Question: Remaining : 46 minutes 16 seconds Question completion dans 10 Chek Submit to complete this assessment Question of Question 16 2 points Mr. Wilson started

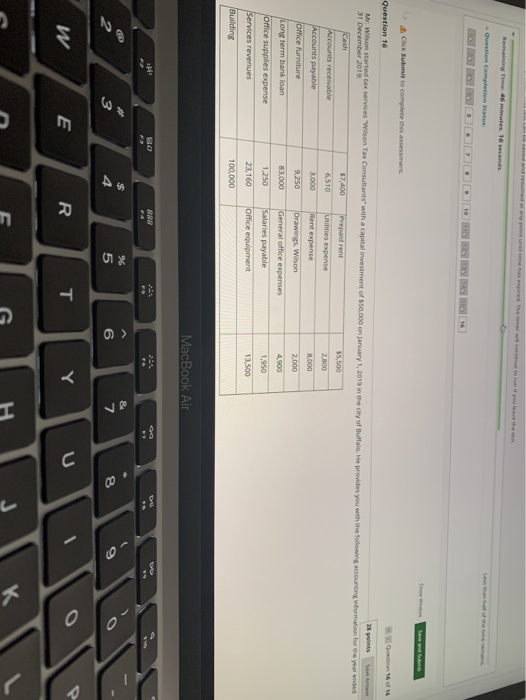

Remaining : 46 minutes 16 seconds Question completion dans 10 Chek Submit to complete this assessment Question of Question 16 2 points Mr. Wilson started tax services "Wilson Tax Consultants with a capital investment of $50.000 on January 1, 2019 in the city of Buffalo. He provides you with the following accounting formation for the year ended 31 December 2013 (Cash 57,400 Prepaid rent 55,500 Accounts receivable 6,510 Utilities expense 2.800 Accounts payable 3.000 Rent expense 3.000 Office furniture 9,250 Drawings. Wilson 2,000 Long term bank loan 83,000 General office expenses 4.900 Office supplies expense 1.250 Salaries payable 1,950 Services revenues 23,160 Office equipment 13.500 Building 100,000 MacBook Air 234 Da Fa 8? D . 3 96 5 03 > & 7 4 8 s W E R Y T K Required Using the above given information, prepare following financial statements for the Wilson Tax Consultants for the year ended December 31, 2018 a) Income Statement b) Owner's Equity Statement c) Classified Balance Sheet You should copy (C) and paste (C) the appropriate template into the answer area and complete with the necessary information for each financial statement. aj Template for income statement b) template for statement of changes in owner's equity c) template for balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts