Question: REGURIED Write the payoff function for the option strategy used for Portfolio I. marks) Write the payoff function for the option strategy used for Portfolio

REGURIED

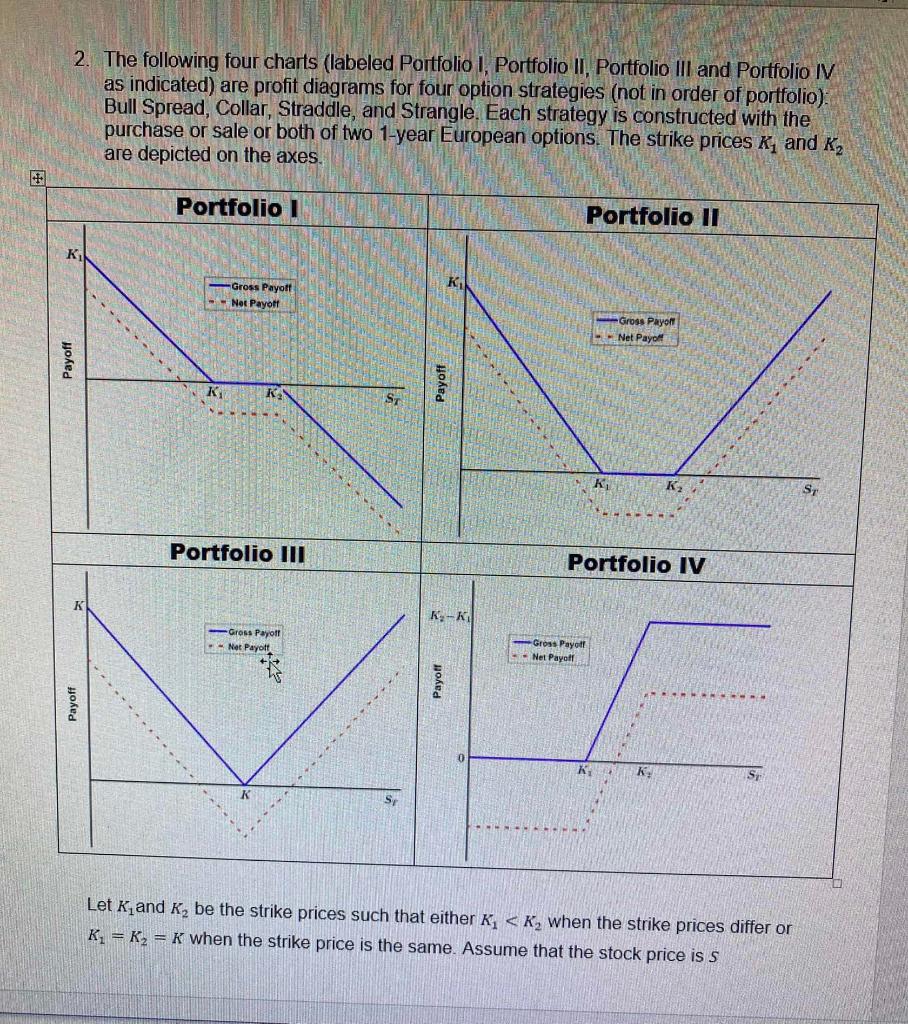

- Write the payoff function for the option strategy used for Portfolio I.

- marks)

- Write the payoff function for the option strategy used for Portfolio II. (5 marks)

- Write the payoff function for the option strategy used for Portfolio III. (5 marks)

- Write the payoff function for the option strategy used for Portfolio IV. (5 marks)

- Name the strategy (Bull Spread or Collar or Straddle or Strangle) that each portfolio represent. That is, write down which strategy Portfolio I represents; Portfolio II represents; Portfolio III represents; and Portfolio IV represents. (5 marks)

2. The following four charts (labeled Portfolio I, Portfolio II, Portfolio III and Portfolio IV as indicated) are profit diagrams for four option strategies (not in order of portfolio): Bull Spread, Collar, Straddle, and Strangle. Each strategy is constructed with the purchase or sale or both of two 1-year European options. The strike prices K, and Kz are depicted on the axes. Portfolio I Portfolio II K Gross Payott Net Payoff Gross Payo Net Payor Payoff Payoff ka ., Portfolio III Portfolio IV K- Gross Payoff --Net Payott Gross Payott Net Payoff Payoff S K Sy Let Kiand K, be the strike prices such that either Ki

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts