Question: (Related to Checkpoint 7.2) (Calculating the geometric and arithmetic average rate of return) Marsh Inc. had the following end-of-year stock prices over the last five

(Related to Checkpoint 7.2) (Calculating the geometric and arithmetic average rate of return) Marsh Inc. had the following end-of-year stock prices over the last five years and paid no cash dividends:

| |||||||||||||

a. Calculate the annual rate of return for each year from the above information.

b. What is the arithmetic average rate of return earned by investing in Marsh's stock over this period?

c. What is the geometric average rate of return earned by investing in Marsh's stock over this period?

d. Considering the beginning and ending stock prices for the five-year period are the same, which type of average rate of return (the arithmetic or geometric) better describes the average annual rate of return earned over the period?

a. The annual rate of return at the end of year 2 is _%.(Round to two decimal places.)

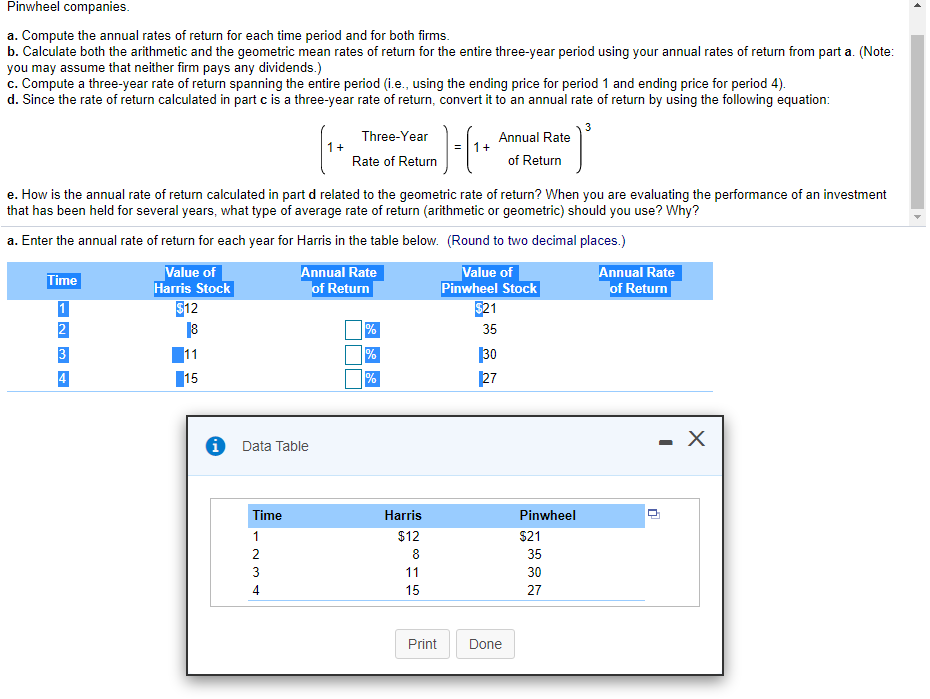

Pinwheel companies. a. Compute the annual rates of return for each time period and for both firms. b. Calculate both the arithmetic and the geometric mean rates of return for the entire three-year period using your annual rates of return from part a. (Note: you may assume that neither firm pays any dividends.) c. Compute a three-year rate of return spanning the entire period (i.e., using the ending price for period 1 and ending price for period 4). d. Since the rate of return calculated in part c is a three-year rate of return, convert it to an annual rate of return by using the following equation: 1 + Three-Year Rate of Return J-C 1 + Annual Rate of Return e. How is the annual rate of return calculated in part d related to the geometric rate of return? When you are evaluating the performance of an investment that has been held for several years, what type of average rate of return (arithmetic or geometric) should you use? Why? a. Enter the annual rate of return for each year for Harris in the table below. (Round to two decimal places.) Time Value of Annual Rate Value of Annual Rate Harris Stock of Return Pinwheel Stock of Return 1 $12 521 2 18 1% 35 3 11 130 4 15 7 70 127 i Data Table - X Time 1 2 3 Harris $12 8 11 15 Pinwheel $21 35 30 27 Print Done (Related to Checkpoint 5.7) (Calculating an EAR) After examining the various personal loan rates available to you, you find that you can borrow funds from a finance company at 11 percent compounded daily or from a bank at 12 percent compounded quarterly. Which alternative is more attractive? If you can borrow funds from a finance company at 11 percent compounded daily, the EAR for the loan is % (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts