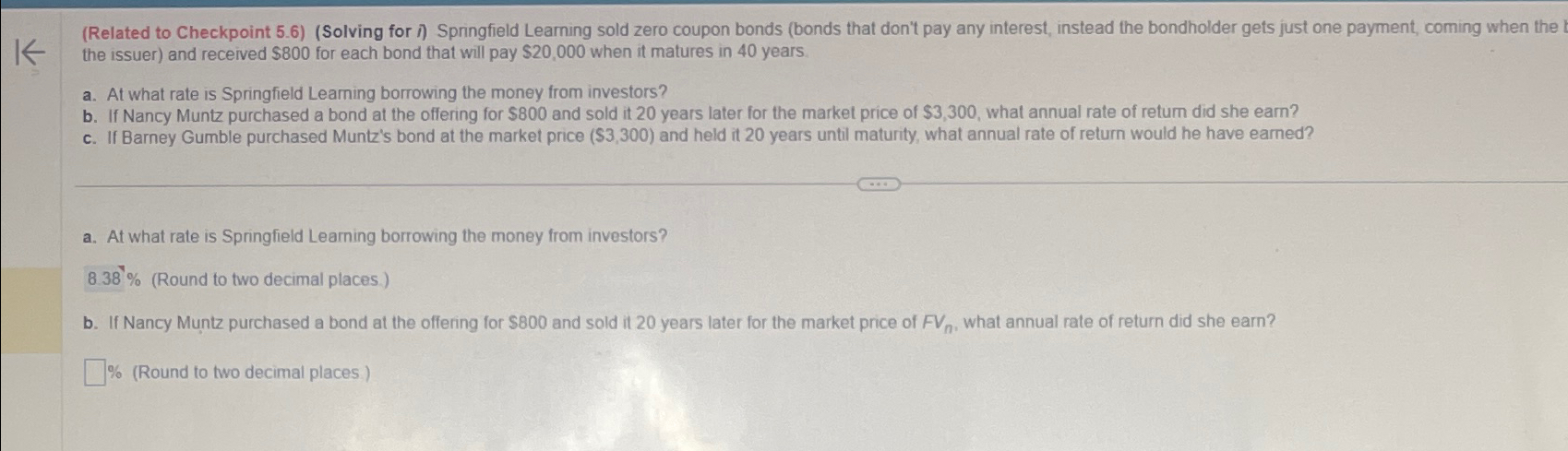

Question: ( Related to Checkpoint 5 . 6 ) ( Solving for i ) Springfield Learning sold zero coupon bonds ( bonds that don't pay any

Related to Checkpoint Solving for i Springfield Learning sold zero coupon bonds bonds that don't pay any interest, instead the bondholder gets just one payment, coming when the the issuer and received $ for each bond that will pay $ when it matures in years.

a At what rate is Springfield Learning borrowing the money from investors?

b If Nancy Muntz purchased a bond at the offering for $ and sold it years later for the market price of $ what annual rate of retum did she earn?

c If Barney Gumble purchased Muntz's bond at the market price $ and held it years until maturity, what annual rate of return would he have earned?

a At what rate is Springfield Learning borrowing the money from investors?

Round to two decimal places

b If Nancy Muntz purchased a bond at the offering for $ and sold it years later for the market price of what annual rate of return did she earn?

Round to two decimal places

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock