Question: (Related to Checkpoint : 1) (Computing the portfolio expected rate of return) Penny Francis inherited a 5200,000 portfolio of investments from her grandparents when she

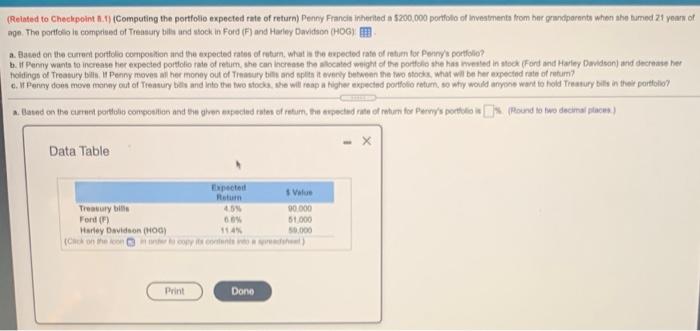

(Related to Checkpoint : 1) (Computing the portfolio expected rate of return) Penny Francis inherited a 5200,000 portfolio of investments from her grandparents when she tumed 21 years of non. The portfolio ha comprend of Trentury bills and stock in Ford (F) and Harley Davidson (HOG) a. Based on the current portfolio composition and the expected rates of return what is the expected rate of return for Penny's portfolio? bf Penny wants to increase the expected portfolio rate of retum, she can increase the located weight of the portfolio she has nevested in stock (Ford and Harley Davidson) and decrease her holdings of Treasury Penny moves the money out of Treasury bills and split it every between the two cock what will be her expected rate of retur? c. Penny do move morning out of Treasury bills and into two sto, she will reap a higher expected portfolio retum, so why would anyone want to hold Treasury bills in their portfolio a. Baund on the current portfolios comenten und es given pechad tates of return, the expected rate of mum for Perwy's portfolios Pound to two decimal pas) Data Table Expected Return Treasury is 455 Fond() 60 Harley Davidson (HOG) 1145 Chek on the scopertoni Per Value 90 000 51 000 50.000 Print Dono

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts