Question: Remaining Time: 1 hour, 35 minutes, 18 seconds. Question Completion Status: TS370 0 13.68% 13.82% QUESTION 5 Tetrarch Corp finances itself with 45% debt and

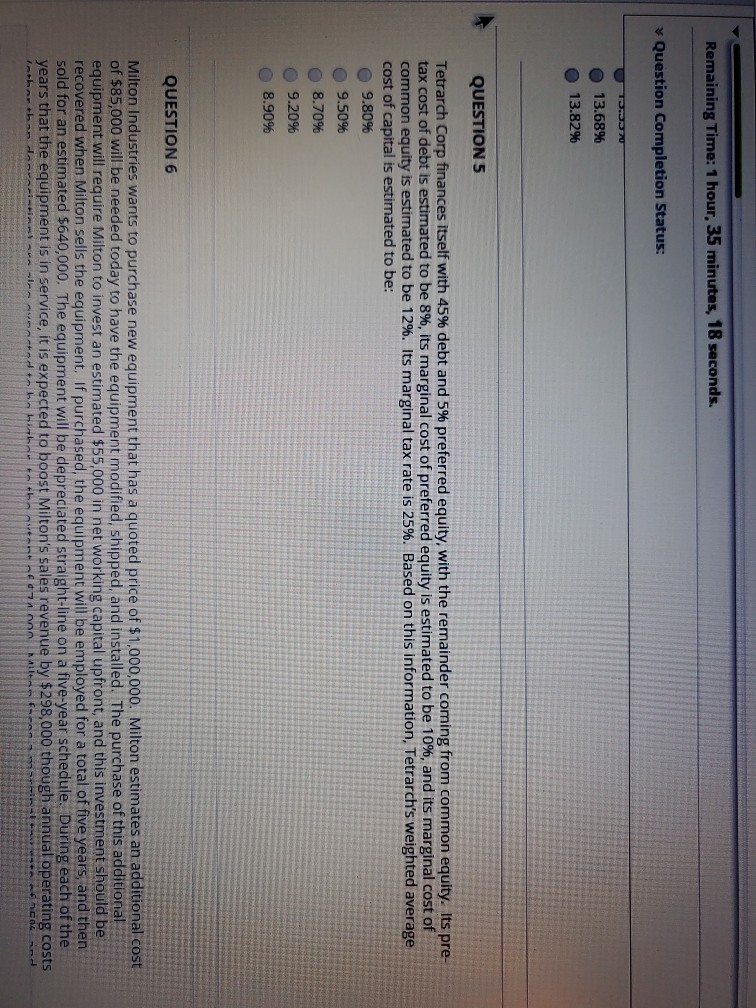

Remaining Time: 1 hour, 35 minutes, 18 seconds. Question Completion Status: TS370 0 13.68% 13.82% QUESTION 5 Tetrarch Corp finances itself with 45% debt and 5% preferred equity, with the remainder coming from common equity. Its pre- tax cost of debt is estimated to be 8%, its marginal cost of preferred equity is estimated to be 10%, and its marginal cost of common equity is estimated to be 12%. Its marginal tax rate is 25%. Based on this information, Tetrarch's weighted average cost of capital is estimated to be: 9.80% 9.50% 8.70% 09.20% 8.90% QUESTION 6 Milton Industries wants to purchase new equipment that has a quoted price of $1,000,000. Milton estimates an additional cost of $85,000 will be needed today to have the equipment modified, shipped, and installed. The purchase of this additional equipment will require Milton to invest an estimated $55,000 in net working capital upfront, and this investment should be recovered when Milton sells the equipment. If purchased, the equipment will be employed for a total of five years, and then sold for an estimated $640,000. The equipment will be depreciated straight-line on a five-year schedule. During each of the years that the equipment is in service, it is expected to boost Milton's sales revenue by $298,000 though annual operating costs + on NALU horth- hinho SC04d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts