Question: (Related to Checkpoint 8.2) (Computing the standard deviation for an individual investment) James Fromholtz is considering whether to invest in a newly formed investment fund.

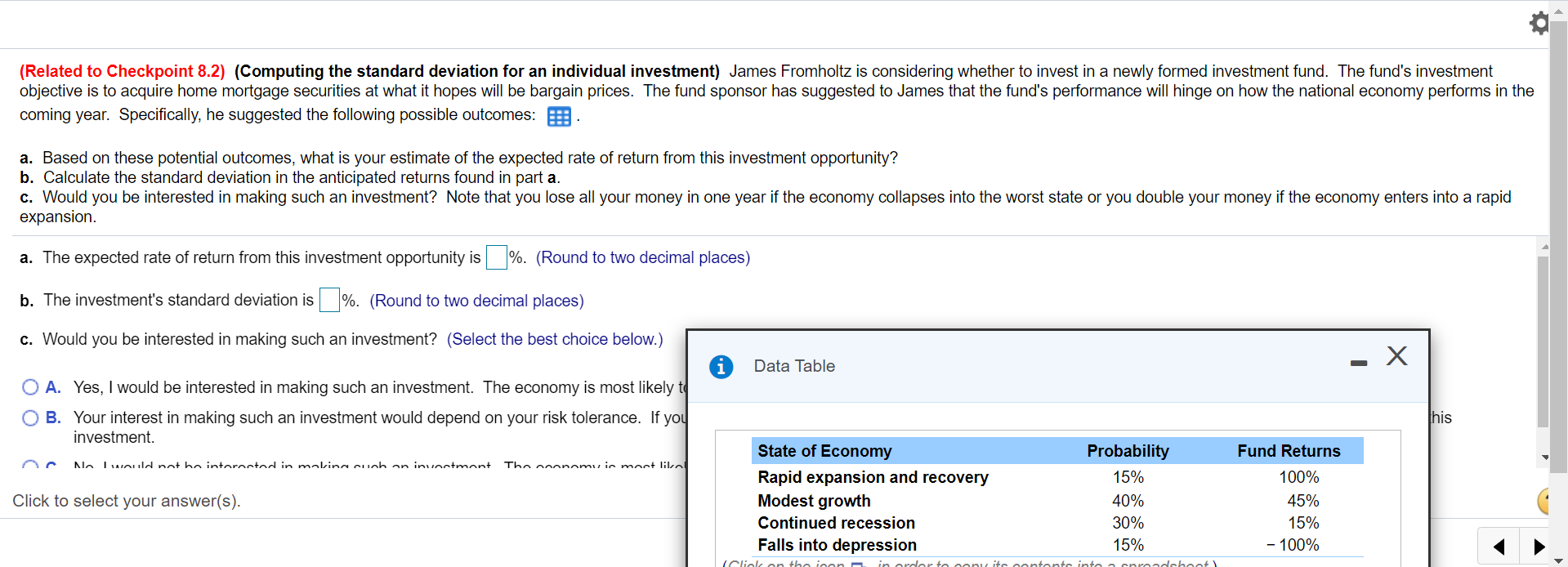

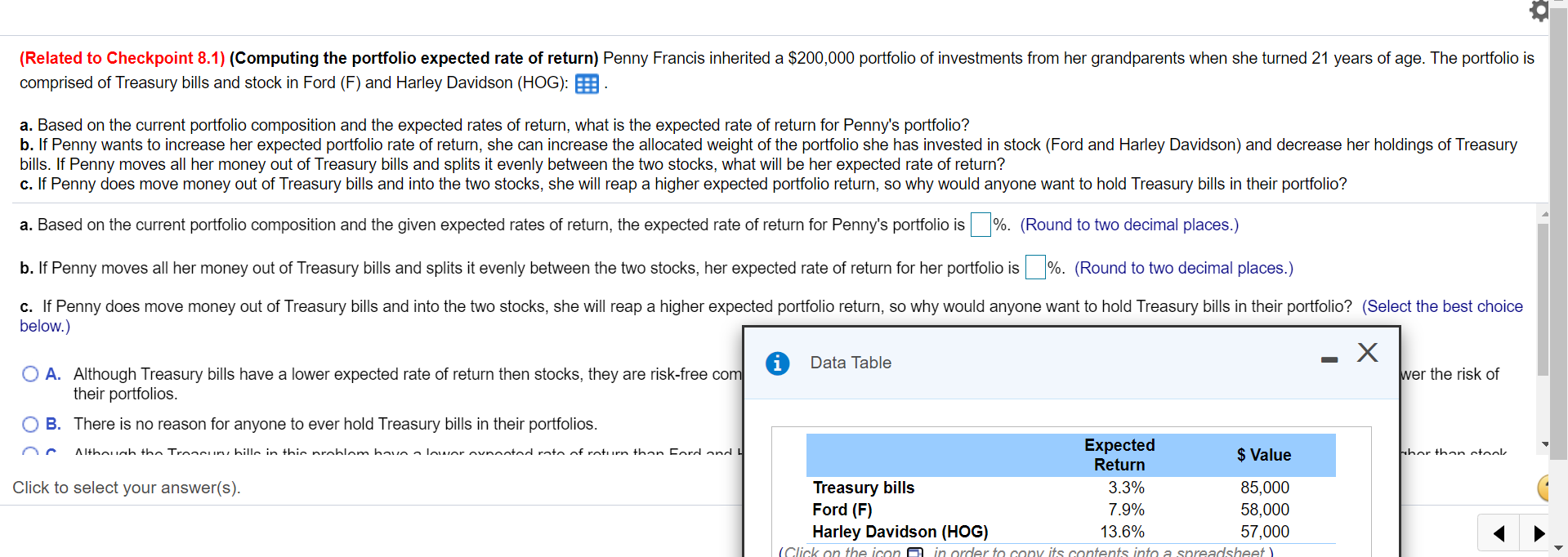

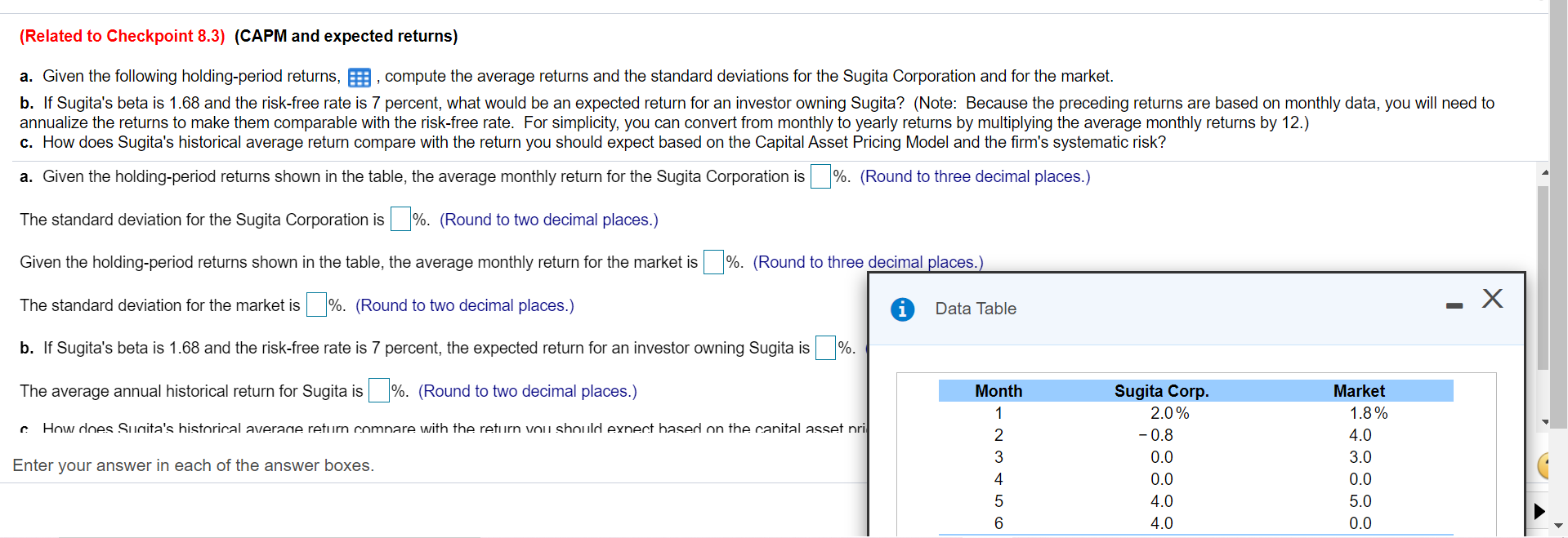

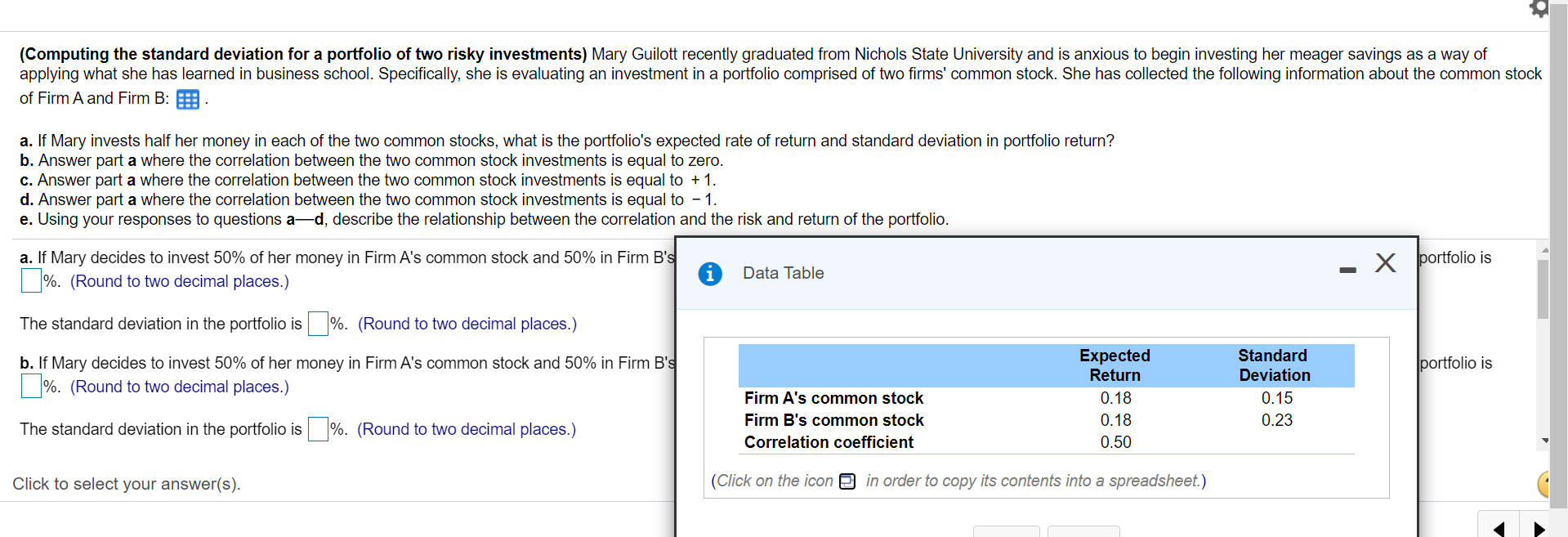

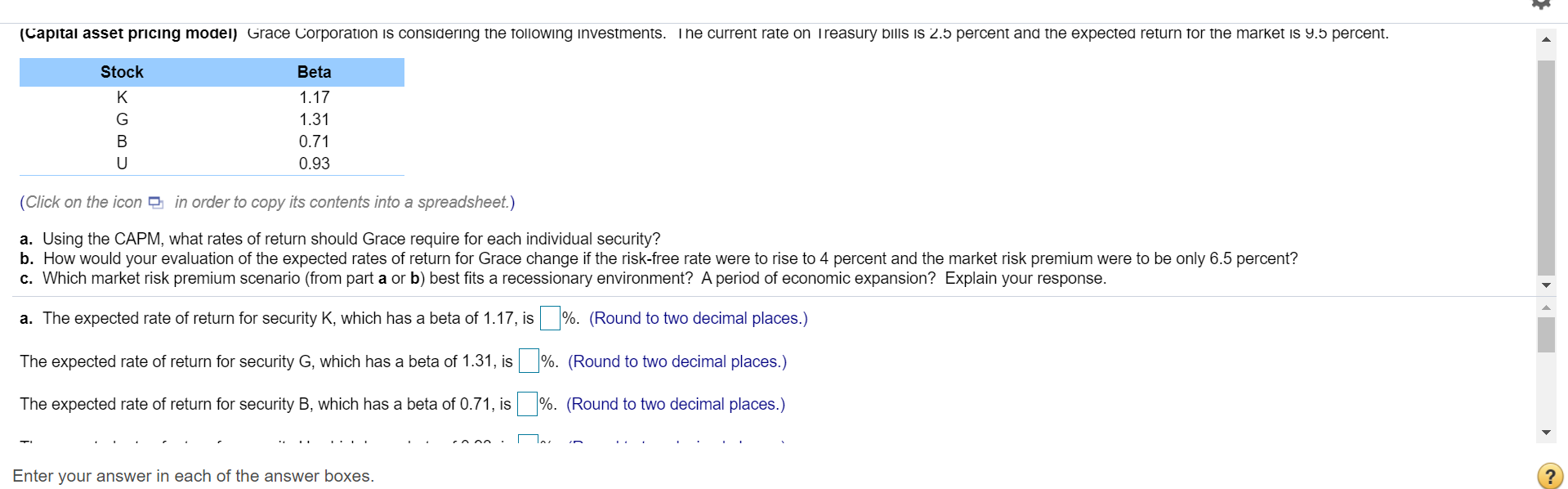

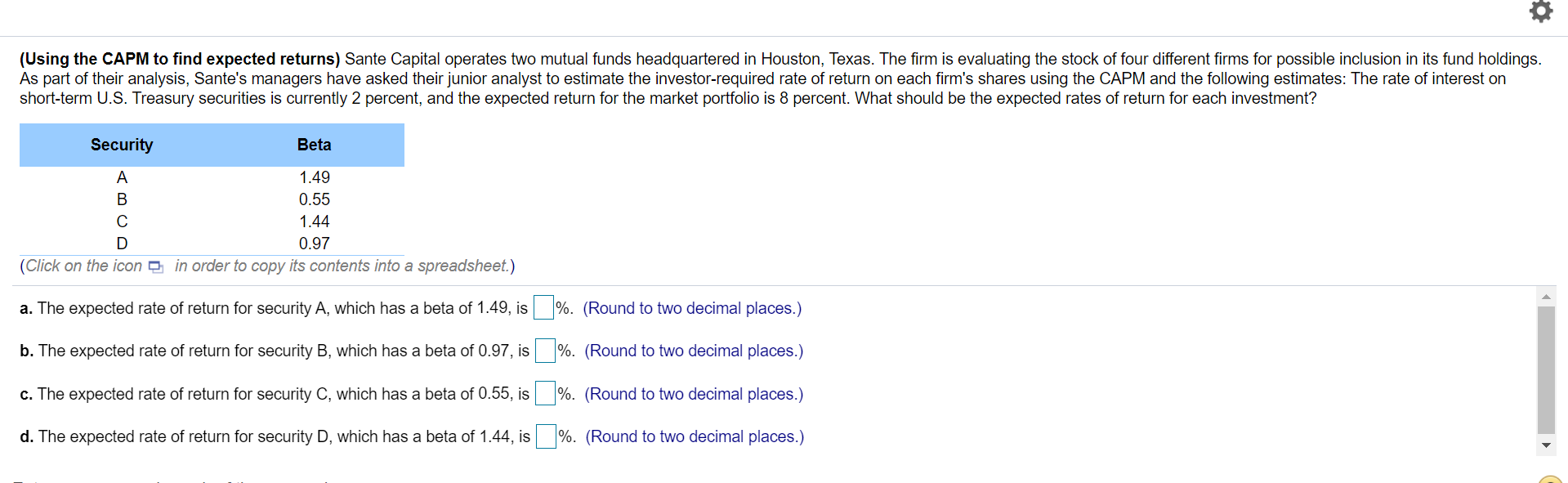

(Related to Checkpoint 8.2) (Computing the standard deviation for an individual investment) James Fromholtz is considering whether to invest in a newly formed investment fund. The fund's investment objective is to acquire home mortgage securities at what it hopes will be bargain prices. The fund sponsor has suggested to James that the fund's performance will hinge on how the national economy performs in the coming year. Specifically, he suggested the following possible outcomes: 5 a. Based on these potential outcomes, what is your estimate of the expected rate of return from this investment opportunity? b. Calculate the standard deviation in the anticipated returns found in part a. c. Would you be interested in making such an investment? Note that you lose all your money in one year if the economy collapses into the worst state or you double your money if the economy enters into a rapid expansion. a. The expected rate of return from this investment opportunity is %. (Round to two decimal places) b. The investment's standard deviation is %. (Round to two decimal places) c. Would you be interested in making such an investment? (Select the best choice below.) Data Table O A. Yes, I would be interested in making such an investment. The economy is most likely to B. Your interest in making such an investment would depend on your risk tolerance. If you investment. This State of Economy Probability Fund Returns Mo Twould not be internetad in molina cuch an investment Thannonamu is most likel 100% Click to select your answer(s). 45% Rapid expansion and recovery 15% Modest growth 40% Continued recession 30% Falls into depression 15% Cliol on the icon in order to convite cantante inte. broadchoot 15% - 100% o (Related to Checkpoint 8.1) (Computing the portfolio expected rate of return) Penny Francis inherited a $200,000 portfolio of investments from her grandparents when she turned 21 years of age. The portfolio is comprised of Treasury bills and stock in Ford (F) and Harley Davidson (HOG): E. a. Based on the current portfolio composition and the expected rates of return, what is the expected rate of return for Penny's portfolio? b. If Penny wants to increase her expected portfolio rate of return, she can increase the allocated weight of the portfolio she has invested in stock (Ford and Harley Davidson) and decrease her holdings of Treasury bills. If Penny moves all her money out of Treasury bills and splits it evenly between the two stocks, what will be her expected rate of return? c. If Penny does move money out of Treasury bills and into the two stocks, she will reap a higher expected portfolio return, so why would anyone want to hold Treasury bills in their portfolio? a. Based on the current portfolio composition and the given expected rates of return, the expected rate of return for Penny's portfolio is %. (Round to two decimal places.) b. If Penny moves all her money out of Treasury bills and splits it evenly between the two stocks, her expected rate of return for her portfolio is [%. (Round to two decimal places.) c. If Penny does move money out of Treasury bills and into the two stocks, she will reap a higher expected portfolio return, so why would anyone want to hold Treasury bills in their portfolio? (Select the best choice below.) x Data Table O A. Although Treasury bills have a lower expected rate of return then stocks, they are risk-free com wer the risk of their portfolios. OB. There is no reason for anyone to ever hold Treasury bills in their portfolios. Althaiah the Tronour hills in this nrohlam hawa lawar avnantod rate of return than Card and Expected $ Value Return Click to select your answer(s). Treasury bills 3.3% 85,000 Ford (F) 7.9% 58,000 Harley Davidson (HOG) 13.6% 57,000 Whor thon ntool, (Click on the icon in order to copy its contents into a spreadsheet (Related to Checkpoint 8.3) (CAPM and expected returns) a. Given the following holding-period returns, : , compute the average returns and the standard deviations for the Sugita Corporation and for the market. b. If Sugita's beta is 1.68 and the risk-free rate is 7 percent, what would be an expected return for an investor owning Sugita? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12.) c. How does Sugita's historical average return compare with the return you should expect based on the Capital Asset Pricing Model and the firm's systematic risk? a. Given the holding-period returns shown in the table, the average monthly return for the Sugita Corporation is %. (Round to three decimal places.) The standard deviation for the Sugita Corporation is %. (Round to two decimal places.) Given the holding-period returns shown in the table, the average monthly return for the market is %. (Round to three decimal places.) The standard deviation for the market is %. (Round to two decimal places.) - x Data Table b. If Sugita's beta is 1.68 and the risk-free rate is 7 percent, the expected return for an investor owning Sugita is %. The average annual historical return for Sugita is %. (Round to two decimal places.) Market Month 1 Sugita Corp. 2.0% 1.8% How does Suaita's historical average return compare with the return vou should expect based on the capital asset pri 2 -0.8 3 0.0 Enter your answer in each of the answer boxes. OOOOO 00 4 0.0 5 4.0 6 4.0 o (Computing the standard deviation for a portfolio of two risky investments) Mary Guilott recently graduated from Nichols State University and is anxious to begin investing her meager savings as a way of applying what she has learned in business school. Specifically, she is evaluating an investment in a portfolio comprised of two firms' common stock. She has collected the following information about the common stock of Firm A and Firm B: E. a. If Mary invests half her money in each of the two common stocks, what is the portfolio's expected rate of return and standard deviation in portfolio return? b. Answer part a where the correlation between the two common stock investments is equal to zero. c. Answer part a where the correlation between the two common stock investments is equal to +1. d. Answer part a where the correlation between the two common stock investments is equal to - 1. e. Using your responses to questions a-d, describe the relationship between the correlation and the risk and return of the portfolio. a. If Mary decides to invest 50% of her money in Firm A's common stock and 50% in Firm B's D%. (Round to two decimal places.) - X portfolio is Data Table The standard deviation in the portfolio is %. (Round to two decimal places.) Expected Return b. If Mary decides to invest 50% of her money in Firm A's common stock and 50% in Firm B's %. (Round to two decimal places.) Standard Deviation portfolio is Firm A's common stock 0.18 0.15 0.23 Firm B's common stock The standard deviation in the portfolio is %. (Round to two decimal places.) 0.18 0.50 Correlation coefficient Click to select your answer(s). (Click on the icon in order to copy its contents into a spreadsheet.) (Capital asset pricing model) Grace Corporation is considering the following investments. The current rate on Treasury bills is 2.5 percent and the expected return for the market is 9.5 percent. Stock Beta K 1.17 G 1.31 B 0.71 U 0.93 (Click on the icon in order to copy its contents into a spreadsheet.) a. Using the CAPM, what rates of return should Grace require for each individual security? b. How would your evaluation of the expected rates of return for Grace change if the risk-free rate were to rise to 4 percent and the market risk premium were to be only 6.5 percent? c. Which market risk premium scenario (from part a or b) best fits a recessionary environment? A period of economic expansion? Explain your response. a. The expected rate of return for security K, which has a beta of 1.17, is %. (Round to two decimal places.) The expected rate of return for security G, which has a beta of 1.31, is %. (Round to two decimal places.) The expected rate of return for security B, which has a beta of 0.71, is %. (Round to two decimal places.) To Enter your answer in each of the answer boxes. (Using the CAPM to find expected returns) Sante Capital operates two mutual funds headquartered in Houston, Texas. The firm is evaluating the stock of four different firms for possible inclusion in its fund holdings. As part of their analysis, Sante's managers have asked their junior analyst to estimate the investor-required rate of return on each firm's shares using the CAPM and the following estimates: The rate of interest on short-term U.S. Treasury securities is currently 2 percent, and the expected return for the market portfolio is 8 percent. What should be the expected rates of return for each investment? Security Beta A 1.49 B 0.55 1.44 D 0.97 (Click on the icon in order to copy its contents into a spreadsheet.) a. The expected rate of return for security A, which has a beta of 1.49, is %. (Round to two decimal places.) b. The expected rate of return for security B, which has a beta of 0.97, is %. (Round to two decimal places.) c. The expected rate of return for security C, which has a beta of 0.55, is %. (Round to two decimal places.) d. The expected rate of return for security D, which has a beta of 1.44, is %. (Round to two decimal places.) (Related to Checkpoint 8.2) (Computing the standard deviation for an individual investment) James Fromholtz is considering whether to invest in a newly formed investment fund. The fund's investment objective is to acquire home mortgage securities at what it hopes will be bargain prices. The fund sponsor has suggested to James that the fund's performance will hinge on how the national economy performs in the coming year. Specifically, he suggested the following possible outcomes: 5 a. Based on these potential outcomes, what is your estimate of the expected rate of return from this investment opportunity? b. Calculate the standard deviation in the anticipated returns found in part a. c. Would you be interested in making such an investment? Note that you lose all your money in one year if the economy collapses into the worst state or you double your money if the economy enters into a rapid expansion. a. The expected rate of return from this investment opportunity is %. (Round to two decimal places) b. The investment's standard deviation is %. (Round to two decimal places) c. Would you be interested in making such an investment? (Select the best choice below.) Data Table O A. Yes, I would be interested in making such an investment. The economy is most likely to B. Your interest in making such an investment would depend on your risk tolerance. If you investment. This State of Economy Probability Fund Returns Mo Twould not be internetad in molina cuch an investment Thannonamu is most likel 100% Click to select your answer(s). 45% Rapid expansion and recovery 15% Modest growth 40% Continued recession 30% Falls into depression 15% Cliol on the icon in order to convite cantante inte. broadchoot 15% - 100% o (Related to Checkpoint 8.1) (Computing the portfolio expected rate of return) Penny Francis inherited a $200,000 portfolio of investments from her grandparents when she turned 21 years of age. The portfolio is comprised of Treasury bills and stock in Ford (F) and Harley Davidson (HOG): E. a. Based on the current portfolio composition and the expected rates of return, what is the expected rate of return for Penny's portfolio? b. If Penny wants to increase her expected portfolio rate of return, she can increase the allocated weight of the portfolio she has invested in stock (Ford and Harley Davidson) and decrease her holdings of Treasury bills. If Penny moves all her money out of Treasury bills and splits it evenly between the two stocks, what will be her expected rate of return? c. If Penny does move money out of Treasury bills and into the two stocks, she will reap a higher expected portfolio return, so why would anyone want to hold Treasury bills in their portfolio? a. Based on the current portfolio composition and the given expected rates of return, the expected rate of return for Penny's portfolio is %. (Round to two decimal places.) b. If Penny moves all her money out of Treasury bills and splits it evenly between the two stocks, her expected rate of return for her portfolio is [%. (Round to two decimal places.) c. If Penny does move money out of Treasury bills and into the two stocks, she will reap a higher expected portfolio return, so why would anyone want to hold Treasury bills in their portfolio? (Select the best choice below.) x Data Table O A. Although Treasury bills have a lower expected rate of return then stocks, they are risk-free com wer the risk of their portfolios. OB. There is no reason for anyone to ever hold Treasury bills in their portfolios. Althaiah the Tronour hills in this nrohlam hawa lawar avnantod rate of return than Card and Expected $ Value Return Click to select your answer(s). Treasury bills 3.3% 85,000 Ford (F) 7.9% 58,000 Harley Davidson (HOG) 13.6% 57,000 Whor thon ntool, (Click on the icon in order to copy its contents into a spreadsheet (Related to Checkpoint 8.3) (CAPM and expected returns) a. Given the following holding-period returns, : , compute the average returns and the standard deviations for the Sugita Corporation and for the market. b. If Sugita's beta is 1.68 and the risk-free rate is 7 percent, what would be an expected return for an investor owning Sugita? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12.) c. How does Sugita's historical average return compare with the return you should expect based on the Capital Asset Pricing Model and the firm's systematic risk? a. Given the holding-period returns shown in the table, the average monthly return for the Sugita Corporation is %. (Round to three decimal places.) The standard deviation for the Sugita Corporation is %. (Round to two decimal places.) Given the holding-period returns shown in the table, the average monthly return for the market is %. (Round to three decimal places.) The standard deviation for the market is %. (Round to two decimal places.) - x Data Table b. If Sugita's beta is 1.68 and the risk-free rate is 7 percent, the expected return for an investor owning Sugita is %. The average annual historical return for Sugita is %. (Round to two decimal places.) Market Month 1 Sugita Corp. 2.0% 1.8% How does Suaita's historical average return compare with the return vou should expect based on the capital asset pri 2 -0.8 3 0.0 Enter your answer in each of the answer boxes. OOOOO 00 4 0.0 5 4.0 6 4.0 o (Computing the standard deviation for a portfolio of two risky investments) Mary Guilott recently graduated from Nichols State University and is anxious to begin investing her meager savings as a way of applying what she has learned in business school. Specifically, she is evaluating an investment in a portfolio comprised of two firms' common stock. She has collected the following information about the common stock of Firm A and Firm B: E. a. If Mary invests half her money in each of the two common stocks, what is the portfolio's expected rate of return and standard deviation in portfolio return? b. Answer part a where the correlation between the two common stock investments is equal to zero. c. Answer part a where the correlation between the two common stock investments is equal to +1. d. Answer part a where the correlation between the two common stock investments is equal to - 1. e. Using your responses to questions a-d, describe the relationship between the correlation and the risk and return of the portfolio. a. If Mary decides to invest 50% of her money in Firm A's common stock and 50% in Firm B's D%. (Round to two decimal places.) - X portfolio is Data Table The standard deviation in the portfolio is %. (Round to two decimal places.) Expected Return b. If Mary decides to invest 50% of her money in Firm A's common stock and 50% in Firm B's %. (Round to two decimal places.) Standard Deviation portfolio is Firm A's common stock 0.18 0.15 0.23 Firm B's common stock The standard deviation in the portfolio is %. (Round to two decimal places.) 0.18 0.50 Correlation coefficient Click to select your answer(s). (Click on the icon in order to copy its contents into a spreadsheet.) (Capital asset pricing model) Grace Corporation is considering the following investments. The current rate on Treasury bills is 2.5 percent and the expected return for the market is 9.5 percent. Stock Beta K 1.17 G 1.31 B 0.71 U 0.93 (Click on the icon in order to copy its contents into a spreadsheet.) a. Using the CAPM, what rates of return should Grace require for each individual security? b. How would your evaluation of the expected rates of return for Grace change if the risk-free rate were to rise to 4 percent and the market risk premium were to be only 6.5 percent? c. Which market risk premium scenario (from part a or b) best fits a recessionary environment? A period of economic expansion? Explain your response. a. The expected rate of return for security K, which has a beta of 1.17, is %. (Round to two decimal places.) The expected rate of return for security G, which has a beta of 1.31, is %. (Round to two decimal places.) The expected rate of return for security B, which has a beta of 0.71, is %. (Round to two decimal places.) To Enter your answer in each of the answer boxes. (Using the CAPM to find expected returns) Sante Capital operates two mutual funds headquartered in Houston, Texas. The firm is evaluating the stock of four different firms for possible inclusion in its fund holdings. As part of their analysis, Sante's managers have asked their junior analyst to estimate the investor-required rate of return on each firm's shares using the CAPM and the following estimates: The rate of interest on short-term U.S. Treasury securities is currently 2 percent, and the expected return for the market portfolio is 8 percent. What should be the expected rates of return for each investment? Security Beta A 1.49 B 0.55 1.44 D 0.97 (Click on the icon in order to copy its contents into a spreadsheet.) a. The expected rate of return for security A, which has a beta of 1.49, is %. (Round to two decimal places.) b. The expected rate of return for security B, which has a beta of 0.97, is %. (Round to two decimal places.) c. The expected rate of return for security C, which has a beta of 0.55, is %. (Round to two decimal places.) d. The expected rate of return for security D, which has a beta of 1.44, is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts