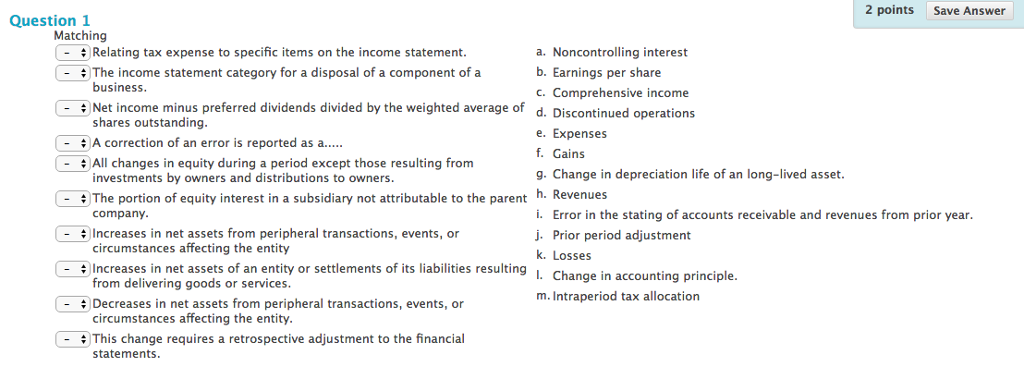

Question: Relating tax expense to specific items on the income statement. The income statement category for a disposal of a component of a business. Net income

Relating tax expense to specific items on the income statement. The income statement category for a disposal of a component of a business. Net income minus preferred dividends divided by the weighted average of shares outstanding. A correction of an error is reported as a..... All changes in equity during a period except those resulting from investments by owners and distributions to owners. The portion of equity interest in a subsidiary not attributable to the parent Revenues company. Increases in net assets from peripheral transactions, events, or circumstances affecting the entity Increases in net assets of an entity or settlements of its liabilities resulting from delivering goods or services. Decreases in net assets from peripheral transactions, events, or circumstances affecting the entity. This change requires a retrospective adjustment to the financial statements. a. Noncontrolling interest b. Earnings per share c. Comprehensive income d. Discontinued operations e. Expenses f. Gains g. Change in depreciation life of an long-lived asset. i. Error in the stating of accounts receivable and revenues from prior year. j. Prior period adjustment k. Losses l. Change in accounting principle. m. Intraperiod tax allocation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts