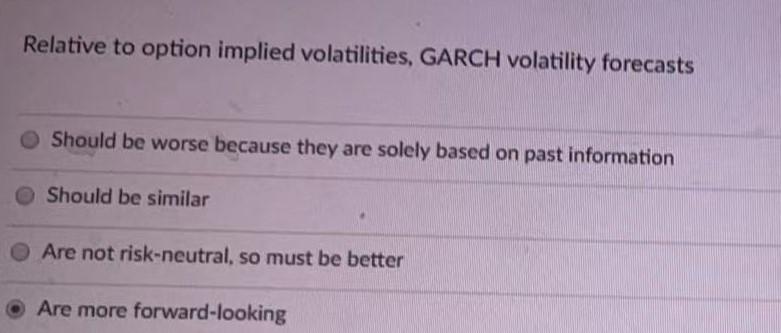

Question: Relative to option implied volatilities, GARCH volatility forecasts Should be worse because they are solely based on past information Should be similar Are not risk-neutral,

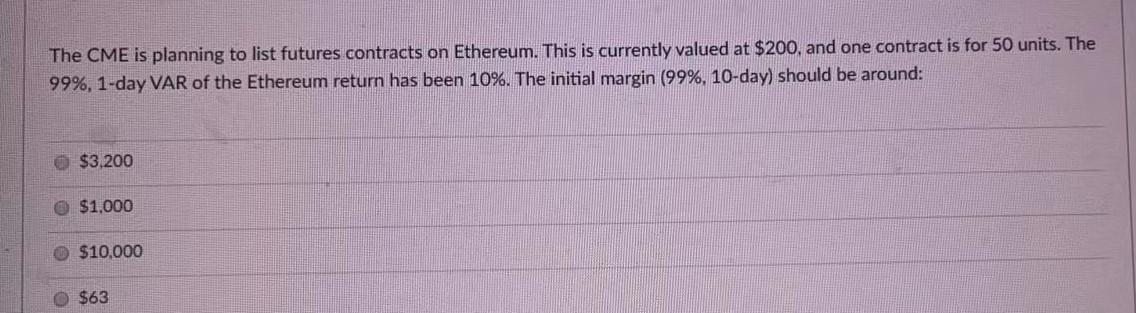

Relative to option implied volatilities, GARCH volatility forecasts Should be worse because they are solely based on past information Should be similar Are not risk-neutral, so must be better Are more forward-looking The CME is planning to list futures contracts on Ethereum. This is currently valued at $200, and one contract is for 50 units. The 99%, 1-day VAR of the Ethereum return has been 10%. The initial margin (99%, 10-day) should be around: $3,200 $1,000 0 $10,000 O $63 Relative to option implied volatilities, GARCH volatility forecasts Should be worse because they are solely based on past information Should be similar Are not risk-neutral, so must be better Are more forward-looking The CME is planning to list futures contracts on Ethereum. This is currently valued at $200, and one contract is for 50 units. The 99%, 1-day VAR of the Ethereum return has been 10%. The initial margin (99%, 10-day) should be around: $3,200 $1,000 0 $10,000 O $63

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts