Question: Remaining journal entries: Part b . Prepare a final statement of partnership liquidation. ( 4 points ) Required: Part a . Prepare journal entries for

Remaining journal entries:

Part b Prepare a final statement of partnership liquidation. points

Required:

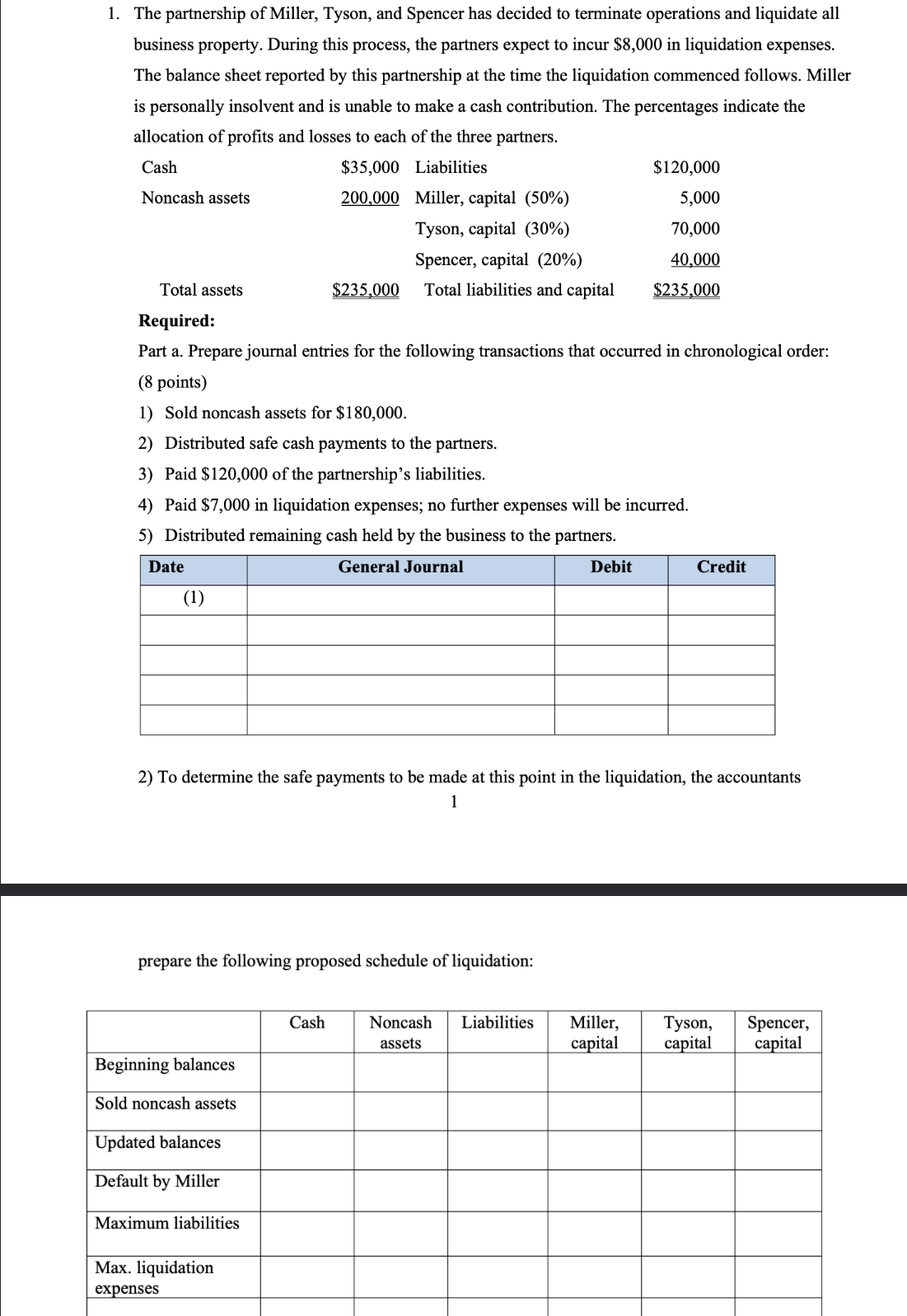

Part a Prepare journal entries for the following transactions that occurred in chronological order: points

Sold noncash assets for $

Distributed safe cash payments to the partners.

Paid $ of the partnership's liabilities.

Paid $ in liquidation expenses; no further expenses will be incurred.

Distributed remaining cash held by the business to the partners.

To determine the safe payments to be made at this point in the liquidation, the accountants

prepare the following proposed schedule of liquidation:

Required:

Part a Prepare journal entries for the following transactions that occurred in chronological order: points

Sold noncash assets for $

Distributed safe cash payments to the partners.

Paid $ of the partnership's liabilities.

Paid $ in liquidation expenses; no further expenses will be incurred.

Distributed remaining cash held by the business to the partners.

To determine the safe payments to be made at this point in the liquidation, the accountants

prepare the following proposed schedule of liquidation:

Remaining journal entries:

Part b Prepare a final statement of partnership liquidation. points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock