Question: Related to Checkpoint 12.1) (Calculating changes in net operating working capital) Tetious Dimensions is introducing a new product and has an expected change in net

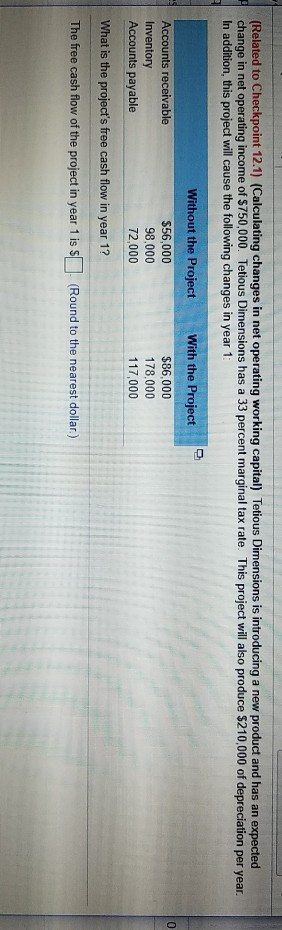

Related to Checkpoint 12.1) (Calculating changes in net operating working capital) Tetious Dimensions is introducing a new product and has an expected change in net operating income of $750,000. Tetious Dimensions has a 33 percent marginal tax rate. This project will also produce $210,000 of depreciation per year In addition, this project will cause the following changes in year 1 Without the Project With the Project vable 0 $56,000 98,000 178,000 117,000 Inventory 72,000 Accounts payable What is the project's free cash flow in year 1? The free cash flow of the project in year 1 is s (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts