Question: Relevant data from the Poster Company's operating budgets are: Quarter 1 Quarter 2 Sales $208,470 $211,540 Direct material purchases 115,300 120,832 Direct labor 75,200 73,298

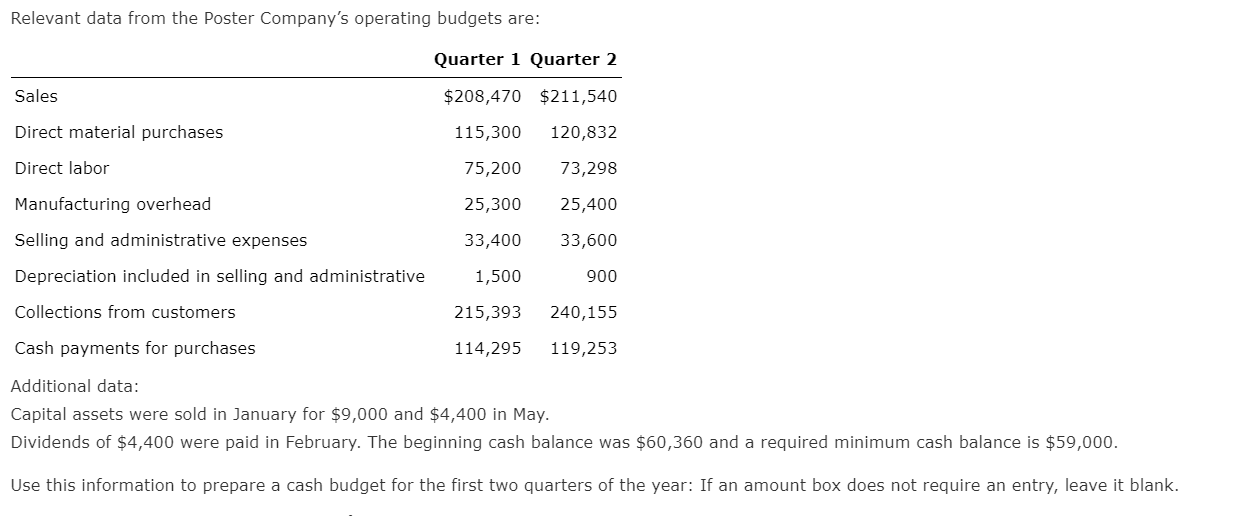

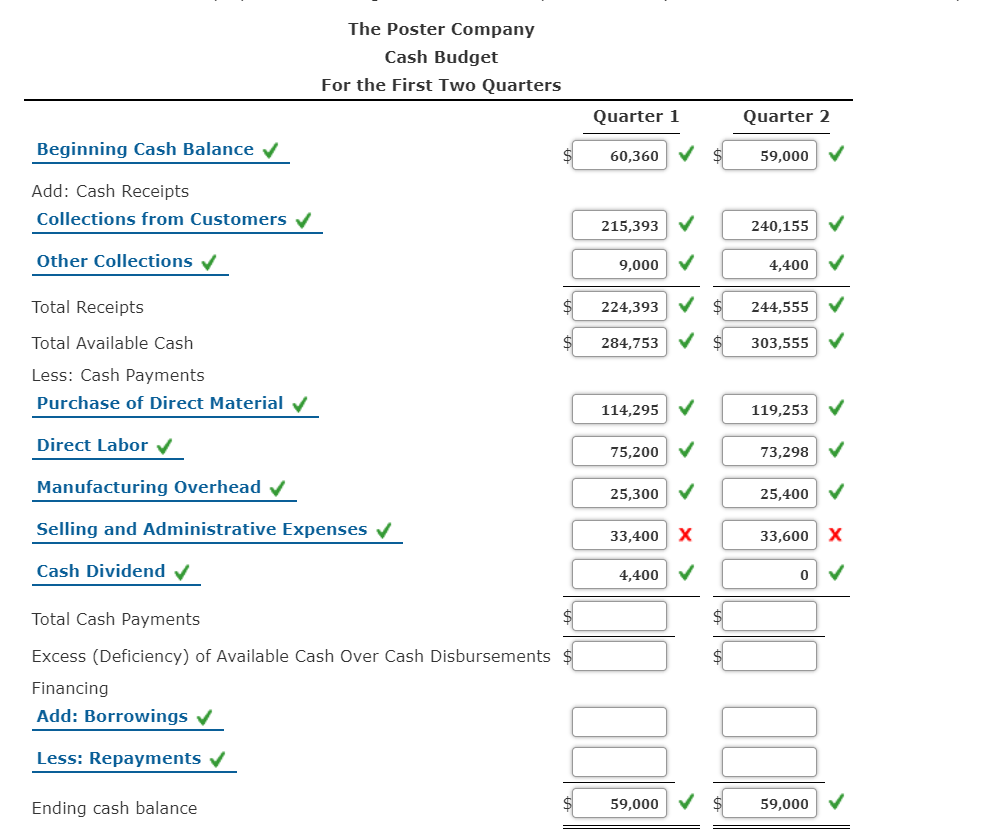

Relevant data from the Poster Company's operating budgets are: Quarter 1 Quarter 2 Sales $208,470 $211,540 Direct material purchases 115,300 120,832 Direct labor 75,200 73,298 Manufacturing overhead 25,300 25,400 33,400 33,600 Selling and administrative expenses Depreciation included in selling and administrative 1,500 900 Collections from customers 215,393 240,155 Cash payments for purchases 114,295 119,253 Additional data: Capital assets were sold in January for $9,000 and $4,400 in May. Dividends of $4,400 were paid in February. The beginning cash balance was $60,360 and a required minimum cash balance is $59,000. Use this information to prepare a cash budget for the first two quarters of the year: If an amount box does not require an entry, leave it blank. The Poster Company Cash Budget For the First Two Quarters Quarter 1 Quarter 2 Beginning Cash Balance 60,360 59,000 Add: Cash Receipts Collections from Customers 215,393 240,155 Other Collections 9,000 4,400 Total Receipts 224,393 244,555 Total Available Cash 284,753 303,555 Less: Cash Payments Purchase of Direct Material 114,295 119,253 Direct Labor 75,200 73,298 Manufacturing Overhead 25,300 25,400 Selling and Administrative Expenses 33,400 33,600 Cash Dividend 4,400 0 $ Total Cash Payments Excess (Deficiency of Available Cash Over Cash Disbursements Financing Add: Borrowings Less: Repayments Ending cash balance 59,000 59,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts