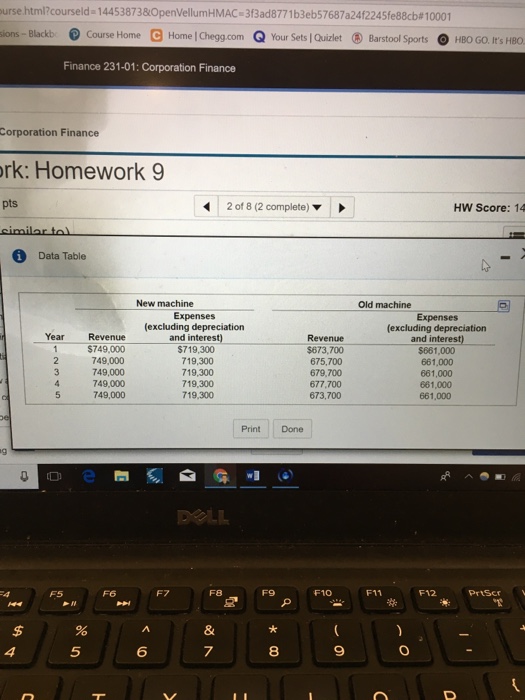

Question: Relevant cash flows long dashNo terminal value??? Central Laundry and Cleaners is considering replacing an existing piece of machinery with a more sophisticated machine. The

urse html?courseld a 1445 3873&OpenVellumHMAC. 3Bad8771 b3eb57687a24f2245fe88cb# 10001 ions -Blackb Course Home C Home | Chegg.com Q Your Sets/ QuizletBarstool Sports HBO GO. It's HBO Finance 231-01: Corporation Finance Corporation Finance rk: Homework 9 2 of 8 (2 complete) HW Score: 14 Data Table New machine Old machine Year Revenue $749,000 749,000 749,000 749,000 749,000 Expenses (excluding depreciation and interest) $719,300 719,300 719,300 719,300 719,300 Revenue $673,700 675,700 679,700 677.700 673,700 Expenses (excluding depreciation and interest) $661,000 661,000 661,000 661,000 661,000 Print Done DOLL F5 F7 F8 F9 F10 F11 F12 Prtsc 5 6 7 8 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts