Question: (Related to Checkpoint 5.6) (Solving for ) You are considering investing in a security that will pay you $2,000 in 31 years. a. If the

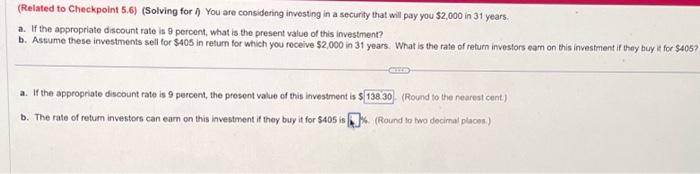

(Related to Checkpoint 5.6) (Solving for ) You are considering investing in a security that will pay you $2,000 in 31 years. a. If the appropriate discount rate is 9 percent, what is the present value of this investment? b. Assume these investments sell for $405 in return for which you receive $2,000 in 31 years. What is the rate of return investors earn on this investment if they buy it for $405? www a. If the appropriate discount rate is 9 percent, the present value of this investment is $138.30. (Round to the nearest cent.) b. The rate of return investors can earn on this investment if they buy it for $405 is%. (Round to two decimal places.)

(Related to Checkpoint 5.6) (Solving for 1 ) You are considering investing in a security that will pay you $2,000 in 31 years. a. If the appropriate discount rate is 9 percent, what is the present value of this investment? b. Astume these investments sell for $405 in retum for which you roceive $2,000 in 31 years. What is the rate of return investors eam on this investment if they buy if for $405 a. If the appropriate discount rate is 9 percent, the present value of this investment is 5 (Round to the rearest cent) b. The rate of retum investors can eam on this investment if they buy it for $405 is 4. (Round io two decimal places)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock