Question: [Related to the Apply the Concept: How to Follow the Futures Market: Reading the Financial Futures Listings] Consider the hypothetical listing in the following table

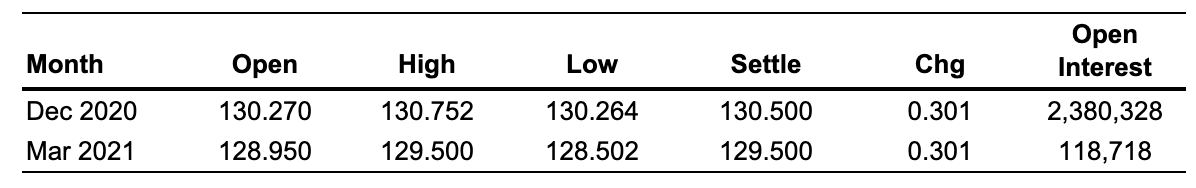

[Related to the Apply the Concept: "How to Follow the Futures Market: Reading the Financial Futures Listings"] Consider the hypothetical listing in the following table for 10-year Treasury note futures on the Chicago Board of Trade. One futures contract for Treasury notes = $100,000 face value of 10-year 6% notes.

If today you bought two contracts expiring in December 2020, you would pay $____ (Enter your response as a whole number.)

If today you bought two contracts expiring in December 2020, you would pay $____ (Enter your response as a whole number.)

Month Dec 2020 Mar 2021 Open 130.270 128.950 High 130.752 129.500 Low 130.264 128.502 Settle 130.500 129.500 Chg 0.301 0.301 Open Interest 2,380,328 118,718

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts