Question: Remaining Time: 1 hour, 10 minutes, 29 seconds. Question Completion Status: Moving to another question will save this response. Question 8 2.5 points Save Answer

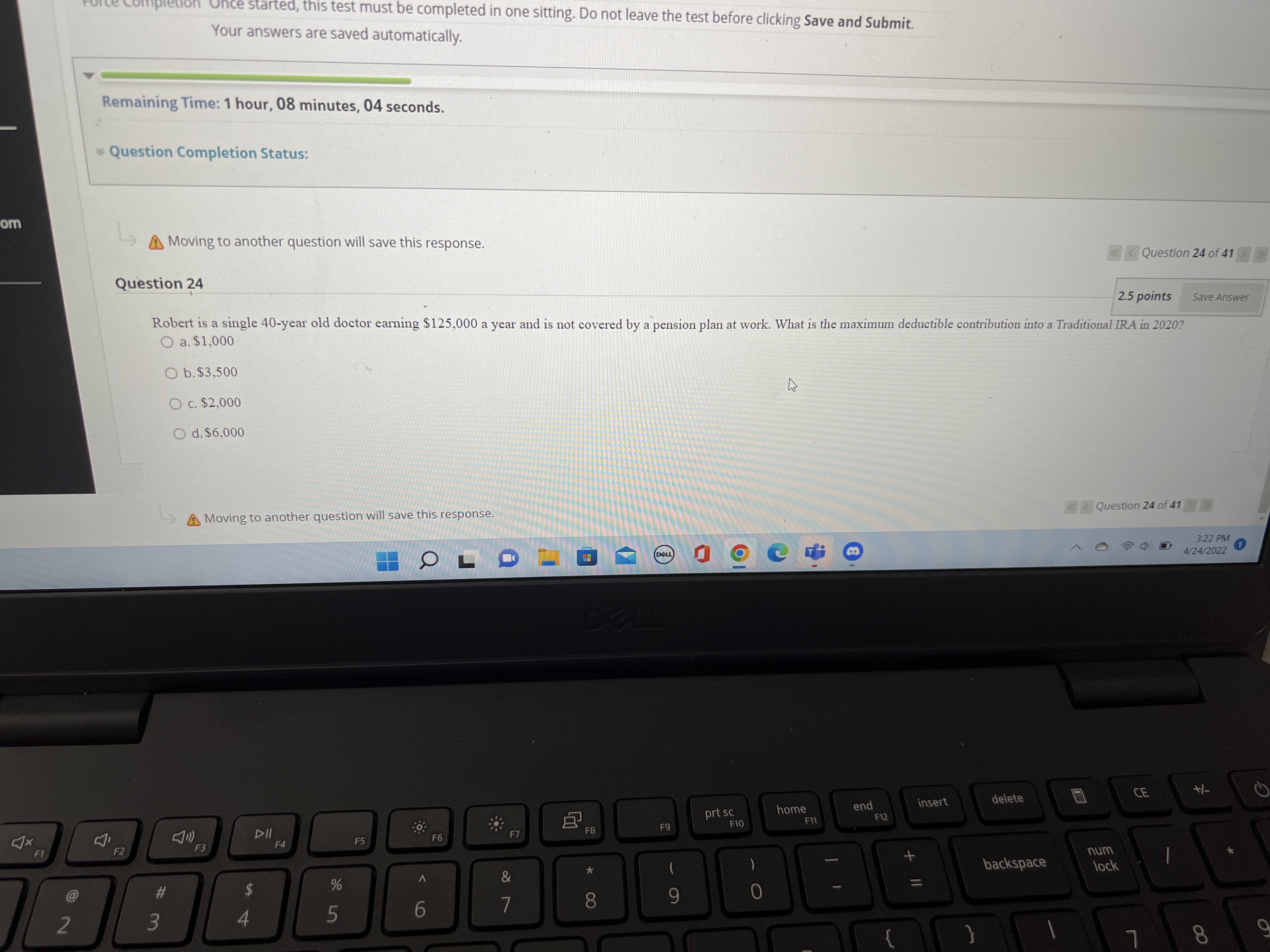

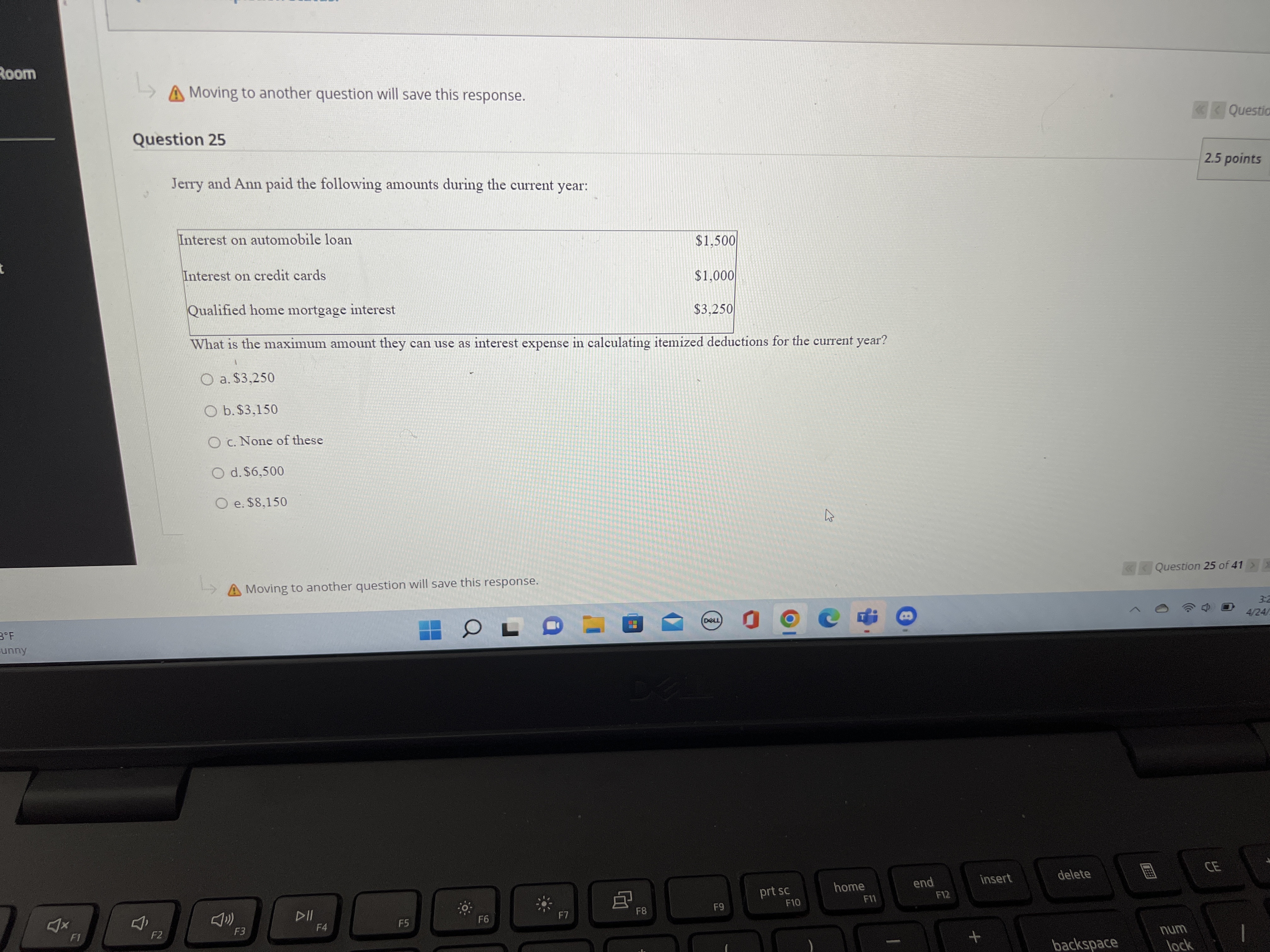

Remaining Time: 1 hour, 10 minutes, 29 seconds. Question Completion Status: Moving to another question will save this response. Question 8 2.5 points Save Answer Assume Tim and Angela Brown are married and file a joint return in 2020. Their AGI is $100,000 and total itemized deductions are $30,200. The standard deduction for married filing jointly taxpayers in 2020 is $24,800. What is Tim and Angela Brown's taxable income for 2020? O a. $0 O b. $75,200 O c. $69,800 O d. $45,000 O e. $100,000 A Moving to another question will save this response. 3:19 PM 4/24/2022 1 insert delete prt sc home end F12 F7 F8 F9 F10 F11 "FI F3 F4 F5 F6 F2 num backspace % & lock # O 8 4 15 N 8 9 O P R Y Usaved automatically. fore clicking Save and Submit. Remaining Time: 1 hour, 09 minutes, 48 seconds. Question Completion Status: Moving to another question will save this response. Question 12 > Question 13 2.5 points Save Answer Stan, a single taxpayer, has $1,700 of state income taxes withheld from his wages in the current year. In the current year, he also received a $320 refund on his prior year state income tax. Stan did not itemize last year but he intends to do so this year. Stan used the sales tax estimate tables and determined his sales tax deduction amount is $1,600. What amount should Stan deduct for state taxes? O a. $1,700 O b. $0 O c. $1,600 O d. None of the above O e. $1,380 A Moving to another question will save this response. 3:20 PM 4/24/2022 home insert delete prt sc end F11 F12 F9 F10 X F6 F1 F2 F3 F4 FS num backspace lock & # O W 4 5 N 8 9 O P R Y U W ERemaining Time: 1 hour, 09 minutes, 04 seconds. Question Completion Status: Moving to another question will save this response. > A Moving to another question will save this response. 3:21 PM 4/24/2022 delete home end insert prt sc F8 F9 F10 F11 F12 DII F6 F7 F2 "F3 F4 F5 num backspace lockstarted, this test must be completed in one sitting. Do not leave the test before clicking Save and Submit. Your answers are saved automatically. Remaining Time: 1 hour, 08 minutes, 04 seconds. Question Completion Status: A Moving to another question will save this response. A Moving to another question will save this response. 4/24 unny insert delete prt sc home end F10 F11 F12 X DII F7 F8 F9 F5 F6 F1 F2 F3 F4 num backspace lock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts