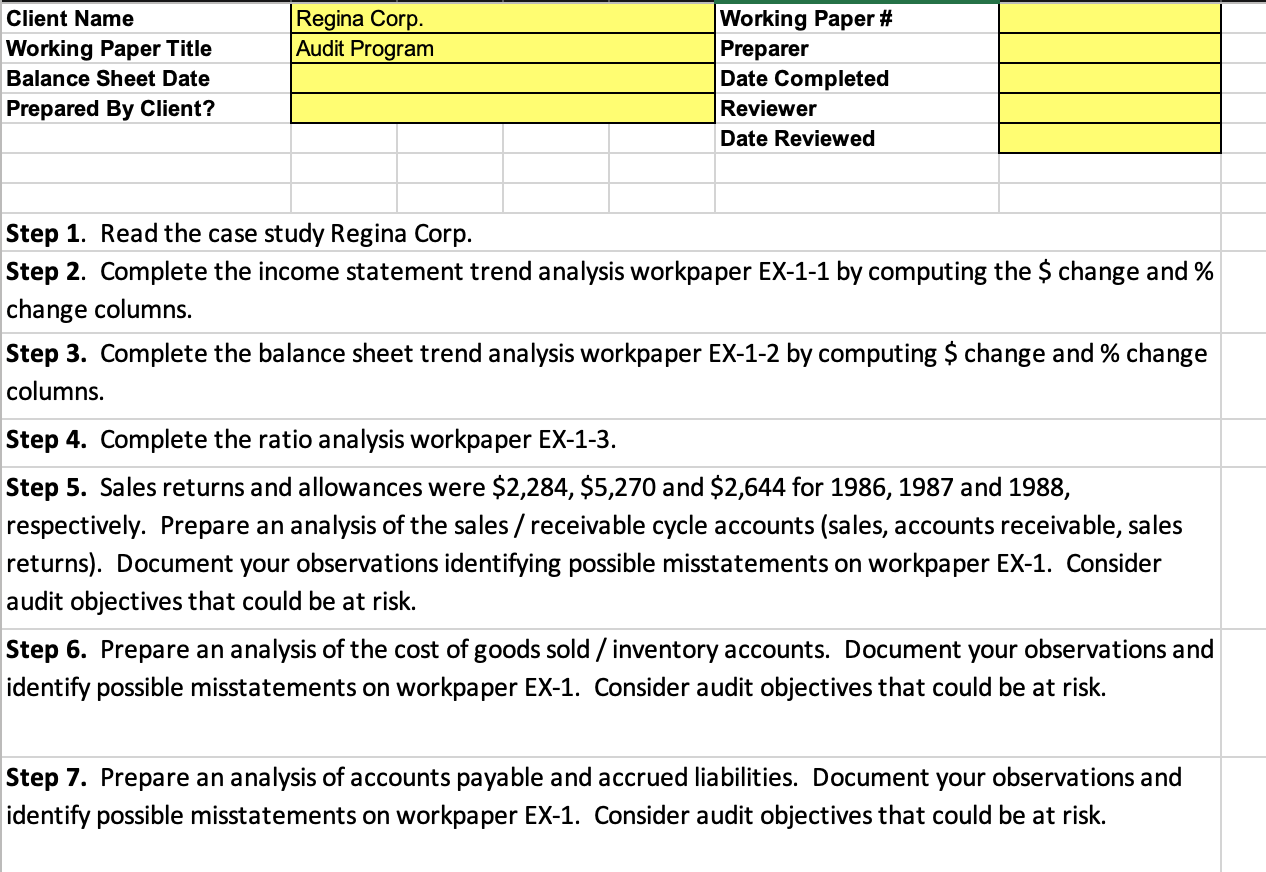

Question: Regina Corp. Audit Program Client Name Working Paper Title Balance Sheet Date Prepared By Client? Working Paper # Preparer Date Completed Reviewer Date Reviewed Step

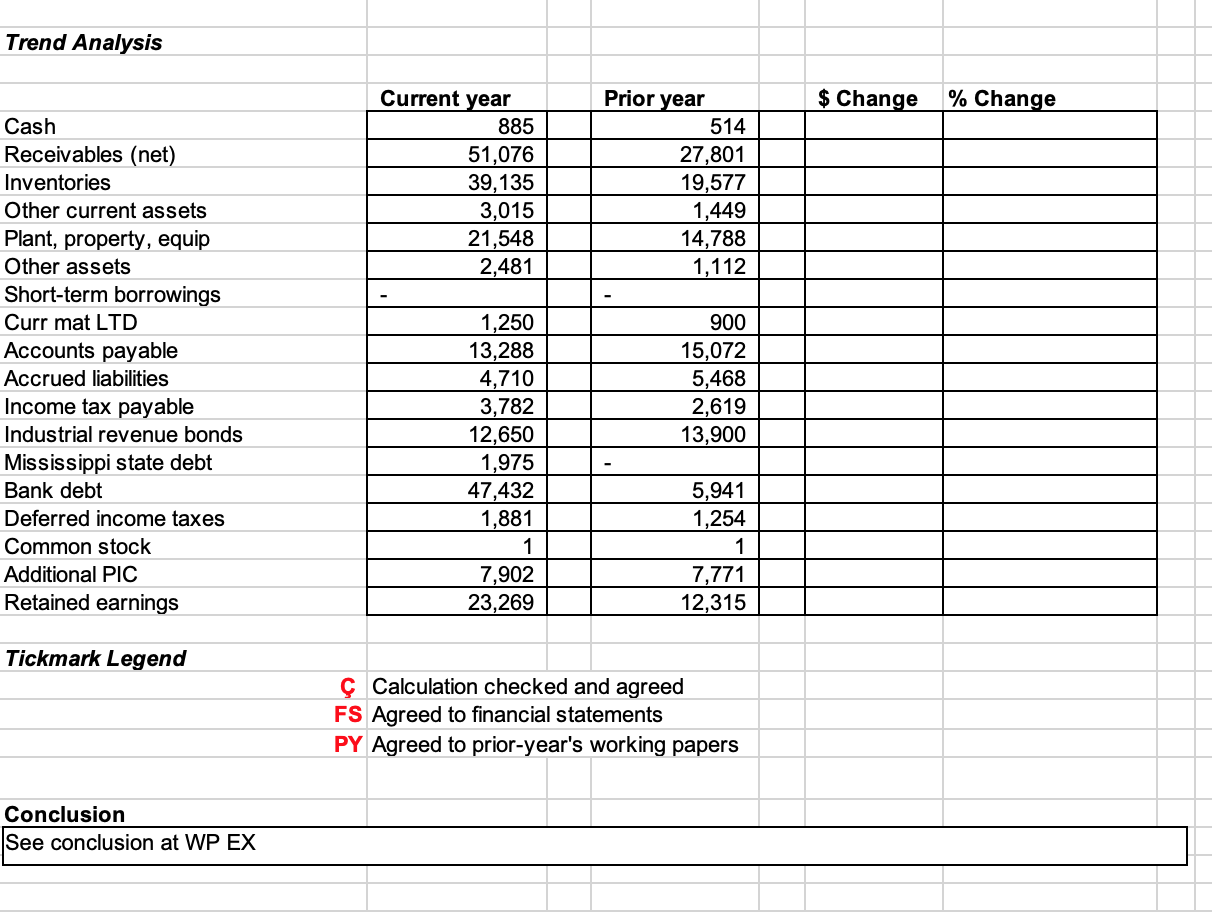

Regina Corp. Audit Program Client Name Working Paper Title Balance Sheet Date Prepared By Client? Working Paper # Preparer Date Completed Reviewer Date Reviewed Step 1. Read the case study Regina Corp. Step 2. Complete the income statement trend analysis workpaper EX-1-1 by computing the $ change and % change columns. Step 3. Complete the balance sheet trend analysis workpaper EX-1-2 by computing $ change and % change columns. Step 4. Complete the ratio analysis workpaper EX-1-3. Step 5. Sales returns and allowances were $2,284, $5,270 and $2,644 for 1986, 1987 and 1988, respectively. Prepare an analysis of the sales / receivable cycle accounts (sales, accounts receivable, sales returns). Document your observations identifying possible misstatements on workpaper EX-1. Consider audit objectives that could be at risk. Step 6. Prepare an analysis of the cost of goods sold / inventory accounts. Document your observations and identify possible misstatements on workpaper EX-1. Consider audit objectives that could be at risk. Step 7. Prepare an analysis of accounts payable and accrued liabilities. Document your observations and identify possible misstatements on workpaper EX-1. Consider audit objectives that could be at risk. Trend Analysis Prior year $ Change % Change Current year 885 51,076 39,135 3,015 21,548 2,481 514 27,801 19,577 1,449 14,788 1,112 Cash Receivables (net) Inventories Other current assets Plant, property, equip Other assets Short-term borrowings Curr mat LTD Accounts payable Accrued liabilities Income tax payable Industrial revenue bonds Mississippi debt Bank debt Deferred income taxes Common stock Additional PIC Retained earnings 1,250 13,288 4,710 3,782 12,650 1,975 47,432 1,881 900 15,072 5,468 2,619 13,900 5,941 1,254 1 1 7,902 23,269 7,771 12,315 Tickmark Legend Calculation checked and agreed FS Agreed to financial statements PY Agreed to prior-year's working papers Conclusion See conclusion at WP EX Regina Corp. Audit Program Client Name Working Paper Title Balance Sheet Date Prepared By Client? Working Paper # Preparer Date Completed Reviewer Date Reviewed Step 1. Read the case study Regina Corp. Step 2. Complete the income statement trend analysis workpaper EX-1-1 by computing the $ change and % change columns. Step 3. Complete the balance sheet trend analysis workpaper EX-1-2 by computing $ change and % change columns. Step 4. Complete the ratio analysis workpaper EX-1-3. Step 5. Sales returns and allowances were $2,284, $5,270 and $2,644 for 1986, 1987 and 1988, respectively. Prepare an analysis of the sales / receivable cycle accounts (sales, accounts receivable, sales returns). Document your observations identifying possible misstatements on workpaper EX-1. Consider audit objectives that could be at risk. Step 6. Prepare an analysis of the cost of goods sold / inventory accounts. Document your observations and identify possible misstatements on workpaper EX-1. Consider audit objectives that could be at risk. Step 7. Prepare an analysis of accounts payable and accrued liabilities. Document your observations and identify possible misstatements on workpaper EX-1. Consider audit objectives that could be at risk. Trend Analysis Prior year $ Change % Change Current year 885 51,076 39,135 3,015 21,548 2,481 514 27,801 19,577 1,449 14,788 1,112 Cash Receivables (net) Inventories Other current assets Plant, property, equip Other assets Short-term borrowings Curr mat LTD Accounts payable Accrued liabilities Income tax payable Industrial revenue bonds Mississippi debt Bank debt Deferred income taxes Common stock Additional PIC Retained earnings 1,250 13,288 4,710 3,782 12,650 1,975 47,432 1,881 900 15,072 5,468 2,619 13,900 5,941 1,254 1 1 7,902 23,269 7,771 12,315 Tickmark Legend Calculation checked and agreed FS Agreed to financial statements PY Agreed to prior-year's working papers Conclusion See conclusion at WP EX

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts