Question: Regression Project - See Attached ACG 6455 - Regression Project The file FEEMW.csv has data about audit fees paid by about 1700 public companies that

Regression Project - See Attached

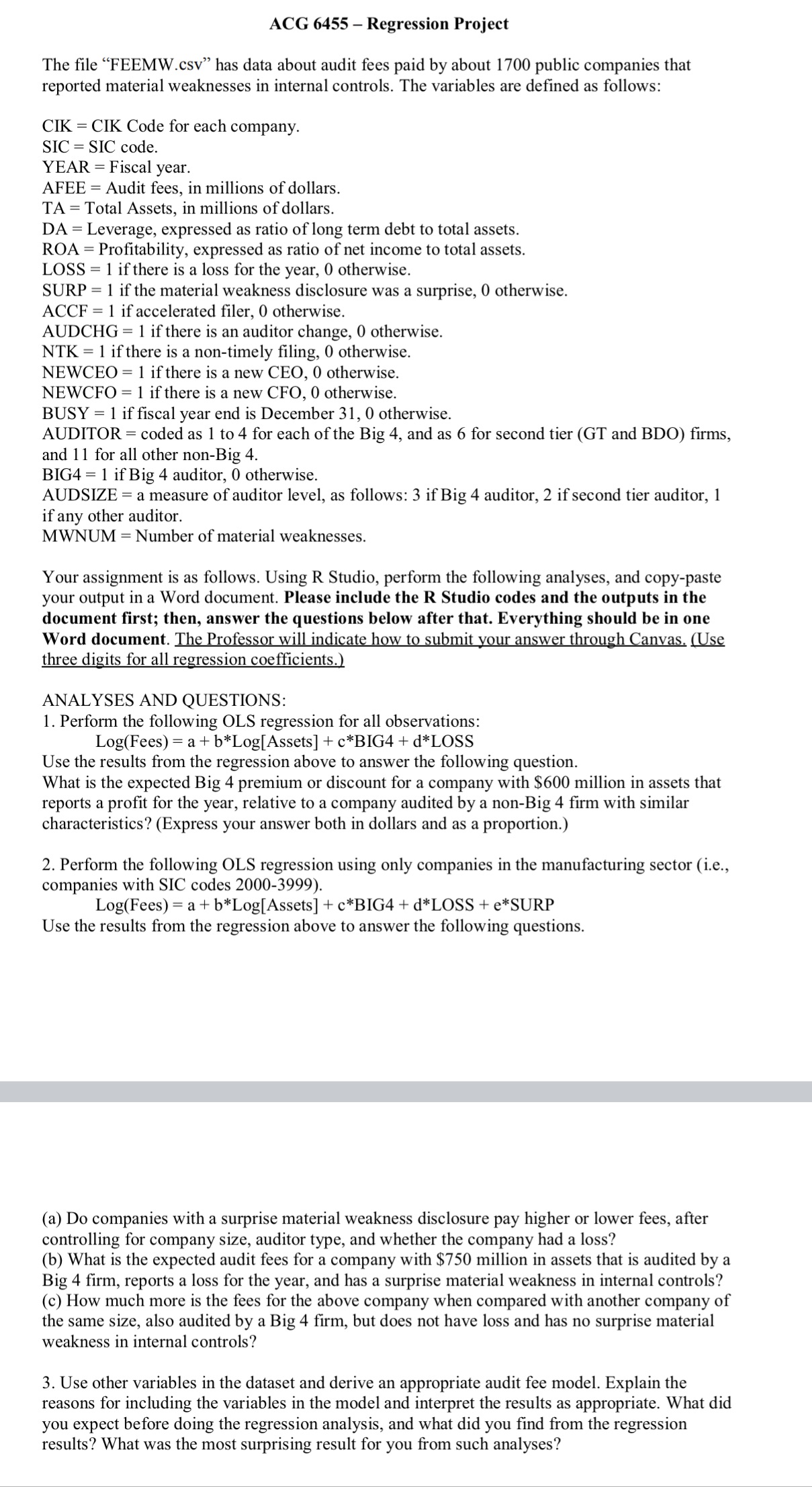

ACG 6455 - Regression Project The file "FEEMW.csv" has data about audit fees paid by about 1700 public companies that reported material weaknesses in internal controls. The variables are defined as follows: CIK = CIK Code for each company. SIC = SIC code. YEAR = Fiscal year. AFEE = Audit fees, in millions of dollars. TA = Total Assets, in millions of dollars. DA = Leverage, expressed as ratio of long term debt to total assets. ROA = Profitability, expressed as ratio of net income to total assets. LOSS = 1 if there is a loss for the year, 0 otherwise. SURP = 1 if the material weakness disclosure was a surprise, 0 otherwise. ACCF = 1 if accelerated filer, 0 otherwise. AUDCHG = 1 if there is an auditor change, 0 otherwise. NTK = 1 if there is a non-timely filing, 0 otherwise. NEWCEO = 1 if there is a new CEO, 0 otherwise. NEWCFO = 1 if there is a new CFO, 0 otherwise. BUSY = 1 if fiscal year end is December 31, 0 otherwise. AUDITOR = coded as 1 to 4 for each of the Big 4, and as 6 for second tier (GT and BDO) firms, and 1 1 for all other non-Big 4. BIG4 = 1 if Big 4 auditor, 0 otherwise. AUDSIZE = a measure of auditor level, as follows: 3 if Big 4 auditor, 2 if second tier auditor, 1 if any other auditor. MWNUM = Number of material weaknesses. Your assignment is as follows. Using R Studio, perform the following analyses, and copy-paste your output in a Word document. Please include the R Studio codes and the outputs in the document first; then, answer the questions below after that. Everything should be in one Word document. The Professor will indicate how to submit your answer through Canvas. (Use three digits for all regression coefficients.) ANALYSES AND QUESTIONS: 1. Perform the following OLS regression for all observations: Log(Fees) = a + b*Log[Assets] + c*BIG4 + d*LOSS Use the results from the regression above to answer the following question. What is the expected Big 4 premium or discount for a company with $600 million in assets that reports a profit for the year, relative to a company audited by a non-Big 4 firm with similar characteristics? (Express your answer both in dollars and as a proportion.) 2. Perform the following OLS regression using only companies in the manufacturing sector (i.e., companies with SIC codes 2000-3999). Log(Fees) = a + b*Log[Assets] + c*BIG4 + d*LOSS + e*SURP Use the results from the regression above to answer the following questions. (a) Do companies with a surprise material weakness disclosure pay higher or lower fees, after controlling for company size, auditor type, and whether the company had a loss? (b) What is the expected audit fees for a company with $750 million in assets that is audited by a Big 4 firm, reports a loss for the year, and has a surprise material weakness in internal controls? (c) How much more is the fees for the above company when compared with another company of the same size, also audited by a Big 4 firm, but does not have loss and has no surprise material weakness in internal controls? 3. Use other variables in the dataset and derive an appropriate audit fee model. Explain the reasons for including the variables in the model and interpret the results as appropriate. What did you expect before doing the regression analysis, and what did you find from the regression results? What was the most surprising result for you from such analyses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts