Question: (Related to Checkpoint 5.6) (Solving for i ) Springfield Learning sold zero coupon bonds (bonds that don't pay any interest, instead the bondholder gets just

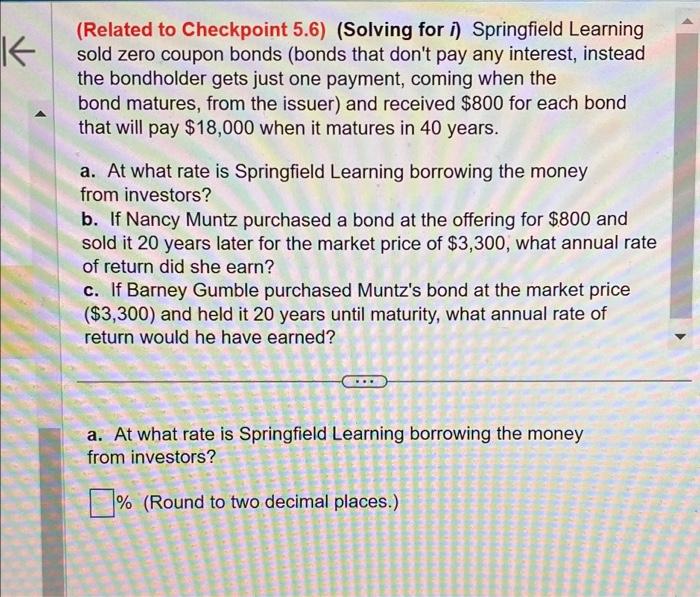

(Related to Checkpoint 5.6) (Solving for i ) Springfield Learning sold zero coupon bonds (bonds that don't pay any interest, instead the bondholder gets just one payment, coming when the bond matures, from the issuer) and received $800 for each bond that will pay $18,000 when it matures in 40 years. a. At what rate is Springfield Learning borrowing the money from investors? b. If Nancy Muntz purchased a bond at the offering for $800 and sold it 20 years later for the market price of $3,300, what annual rate of return did she earn? c. If Barney Gumble purchased Muntz's bond at the market price ($3,300) and held it 20 years until maturity, what annual rate of return would he have earned? a. At what rate is Springfield Learning borrowing the money from investors? \% (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts