Question: Remaining part for case study 3 is below answer correct to the nearer cent.) If Ali invests all the funds to buy this share explain

Remaining part for case study 3 is below answer correct to the nearer cent.) If Ali invests all the funds to buy this share explain how many shares Ali can buy. b. A bond issued by DMO Ltd that has a face value of $1,000 and a coupon rate of 5% pa. The coupons are paid semi-annually and the bond has 10 years to maturity and 6.5% pa yield. Calculate the price of the bond (show answer correct to the nearer cent). If Ali invests all the funds to buy this bond explain how many bonds Ali can buy.

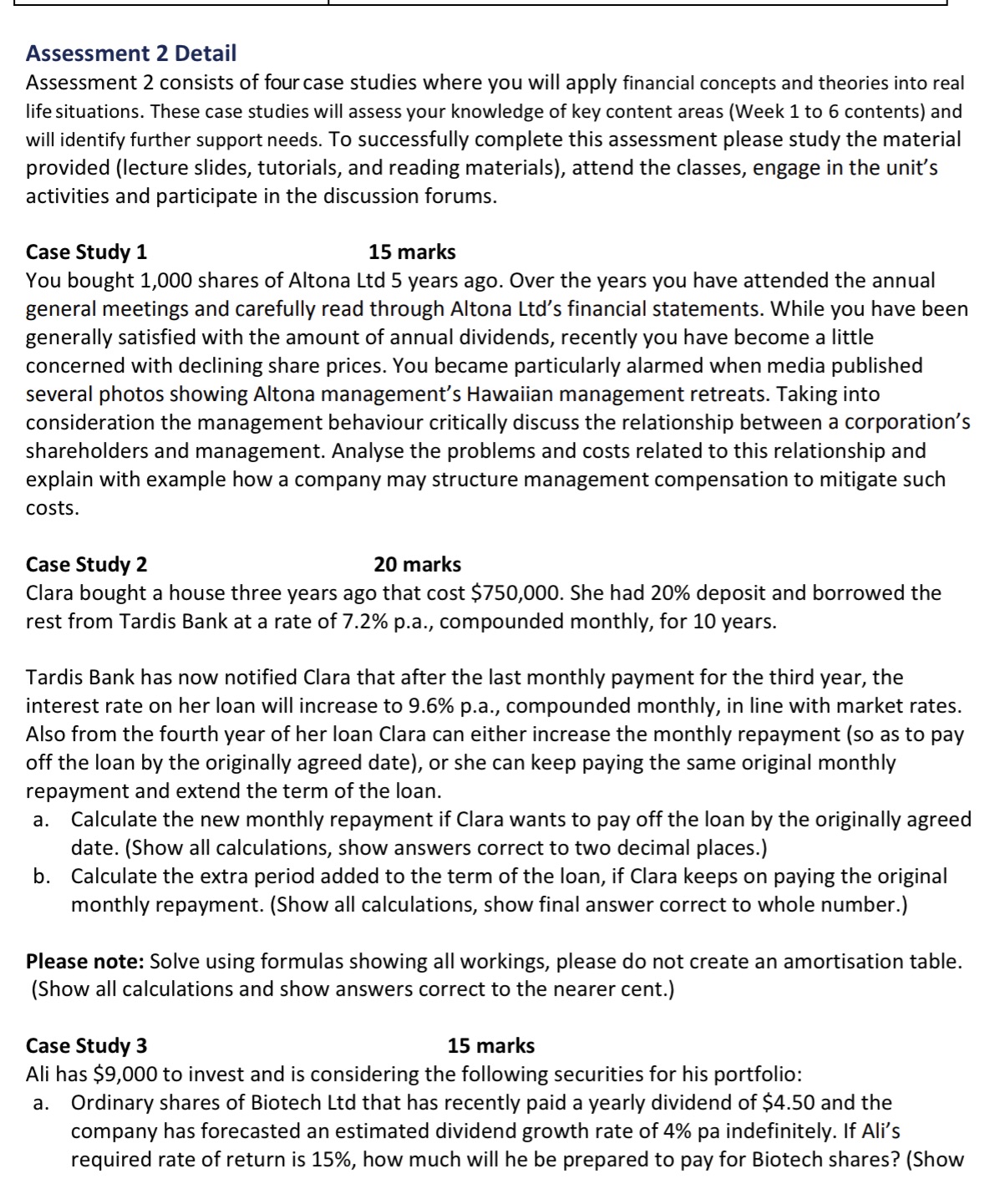

Assessment 2 Detail Assessment 2 consists of four case studies where you will apply nancial concepts and theories into real life situations. These case studies will assess your knowledge of key content areas (Week 1 to 6 contents) and will identify further support needs. To successfully complete this assessment please study the material provided (lecture slides, tutorials, and reading materials), attend the classes, engage in the unit' 5 activities and participate in the discussion forums. Case Study 1 15 marks You bought 1,000 shares of Altona Ltd 5 years ago. Over the years you have attended the annual general meetings and carefully read through Altona Ltd's financial statements. While you have been generally satisfied with the amount of annual dividends, recently you have become a little concerned with declining share prices. You became particularly alarmed when media published several photos showing Altona management's Hawaiian management retreats. Taking into consideration the management behaviour critically discuss the relationship between a corporation's shareholders and management. Analyse the problems and costs related to this relationship and explain with example how a company may structure management compensation to mitigate such costs. Case Study 2 20 marks Clara bought a house three years ago that cost $750,000. She had 20% deposit and borrowed the rest from Tardis Bank at a rate of 7.2% p.a., compounded monthly, for 10 yea rs. Tardis Bank has now notified Clara that after the last monthly payment for the third year, the interest rate on her loan will increase to 9.6% p.a., compounded monthly, in line with market rates. Also from the fourth year of her loan Clara can either increase the monthly repayment (so as to pay off the loan by the originally agreed date), or she can keep paying the same original monthly repayment and extend the term of the loan. a. Calculate the new monthly repayment if Clara wants to pay off the loan by the originally agreed date. (Show all calculations, show answers correct to two decimal places.) b. Calculate the extra period added to the term of the loan, if Clara keeps on paying the original monthly repayment. (Show all calculations, show final answer correct to whole number.) Please note: Solve using formulas showing all workings, please do not create an amortisation table. (Show all calculations and show answers correct to the nearer cent.) Case Study 3 15 marks All has 59,000 to invest and is considering the following securities for his portfolio: a. Ordinary shares of Biotech Ltd that has recently paid a yearly dividend of 54.50 and the company has forecasted an estimated dividend growth rate of 4% pa indefinitely. If Ali's required rate of return is 15%, how much will he be prepared to pay for Biotech shares? (Show