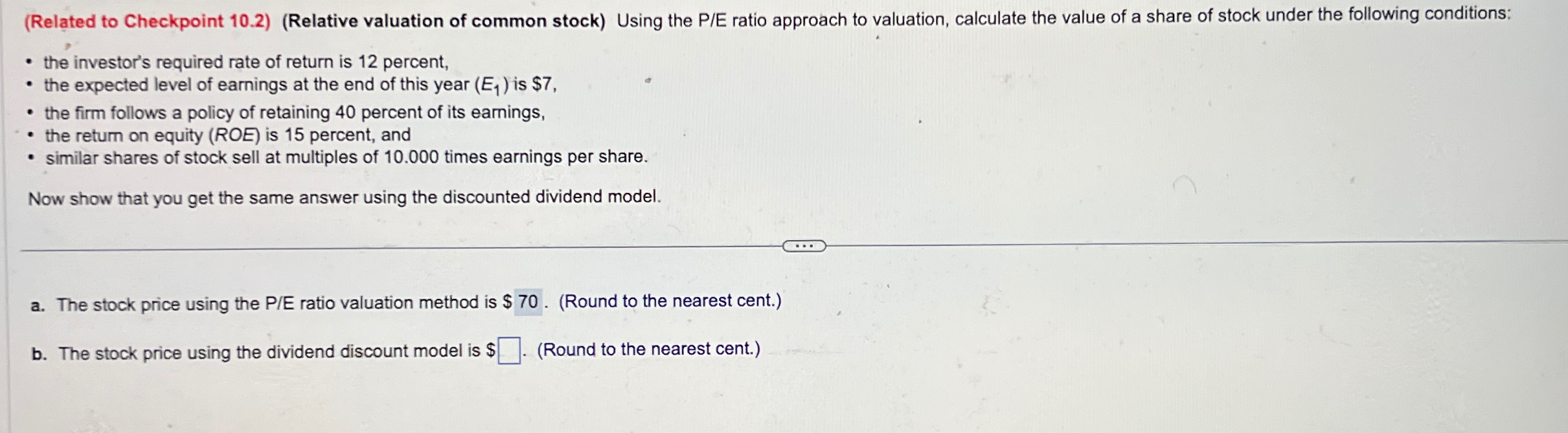

Question: ( Related to Checkpoint 1 0 . 2 ) ( Relative valuation of common stock ) Using the P / E ratio approach to valuation,

Related to Checkpoint Relative valuation of common stock Using the PE ratio approach to valuation, calculate the value of a share of stock under the following conditions:

the investor's required rate of return is percent,

the expected level of earnings at the end of this year is $

the firm follows a policy of retaining percent of its earnings,

the retum on equity is percent, and

similar shares of stock sell at multiples of times earnings per share.

Now show that you get the same answer using the discounted dividend model.

a The stock price using the PE ratio valuation method is $Round to the nearest cent.

b The stock price using the dividend discount model is $Round to the nearest cent.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock