Question: Remaining Time: 05 minutes, 35 seconds. Question Completion Status: QUESTION 1 Snow Cone King is reviewing its capital budgeting proposals. The firm's corporate tax rate

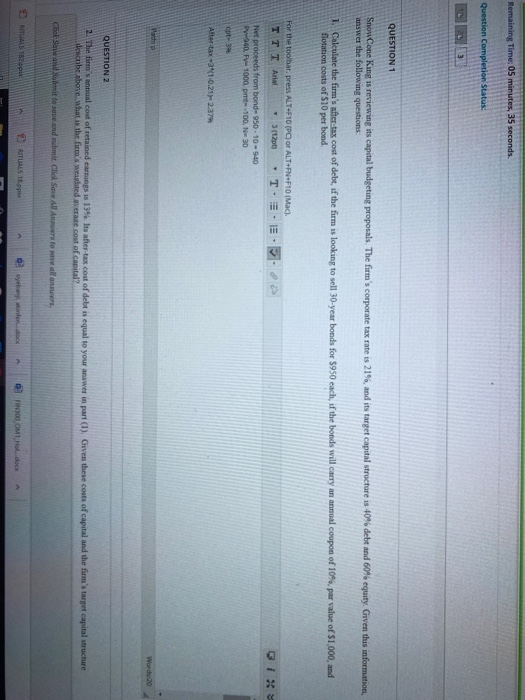

Remaining Time: 05 minutes, 35 seconds. Question Completion Status: QUESTION 1 Snow Cone King is reviewing its capital budgeting proposals. The firm's corporate tax rate is 21%, and its target capital structure is 40% debt and 60% equity. Given this information, answer the following questions 1. Calculate the firm's after tax cost of debt, if the firm is looking to sell 30-year bonds for $950 each, if the bonds will carry an annual coupon of 10%, par value of $1,000, and flotation costs of $10 per bond. For the toolbar, press ALT+F10 (PC or ALT+FN+F10 (Mac). TTT Ariel (12) - E. .225 Net proceeds from bond-950 - 10 -940 P900 - 1000 100, N30 C -3 After-tax-31-0.212:37 Word QUESTION 2 2. The firm annual cost of retained earnings is 13%. Its after-tax cost of debt is equal to your answer in part (1). Given these costs of capital and the firm's target capital structure descbt above what is the firms weihted average cost of capital Cock Save and Submit to save and submit Click Save All An t a ll answers MITUS 1 0 years intend 4 FIND OM Holdi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts