Question: Relations between Financial Statement Items a. Compute the amount of cash collected from customers during 2016. b. Compute the amount of cash payments made to

Relations between Financial Statement Items

a. Compute the amount of cash collected from customers during 2016.

b. Compute the amount of cash payments made to suppliers of merchandise during 2016.

c. Reconcile the change in retained earnings during 2016 Reference:

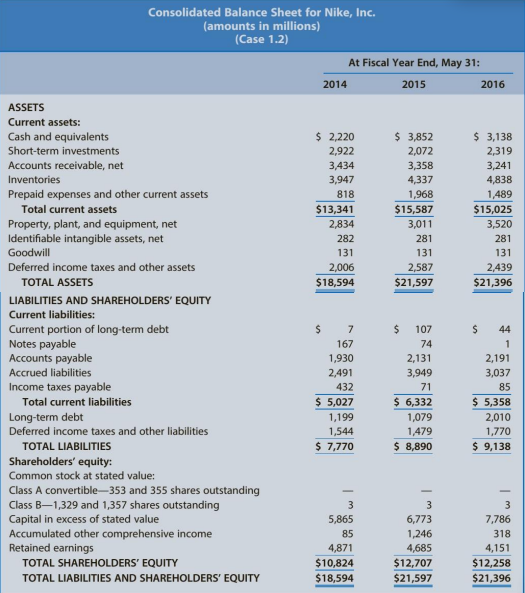

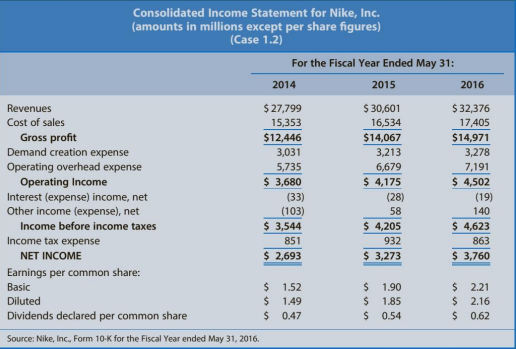

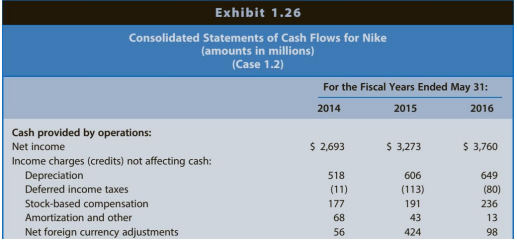

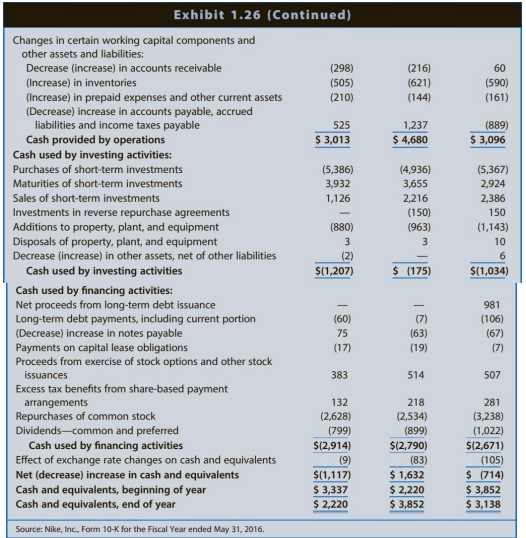

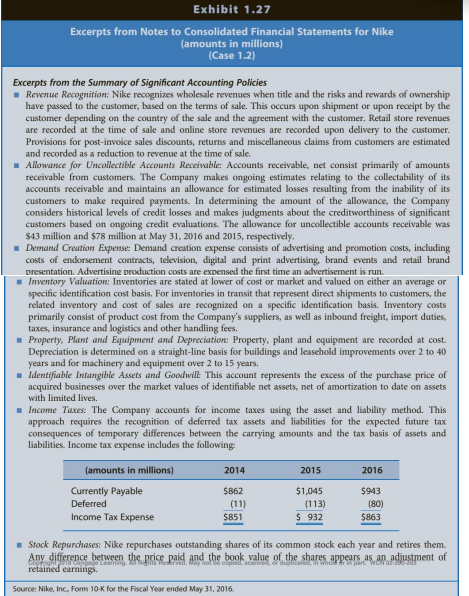

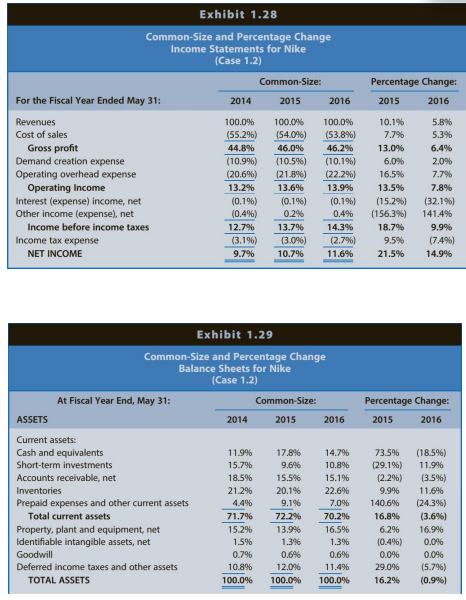

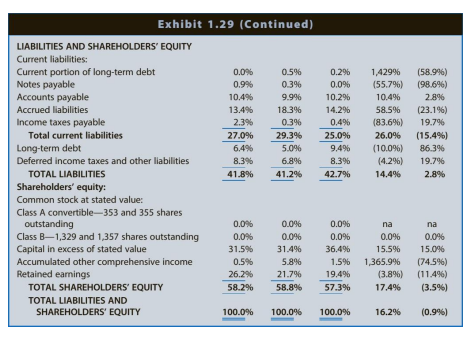

Consolidated Balance Sheet for Nike, Inc. (amounts in millions) (Case 1.2) At Fiscal Year End, May 31: 2014 2015 2016 ASSETS Current assets: Cash and equivalents $ 2,220 $ 3,852 $ 3,138 Short-term investments 2,922 2,072 2,319 Accounts receivable, net 3,434 3,358 3,241 Inventories 3,947 4,337 4,838 Prepaid expenses and other current assets 818 1,968 1,489 Total current assets $13,341 $15,587 $15,025 Property, plant, and equipment, net 2,834 3,011 3,520 Identifiable intangible assets, net 282 281 281 Goodwill 131 131 131 Deferred income taxes and other assets 2,006 2,587 2,439 TOTAL ASSETS $18,594 $21,597 $21,396 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Current portion of long-term debt S 7 107 S 44 Notes payable 167 74 Accounts payable 1,930 2,131 2,191 Accrued liabilities 2,491 3,949 3,037 Income taxes payable 432 71 85 Total current liabilities $ 5,027 $ 6,332 $ 5,358 Long-term debt 1,199 1,079 2,010 Deferred income taxes and other liabilities 1,544 1,479 1,770 TOTAL LIABILITIES $ 7,770 $ 8,890 $ 9,138 Shareholders' equity: Common stock at stated value: Class A convertible-353 and 355 shares outstanding - Class B-1,329 and 1,357 shares outstanding 3 3 3 Capital in excess of stated value 5,865 6,773 7,786 Accumulated other comprehensive income 85 1,246 318 Retained earnings 4,871 4,685 4,151 TOTAL SHAREHOLDERS' EQUITY $10,824 $12,707 $12,258 TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $18,594 $21,597 $21,396Consolidated Income Statement for Nike, Inc. (amounts in millions except per share figures) (Case 1.2) For the Fiscal Year Ended May 31: 2014 2015 2016 Revenues $ 27,799 $ 30,601 $32,376 Cost of sales 15,353 16.534 17,405 Gross profit $12,446 $14,067 $14,971 Demand creation expense 3,031 3,213 3,278 Operating overhead expense 5,735 6,679 7,191 Operating Income $ 3,680 $ 4,175 $ 4,502 Interest (expense) income, net (33) (28) (19) Other income (expense), net (103) 58 140 Income before income taxes $ 3,544 $ 4,205 5 4,623 Income tax expense 851 932 863 NET INCOME $ 2,693 $ 3,273 $ 3,760 Earnings per common share: Basic S 1.52 S 1.90 5 2.21 Diluted S 1.49 1.85 5 2.16 Dividends declared per common share 0.47 0.54 5 0.62 Source: Nike, Inc., Form 10-K for the Fiscal Year ended May 31, 2016.Exhibit 1.26 Consolidated Statements of Cash Flows for Nike (amounts in millions) (Case 1.2) For the Fiscal Years Ended May 31: 2014 2015 2016 Cash provided by operations: Net income $ 2,693 $ 3,273 $ 3,760 Income charges (credits) not affecting cash: Depreciation 518 606 649 Deferred income taxes (11) (113) (80) Stock-based compensation 177 191 236 Amortization and other 68 43 13 Net foreign currency adjustments 56 424 98Exhibit 1.26 (Continued) Changes in certain working capital components and other assets and liabilities: Decrease (increase) in accounts receivable (298) (216) 60 (Increase) in inventories (505) (621) (590) (Increase) in prepaid expenses and other current assets (210) (144) (161) (Decrease) increase in accounts payable, accrued liabilities and income taxes payable 525 1,237 (889) Cash provided by operations $ 3,013 $ 4,680 $ 3,096 Cash used by investing activities: Purchases of short-term investments (5,386) (4,936) (5,367) Maturities of short-term investments 3,932 3,655 2,924 Sales of short-term investments 1,126 2,216 2,386 Investments in reverse repurchase agreements (150) 150 Additions to property, plant, and equipment (880) (963) (1,143) Disposals of property, plant, and equipment 3 3 10 Decrease (increase) in other assets, net of other liabilities (2) 6 Cash used by investing activities $(1,207) $ (175) $(1,034) Cash used by financing activities: Net proceeds from long-term debt issuance 981 Long-term debt payments, including current portion (60) (7) (106) (Decrease) increase in notes payable 75 (63) (67) Payments on capital lease obligations (17) (19) (7) Proceeds from exercise of stock options and other stock issuances 383 514 507 Excess tax benefits from share-based payment arrangements 132 218 281 Repurchases of common stock (2,628) (2,534) (3,238) Dividends-common and preferred (799) (899) (1,022) Cash used by financing activities $(2,914) $(2,790) $(2,671) Effect of exchange rate changes on cash and equivalents (9) (83 (105) Net (decrease) increase in cash and equivalents $(1,117) $ 1,632 $ (714) Cash and equivalents, beginning of year $ 3,337 $ 2,220 $ 3,852 Cash and equivalents, end of year $ 2,220 $ 3,852 $ 3,138 Source: Nike, Inc., Form 10-K for the Fiscal Year ended May 31, 2016.Exhibit 1.27 Excerpts from Notes to Consolidated Financial Statements for Nike (amounts in millions) (Case 1.2) Excerpts from the Summary of Significant Accounting Policies Revenue Recognition: Nike recognizes wholesale revenues when title and the risks and rewards of ownership have passed to the customer, based on the terms of sale. This occurs upon shipment or upon receipt by the customer depending on the country of the sale and the agreement with the customer. Retail store revenues are recorded at the time of sale and online store revenues are recorded upon delivery to the customer. Provisions for post-invoice sales discounts, returns and miscellaneous claims from customers are estimated and recorded as a reduction to revenue at the time of sale. Allowance for Uncollectible Accounts Receivable: Accounts receivable, net consist primarily of amounts receivable from customers. The Company makes ongoing estimates relating to the collectability of its accounts receivable and maintains an allowance for estimated losses resulting from the inability of its customers to make required payments. In determining the amount of the allowance, the Company considers historical levels of credit losses and makes judgments about the creditworthiness of significant customers based on ongoing credit evaluations. The allowance for uncollectible accounts receivable was $43 million and $78 million at May 31, 2016 and 2015, respectively. Demand Creation Expense: Demand creation expense consists of advertising and promotion costs, including costs of endorsement contracts, television, digital and print advertising, brand events and retail brand presentation. Advertising production costs are expensed the first time an advertisement is run. Inventory Valuation: Inventories are stated at lower of cost or market and valued on either an average or specific identification cost basis, For inventories in transit that represent direct shipments to customers, the related inventory and cost of sales are recognized on a specific identification basis. Inventory costs primarily consist of product cost from the Company's suppliers, as well as inbound freight, import duties. taxes, insurance and logistics and other handling fees. Property, Plant and Equipment and Depreciation: Property, plant and equipment are recorded at cost. Depreciation is determined on a straight-line basis for buildings and leasehold improvements over 2 to 40 years and for machinery and equipment over 2 to 15 years. Identifiable Intangible Assets and Goodwill: This account represents the excess of the purchase price of acquired businesses over the market values of identifiable net assets, net of amortization to date on assets with limited lives. Income Taxes: The Company accounts for income taxes using the asset and liability method. This approach requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of temporary differences between the carrying amounts and the tax basis of assets and liabilities. Income tax expense includes the following [amounts in millions] 2014 2015 2016 Currently Payable $862 $1,045 $943 Deferred (11) [1 13) 180 Income Tax Expense $851 $ 932 $863 Stock Repurchases: Nike repurchases outstanding shares of its common stock each year and retires them. Any difference between the price paid and the book value of the shares appears as an adjustment of retained earnings. Source: Nike, Inc. Form 10-K for the Fiscal Year ended May 31, 2016.Exhibit 1.28 Common-Size and Percentage Change Income Statements for Nike [Case 1.2) Common-Size: Percentage Change: For the Fiscal Year Ended May 31: 2014 2015 2016 2015 2016 Revenues 100.0% 100.0% 100.0% 10.1% 5.6% Cost of sales (55.296) (54046] (53.896] 7.79% 5.39% Gross profit 44.8% 46.0% 46.2% 13.0% 6.49% Demand creation expense (10.9%) (10.5%) (10.1%) 6.0% 2.0% Operating overhead expense (20.6%) (21.86) (22.2%] 16.5% 7.79% Operating Income 13.2% 13.6% 13.9% 13.5% 7.8% Interest (expense) income, net (0.19%) (0.1%) (0.19%) (15.2%%) (32.1%) Other income (expense), net (0.496) 0.2% 0.49% (156.3%) 141.4% Income before income taxes 12.7%% 13.7% 14.3% 18.7% 9.9% Income tax expense (3.1%) (3.096) (2.79%] 9.5% (7.4%) NET INCOME 9.79 10.7% 11.6% 21.5% 14.9% Exhibit 1.29 Common-Size and Percentage Change Balance Sheets for Nike [Case 1.2) At Fiscal Year End, May 31: Common-Size: Percentage Change: ASSETS 2014 2015 2016 2015 2016 Current assets: Cash and equivalents 11.946 17.8%% 14.79% 73.5% (18 59%) Short-term investments 15.79% 9.60% 10.8% (29-19%) 11.96 Accounts receivable, net 18.5% 15.5% 15.1% (2.20%) (3.5%) Inventories 21.29% 20.1% 22.69% 9.94% 11.6% Prepaid expenses and other current assets 4.4% 9.1% 7.09% 140.6% (24 3%) Total current assets 71.7% 72.2% 70.2% 16.8% (3.69%] Property, plant and equipment, net 15.2% 13.9%% 16.5% 6.2% 16.946 Identifiable intangible assets, net 1.5% 1.3% 1.3% (0.4%) 0.0%% Goodwill 0.74% 0.016 0.6% 0.046 0.0%% Deferred income taxes and other assets 10.8% 12.0% 11.4% 29.0% (5.796) TOTAL ASSETS 100.0% 100.0% 100,0% 16.2% (0.9%)Exhibit 1.29 (Continued) LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Current portion of long-term debt 0.09% 0.5% 0.29% 1,429% (58.9%6) Notes payable 0.9% 0.3% 0.0% (55.795) (98 616) Accounts payable 10.4% 9.9% 10.2% 10.4% 2 86 Accrued liabilities 13.4%% 18 3% 14.2% 58.5% (23.1%) Income taxes payable 2.3%% 0346 0.49% (83.6%) 19.7% Total current liabilities 27.0% 29.3% 25.0% 26.0% (15.4%] Long-term debt 6,4% 9.49% (10.0%) 86.3% Deferred Income taxes and other liabilities 8.39% 6.85 8.39% (4.29%) 19.76 TOTAL LIABILITIES 41.6% 41.2% 42.79% 14.4% 2.8% Shareholders' equity: Common stock at stated value: Class A convertible-353 and 355 shares outstanding 0.09% 0.0% 0.09% na na Class B-1,329 and 1,357 shares outstanding 0.0% 0.0% 0.0% 0.0% 0.0% Capital in excess of stated value 31.5% 31.4% 36.49% 15.5% 15.06 Accumulated other comprehensive income 0.59% 5.8% 1.5% 1,365.9% (74.596) Retained earnings 26.26 21.7% 19.4% (3.8%) [11.46) TOTAL SHAREHOLDERS' EQUITY 58.2% 58.8% 57.3% 17.4% (3.5%) TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 100.0% 100.0% 100.0% 16.2% (0.9%]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts