Question: Related to Checkpoint Computing the standard deviation for an individual investme) James Fromholte in considering whether to invest in a newly formed investment and The

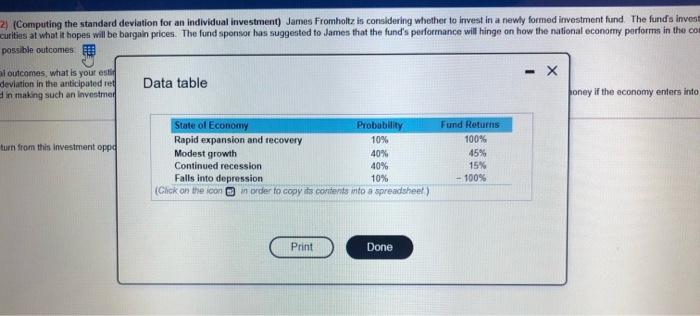

Related to Checkpoint Computing the standard deviation for an individual investme) James Fromholte in considering whether to invest in a newly formed investment and The life objective to equire home mortgage securities at what hapes will be burgain prices The land spoor has sugested to James that the funds performance willinge on how the national economy perform in the coming you Specifically tested the following possible outcomes ased on the potential cotcomes, what is your imate of the spected to run from the sportul Calculate the standard deviation in the anticipated returns found in part c. Would you be interested in making wochen werd? Now that you lose all your money on yow if the economy clap into the worst state or you double your money the economy internet rapidevation The expected tate of retum from this mesentertuny Round to wo decimal places) 2) (Computing the standard deviation for an individual investment) James Fromholtz is considering whether to invest in a newly formed investment fund. The funds invest curities at what it hopes will be bargain prices. The fond sponsor has suggested to James that the fund's performance will hinge on how the national economy perform in the com possible outcomes al outcomes, what is your est - X deviation in the anticipated red Data table in making such an investme honey if the economy enters into turn from this investment opp State of Economy Probability Rapid expansion and recovery 10% Modest growth 40% Continued recession 40% Falls into depression 10% (Click on the icon in order to copy its contents into a spreadsheet) Fund Returns 100% 45% 15% -- 100% Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts