Question: REGULAR TRANSACTIONS NOT RECORDED YET: TRANSACTION 1 TRANSACTION 2 TRANSACTION 3 TRANSACTION 4 TRANSACTION 5 WOF sent customer promotional mailers worth $1200 to potential customers

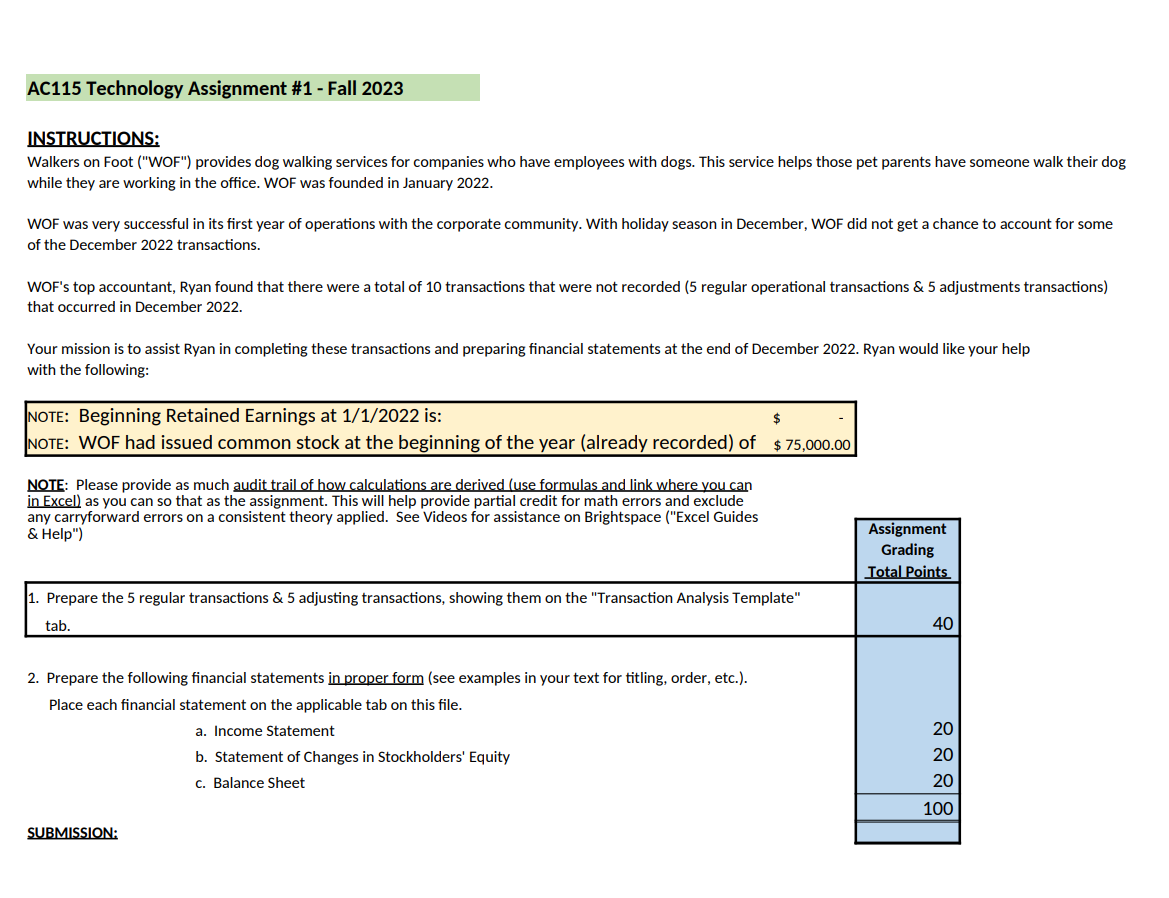

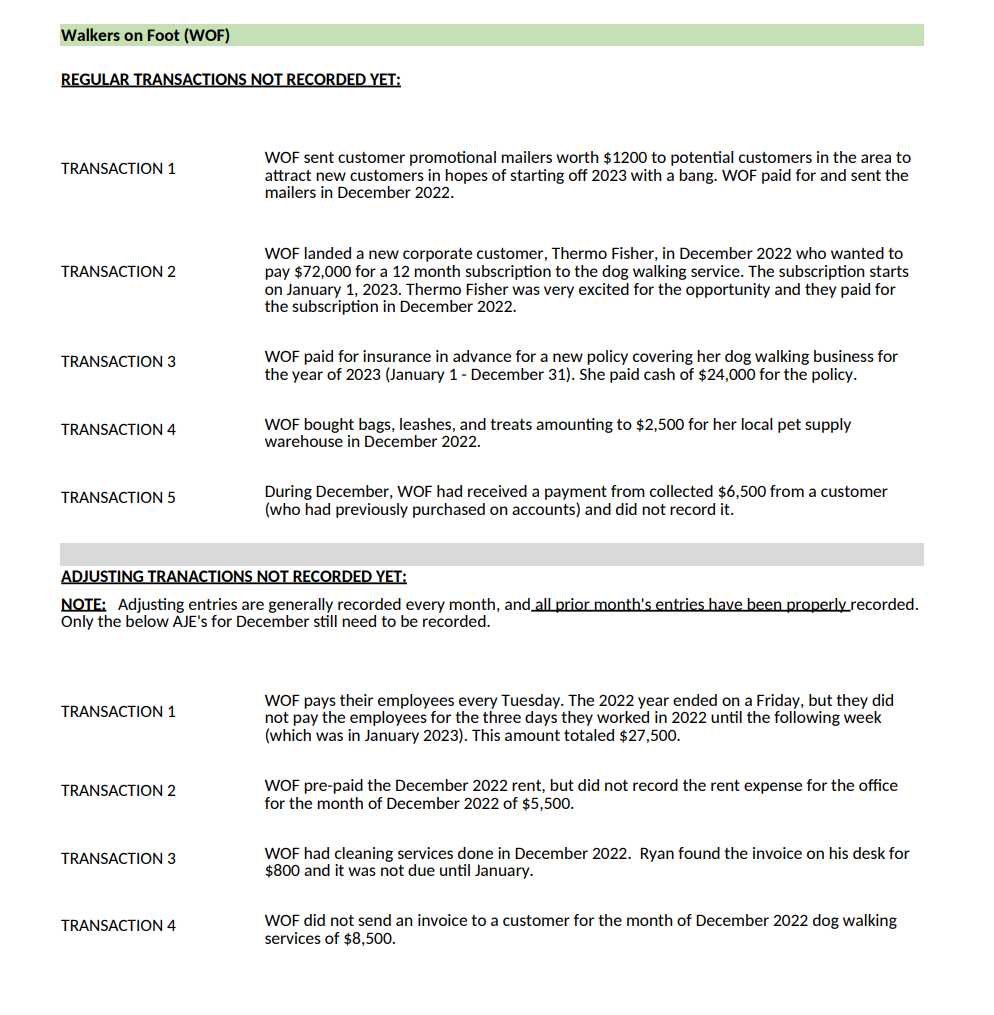

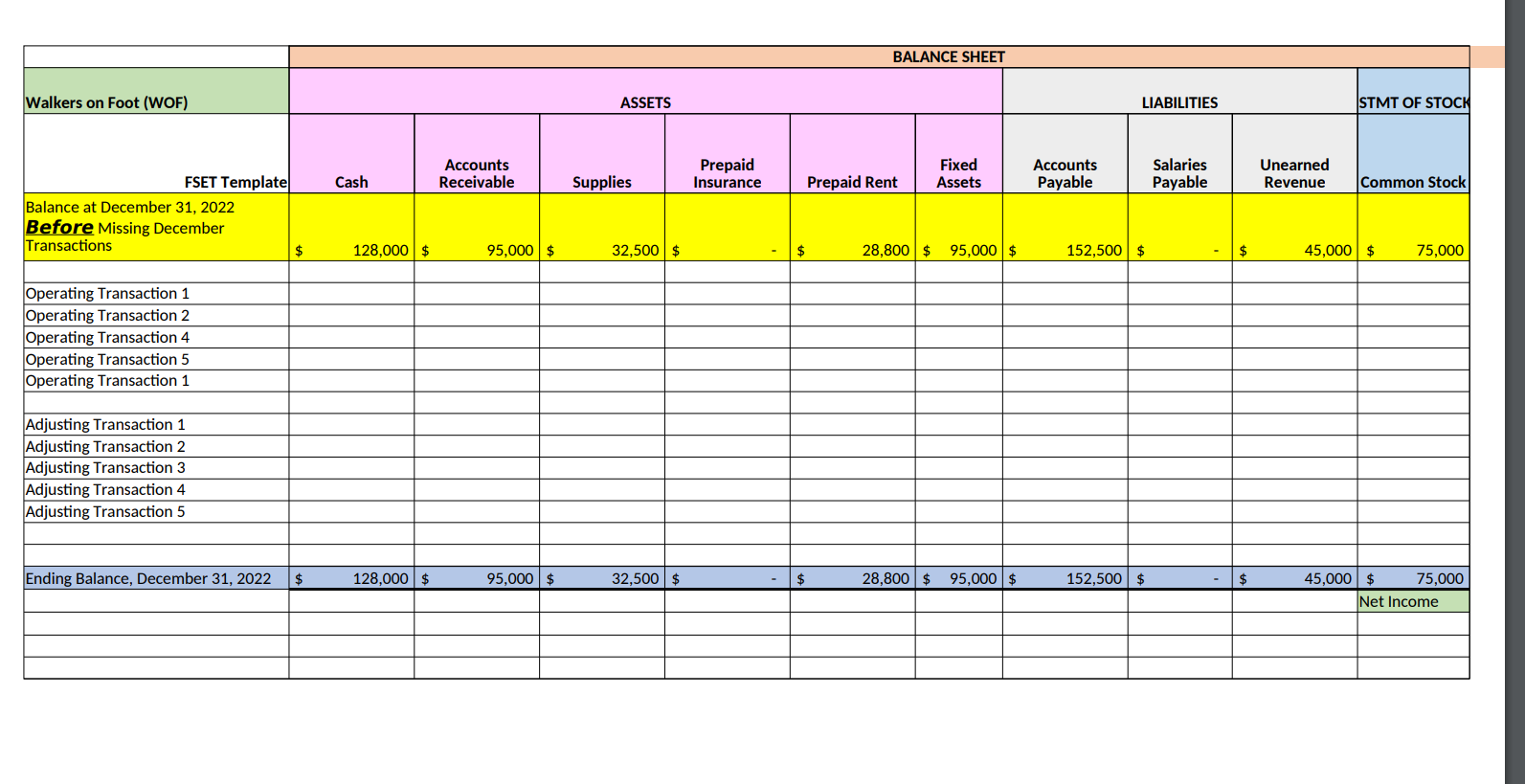

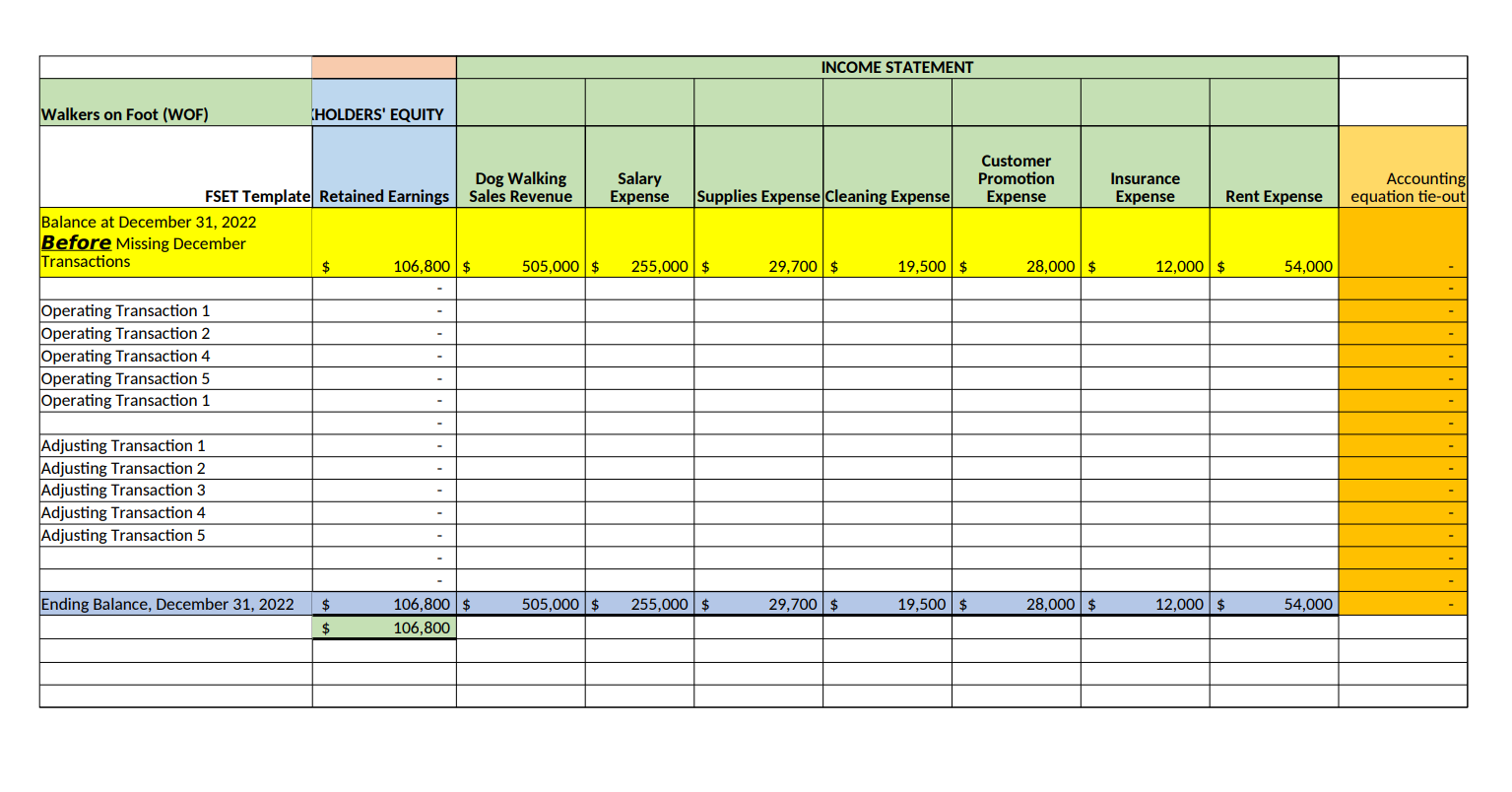

REGULAR TRANSACTIONS NOT RECORDED YET: TRANSACTION 1 TRANSACTION 2 TRANSACTION 3 TRANSACTION 4 TRANSACTION 5 WOF sent customer promotional mailers worth $1200 to potential customers in the area to attract new customers in hopes of starting off 2023 with a bang. WOF paid for and sent the mailers in December 2022. WOF landed a new corporate customer, Thermo Fisher, in December 2022 who wanted to pay $72,000 for a 12 month subscription to the dog walking service. The subscription starts on January 1, 2023. Thermo Fisher was very excited for the opportunity and they paid for the subscription in December 2022. WOF paid for insurance in advance for a new policy covering her dog walking business for the year of 2023 (January 1 - December 31). She paid cash of $24,000 for the policy. WOF bought bags, leashes, and treats amounting to $2,500 for her local pet supply warehouse in December 2022. During December, WOF had received a payment from collected $6,500 from a customer (who had previously purchased on accounts) and did not record it. ADJUSTING TRANACTIONS NOT RECORDED YET: NOTE: Adjusting entries are generally recorded every month, and all prior month's entries have been properly recorded. Only the below AJE's for December still need to be recorded. \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Walkers on Foot (WOF) } & \multirow[b]{2}{*}{ 'HOLDERS' EQUITY } & \multicolumn{7}{|c|}{ INCOME STATEMENT } & \multirow[b]{3}{*}{Accountingequationtie-out} \\ \hline & & & & & & & & & \\ \hline FSET Template & Retained Earnings & DogWalkingSalesRevenue & SalaryExpense & Supplies Expense & Cleaning Expense & CustomerPromotionExpense & InsuranceExpense & Rent Expense & \\ \hline \multirow[t]{2}{*}{BalanceatDecember31,2022BeforeMissingDecemberTransactions} & 106,800 & \multirow[t]{2}{*}{505,000} & \multirow[t]{2}{*}{255,000} & \multirow[t]{2}{*}{29,700} & 19,500 & 28,000 & 12,000 & \multirow[t]{2}{*}{54,000} & - \\ \hline & - & & & & & & & & - \\ \hline Operating Transaction 1 & - & & & & & & & & - \\ \hline Operating Transaction 2 & - & & & & & & & & - \\ \hline Operating Transaction 4 & - & & & & & & & & - \\ \hline Operating Transaction 5 & - & & & & & & & & - \\ \hline \multirow[t]{2}{*}{ Operating Transaction 1} & - & & & & & & & & - \\ \hline & - & & & & & & & & - \\ \hline Adjusting Transaction 1 & - & & & & & & & & - \\ \hline Adjusting Transaction 2 & - & & & & & & & & - \\ \hline Adjusting Transaction 3 & - & & & & & & & & - \\ \hline Adjusting Transaction 4 & - & & & & & & & & - \\ \hline \multirow[t]{3}{*}{ Adjusting Transaction 5} & - & & & & & & & & - \\ \hline & - & & & & & & & & - \\ \hline & - & & & & & & & & - \\ \hline \multirow[t]{2}{*}{ Ending Balance, December 31, 2022} & 106,800 & 505,000 & 255,000 & 29,700 & 19,500 & 28,000 & 12,000 & 54,000 & - \\ \hline & 106,800 & & & & & & & & \\ \hline & & & & & & & & & \\ \hline & & & & & & & & & \\ \hline & & & & & & & & & \\ \hline \end{tabular} You can put all three financial statements on this tab. a. Income Statement b. Statement of Changes in Stockholders' Equity c. Balance Sheet Note: You are required to create the financial statements for year 2022. INSTRUCTIONS: Walkers on Foot ("WOF") provides dog walking services for companies who have employees with dogs. This service helps those pet parents have someone walk their dog while they are working in the office. WOF was founded in January 2022. WOF was very successful in its first year of operations with the corporate community. With holiday season in December, WOF did not get a chance to account for some of the December 2022 transactions. WOF's top accountant, Ryan found that there were a total of 10 transactions that were not recorded (5 regular operational transactions \& 5 adjustments transactions) that occurred in December 2022. Your mission is to assist Ryan in completing these transactions and preparing financial statements at the end of December 2022. Ryan would like your help with the following: NOTE: Beginning Retained Earnings at 1/1/2022 is: NOTE: WOF had issued common stock at the beginning of the year (already recorded) of $75,000.00 NOIE: Please provide as much audit trail of how calculations are derived (use formulas and link where vou can in Excel) as you can so that as the assignment. This will help provide partial credit for math errors and exclude any carryforward errors on a consistent theory applied. See Videos for assistance on Brightspace ("Excel Guides \& Help")

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts