM resets. a. None of the other answer choices is correct. b. $397.46;$1,866.25 c. $947.92;$2,453.94 d. $388.47;$1,818.33 e. $416.67;$1,950.31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts